Manila, April 2020 - The Philippines is transforming its financial services with the target to have 20% of transactions done electronically by 2020. However, despite the rapidly expanding financial technology, 99% of current local transactions are still made in cash. With the support from both private and government institutions, e-money will continue to drive the industry forward and change the payment landscape in the country, as highlighted in our latest report, “The Digitization of the Philippine Wallet: E-Money's Emergence in the Philippines".

The Impressive Growth of E-Money

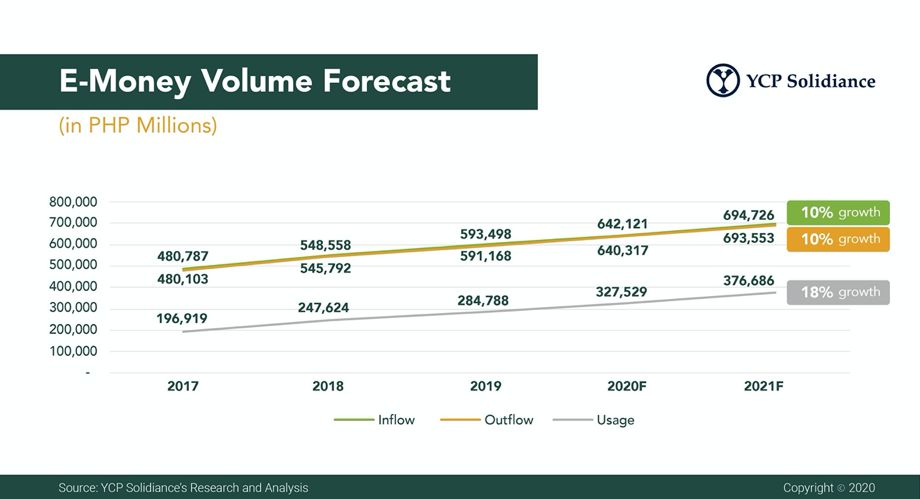

E-money has seen steady growth from 2014 to 2018, with 8% and 15% CAGR in amount inflows and amount usage respectively. Transaction numbers are also seeing steep growth rates, with usage boasting a 36% CAGR throughout the same period.

With regard to usage, the e-money issuers, comprising mobile wallet companies, are leading other categories. Mobile wallets’ usage growth rates overtook the banks’ in 2018, displaying their growing significance and capabilities in influencing the spending behaviors of the Filipinos.

Prepaid Cards and Mobile Wallets

E-money is made accessible either through prepaid cards or mobile wallets. Among the 45 commercial banks in the Philippines, 31 have the license to issue e-money by introducing their own prepaid cards. RCBC and BDO have consistently remained the most used prepaid cards in terms of transaction volumes, followed by the prepaid card options from mobile wallet players such as Paymaya and GCash.

Prepaid Cards and Mobile Wallets

E-money is made accessible either through prepaid cards or mobile wallets. Among the 45 commercial banks in the Philippines, 31 have the license to issue e-money by introducing their own prepaid cards. RCBC and BDO have consistently remained the most used prepaid cards in terms of transaction volumes, followed by the prepaid card options from mobile wallet players such as Paymaya and GCash.

While prepaid cards and mobile wallets are the leading fintech tools, traditional banks are not letting themselves lag too far behind in terms of digitization. Among the top 10 commercial banks, nine of these already have fully functional mobile apps or browser-based online platforms that have been released, In addition to the proliferation of mobile and online banking, the country has seen the introduction of all-digital banking.

The Future Outlook for E-Money

E-money’s future in the Philippines appears to be bright, with wallet inflows and transaction values estimated at PHP 700 billion and PHP 370 billion respectively by 2021. Continued support from the government and efforts from private institutions are instrumental for this industry to see substantial growth within the next few years.

For more details about this report, download the full version of the white paper here.