Financial Services

Effective financial management is crucial for success, requiring strategic planning from market entry to risk control.

Attaining maximum value in Asia’s markets with expertly crafted strategies. Asia’s financial services market drives regional development and thrives on intense competition. YCP offers expert guidance in strategy planning, new market entry, and digitalization. Our tailored solutions and local insights help clients navigate this dynamic sector, capitalize on growth opportunities, and enhance their competitive edge for lasting success.

Our Services

Strategy Planning

Asia's financial markets pose challenges with potential disruptions and volatility. Success demands robust strategies that enhance revenue, provide competitive edges, and drive business expansion. YCP leverages financial expertise to steer clients toward sustainable growth, delivering optimized organizational performance.

New Market Entry

Asian business sectors offer great potential for investment. Understanding local market conditions is crucial. Our finance experts specialize in developing effective market entry strategies, ensuring clients maximize value as potential market players. We advise on challenges, risks, and opportunities to facilitate successful market entry.

Operation and Process

Sustainable growth in Asia demands effective strategies tailored to local market conditions. Innovative operations alleviate costs, reduce risks, and enhance resource allocation. Our finance team develops models aligned with Asian industry trends, designed to achieve operational excellence.

Risk Management

In business, mitigating risks is crucial, particularly in Asia where challenges like natural disasters, trade tensions, and financial instability abound. YCP's expert team offers guidance on tools and methodologies to manage such risks. We support clients in implementing strategies for high-risk-adjusted performance, propelling growth in Asian markets.

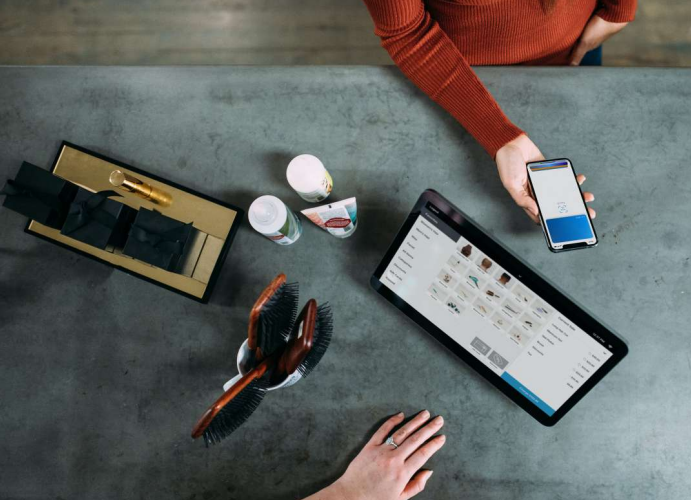

Digital Banking

The rise of financial technology has spurred digital banking growth in Asia, catering to the unbanked and underbanked. With the adoption of mobile, e-banking, and phone banking, the financial landscape is evolving rapidly. YCP offers strategic frameworks informed by years of industry experience and current trends to help firms seize opportunities in digital banking.

Our Clients

Relevant Insights

Inquiries

Get in touch with us to discuss your strategy needs and how we can help you develop a plan to accelerate your growth.