Last October 5, 2021, YCP Solidiance co-hosted the seminar “How to Conduct Due Diligence: The Key to M&A Success in Southeast Asia” together with es Networks and One Asia Lawyers.

Our Southeast Asia Director Yukako Matsuka moderated the seminar, where our YCP Solidiance Partner and Head of M&A Services Gary Murakami, together with Chikumi Okumura of es Networks and Yuto Yabumoto and Masaki Fujiwara of One Asia Lawyers, shared their expertise and insights.

The M&A sector in Southeast Asia is growing rapidly year by year, but it is not easy to succeed without knowing how to overcome or avoid the challenges unique to small and medium-sized deals in non-Japanese markets. This seminar explored the points Japanese firms considering M&A deals with Southeast Asian companies must keep in mind—along with issues to anticipate, and the solutions to be found in the due diligence process—by using specific examples from the perspectives of business, finance, and legal affairs.

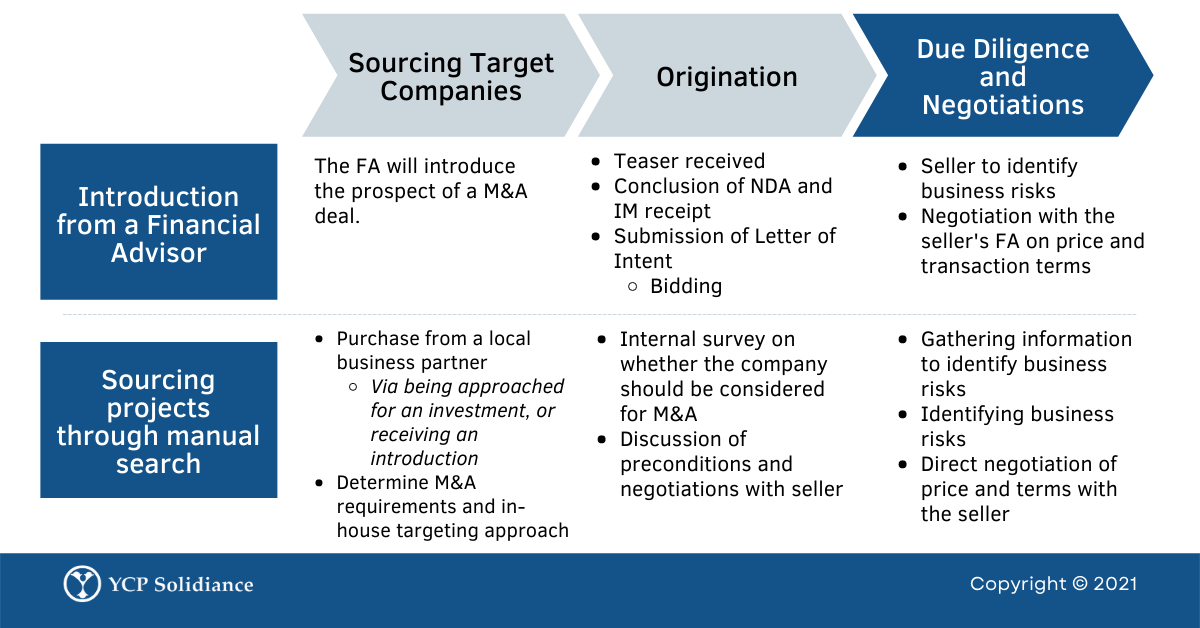

The General Process of M&As

In Southeast Asia, M&A deals mostly come about through introductions from Financial Advisors (FAs) or through a manual search, with data showing that 80% of deals are in the latter category. In many cases where the seller does not have a FA, negotiations may be more attractive, however the most common issue is that the buyer company itself must go out and find information about the firm they are acquiring.

Bottlenecks Faced by Japanese Companies in Southeast Asian M&A

There are both financial and legal risks involved when undergoing M&A in Southeast Asia, particularly in deals involving small and medium-sized companies, as there is a risk of said companies having poor disclosure materials and understanding of the process.

In response to this, a number of measures can be taken: developing the seller’s business plan, arranging a meeting with the seller to discuss the business at length face-to-face, and acquiring further information about the business. However, there may be difficulty in gaining a comprehensive understanding of the local business environment, as well as the source of the target company’s competitiveness in the current space, due to the limited time available in M&A especially for Japanese firms unfamiliar with the Southeast Asian market.

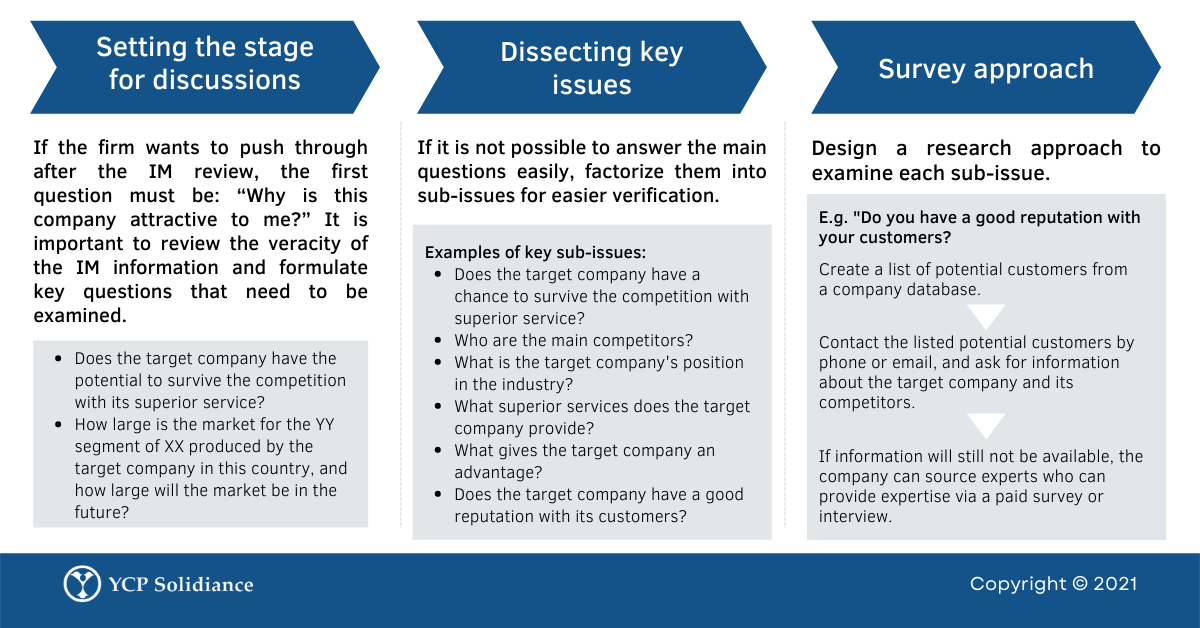

How to Start Business Due Diligence

Due diligence, from a business perspective, is conducted in order to examine the business potential and risks of the target company, and to incorporate the results of that assessment into future financial forecasts.

The process begins with the question “What are we verifying?” This will set the main issues involved and break them down into questions that can be easily answered, leading to the design of a research approach to verify them.

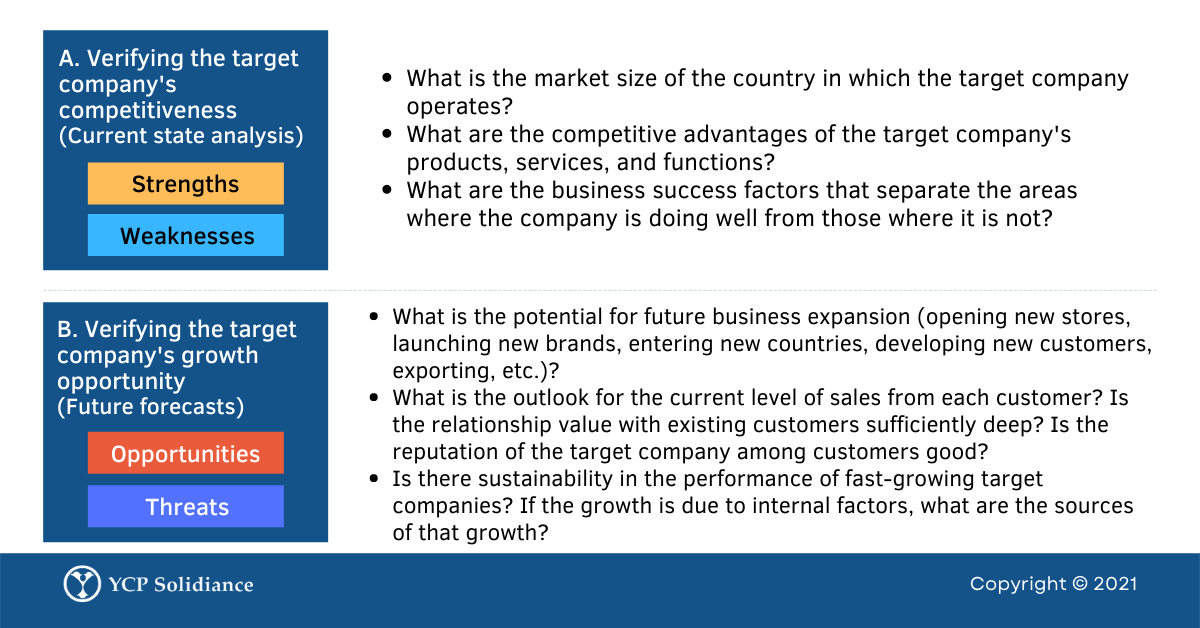

Business Due Diligence Checklist

When conducting business due diligence, the following issues need to be specifically covered, as this will determine whether or not the process has been conducted properly:

- When the resources and know-how of local staff are insufficient;

- When the perspective of a third party is required;

- When a financial forecasting model is tied to the verification.

In addition, it is not necessary for companies to conduct all research on their own, as the use of advisory services—even for smaller-scale projects or to answer basic local questions and context—will lead to successful M&A deals in Southeast Asia.

To find out how YCP Solidiance can help your firm conduct M&A in Southeast Asia, send us an inquiry here.