What should businesses and professionals in Singapore expect in the second half of 2022? As part of a new series, YCP Solidiance will be releasing several in-depth articles that revisit previously analyzed emerging business trends in Singapore, guided by research and analysis from our team of professionals in the country.

Read the first installment below to get a comprehensive overview of the potential business trends in Singapore for Q3 and Q4 of 2022. To read future installments, subscribe to our newsletter here.

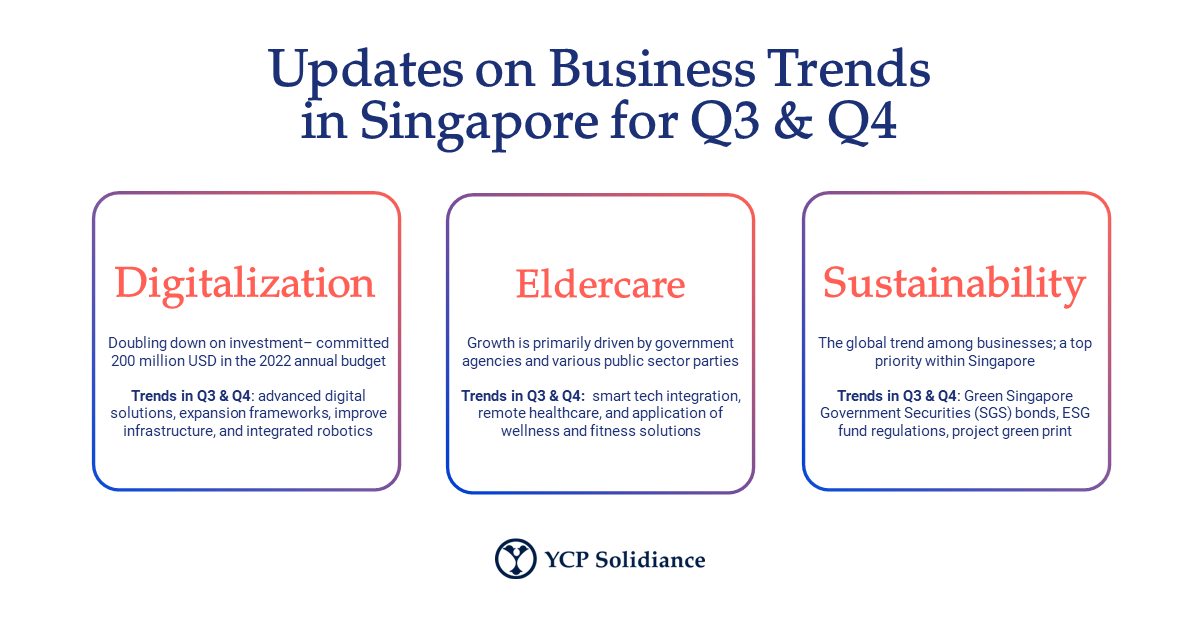

Trend 1: Digitalization

In Q1 and Q2 of 2022, Singapore doubled down on its digitalization investments as evidenced by the government's pledge to set aside 200 million USD in its annual budget breakdown to enhance digital acceleration efforts over the next few years. The nation is also looking to further capitalize on smart technologies as Singapore has seen a rapid increase in adoption across sectors like robotics. Between 2010 and 2015, Singapore registered a robot deployment rate of 20%, which is far higher than the global average of 16%.

Given that continued investment in digitalization will bear fruit innovative solutions for current issues in Singapore such as staff shortages and a tight labor market, relevant stakeholders are expected to explore the following key digitalization initiatives: (1) an advanced digital solutions scheme; (2) digital growth and expansion framework; (3) improved infrastructure; and (4) emphasis on the integration of robotics.

For the remainder of 2022 and for Q3 and Q4 specifically, digitalization will likely remain a key business trend that will be bolstered by ongoing interest from both the private and public sectors. As the government and private firms move toward a more innovative future, expect local SMEs to benefit greatly from the local support for digitalization.

Trend 2: Eldercare and Eldertech

As per an article by The Straits Times, Singapore’s community care sector will continue to grow primarily driven by an aging population. Because of this, the government is heavily engaged in deploying recent eldercare and eldertech initiatives like the Community Care Digital Transformation Plan, a project by the Agency for Integrated Care (AIC). This program aims to increase digitalization and community care job productivity, which entails upscaling eldercare services via technology and specialized training. Further projects aimed at increasing the number of eldercare centers are also underway, primarily spearheaded by agencies like the Ministry of Health (MOH).

In Q3 and Q4 of 2022, three primary aspects of eldertech are likely to witness an increase in activity: (1) safety and smart-living technologies; (2) health and remote care; and (3) wellness and fitness applications.

Trend 3: ESG and Sustainability

On a global stage, environmental, social, and corporate governance (ESG) and sustainability continue to be top priorities among businesses. While focusing on these aspects will minimize the environmental impact of corporations, it also offers advantages such as better engagement with customers, employees, and stakeholders. In Singapore, the public sector is also heavily interested in sustainability as steps are being taken to create a greener economy—a major step to achieving their goal of net-zero emissions by 2050.

As sustainability continues to trend for both the public and private sectors well into 2022, the following ESG and sustainability initiatives will likely become of importance in Q3 and Q4: (1) Green Singapore Government Securities (SGS) bonds, (2) funds regulations, and (3) national initiatives like Project Greenprint.