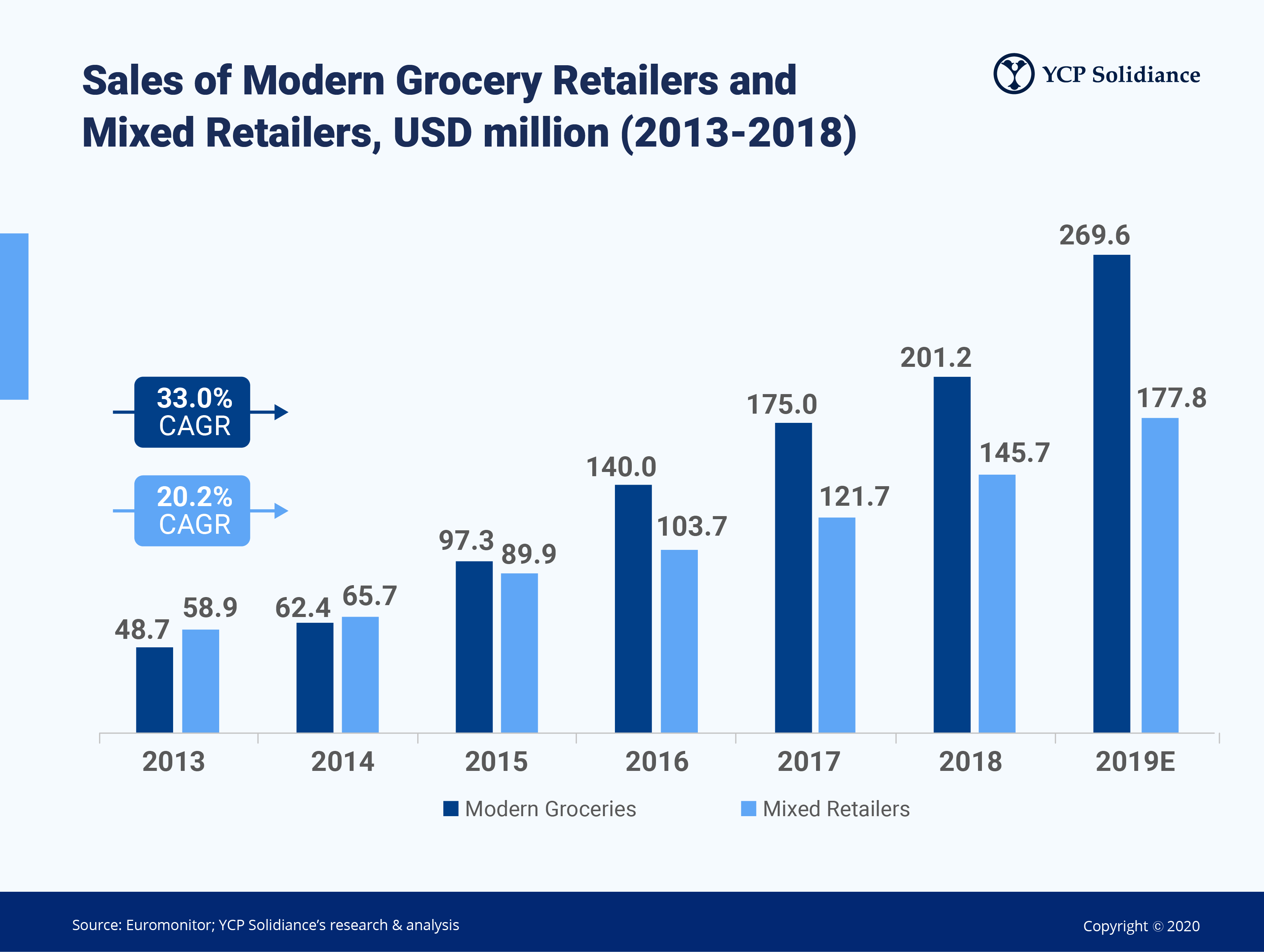

Between 2014 and 2019, the average year-on-year GDP growth of Myanmar was over 6% due to the government’s ongoing effort on policy and economic reforms. In 2019, the modern grocery sales were at USD 269.6 million (an increase of USD 68.4 million) and those of mixed retailers were US$177.8 million combined. Despite the domination of traditional retail markets, there are more modern retail markets found in Myanmar’s commercial cities.

Our latest white paper, “The Transformation of Myanmar’s Retail Industry: Changing Consumer Dynamics and Opportunities for Foreign Investments” highlights that Myanmar's retail will maintain a strong and steady growth - represented by the growth of modern retail with a CAGR of 33%, presenting ample opportunities for investors to tap into this promising sector.

How Does Myanmar's Retail Look Going Forward?

Here are some key aspects in the retail industry of Myanmar:

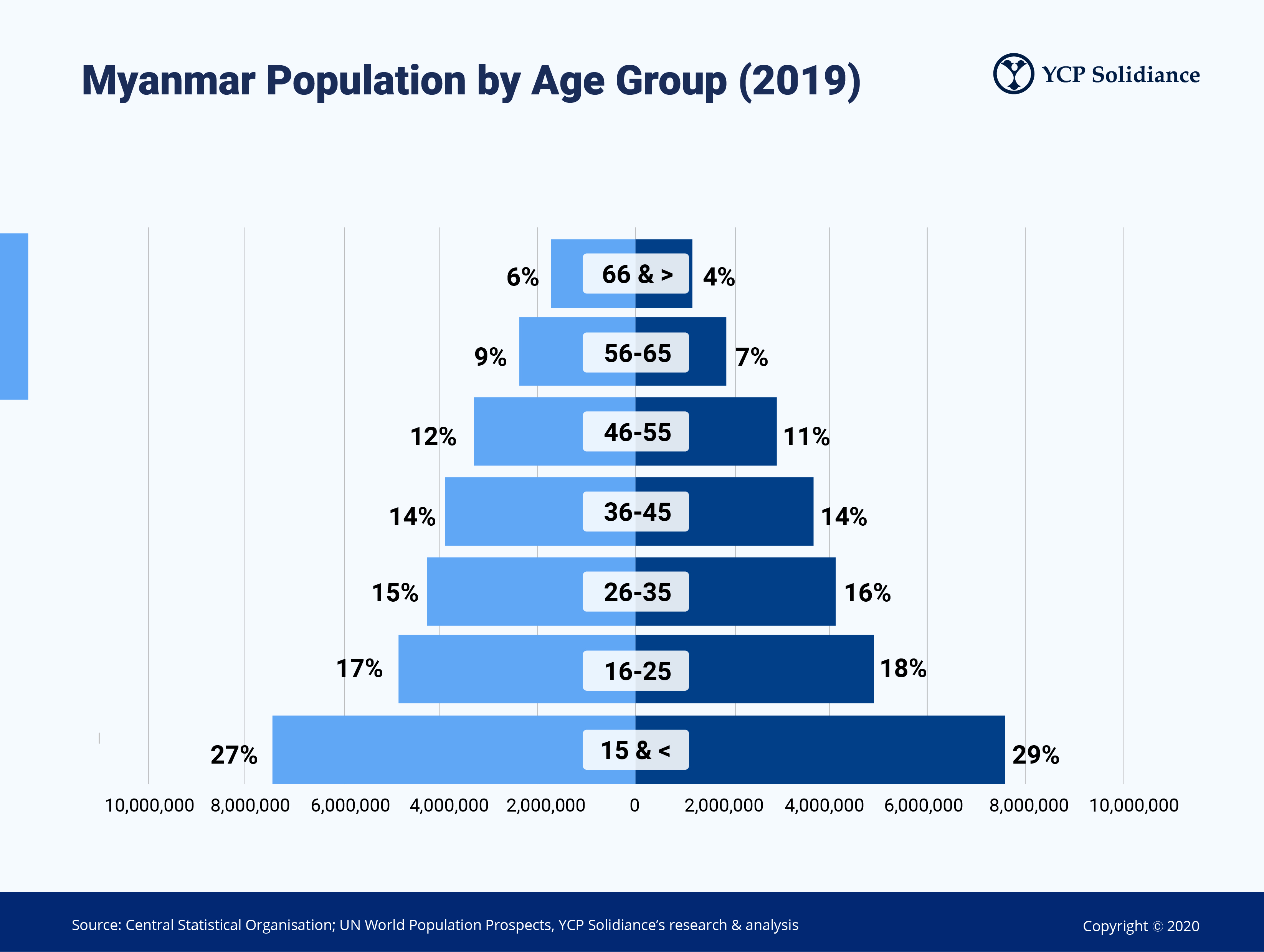

- Changing consumer dynamics: The 16-35 years age group accounts for a third of the country’s 54 million population, while the under 25 years age group accounts for 46% of the total population. As such, Myanmar not only represents the untapped rising consumer market but also promises long-term growth opportunities for retailers and consumer brands.

- The retail landscape transformed: The number of modern retail channels currently accounts for approximately 10% of the country’s retail segment with revenue growth of 32.8% from 2013 to 2018.

- Bright outlook for retail: In the Q4 of 2019, Yangon’s retail area grew by 5% Q-o-Q and 6% Y-o-Y that was largely driven by new shopping malls.

Myanmar's consumers’ behavior, purchasing habits, and shift in market demand show that there are various opportunities for multinational retailers to enter and invest in the retail sector. Download the report and find out available opportunities to capture.