Financial technology companies, also known fintech, have been disrupting the financial industry around the world by changing the way consumers use financial products and services. This change is also visible in Vietnam’s financial industry, where fintech is leveraging rising bank penetration to promote value-added financial services while also offering the unbanked population access to alternative payment solutions. In 2019, Vietnam’s fintech market reached USD 9.0 billion in transaction value and is expected to grow to USD 22 billion by 2025.

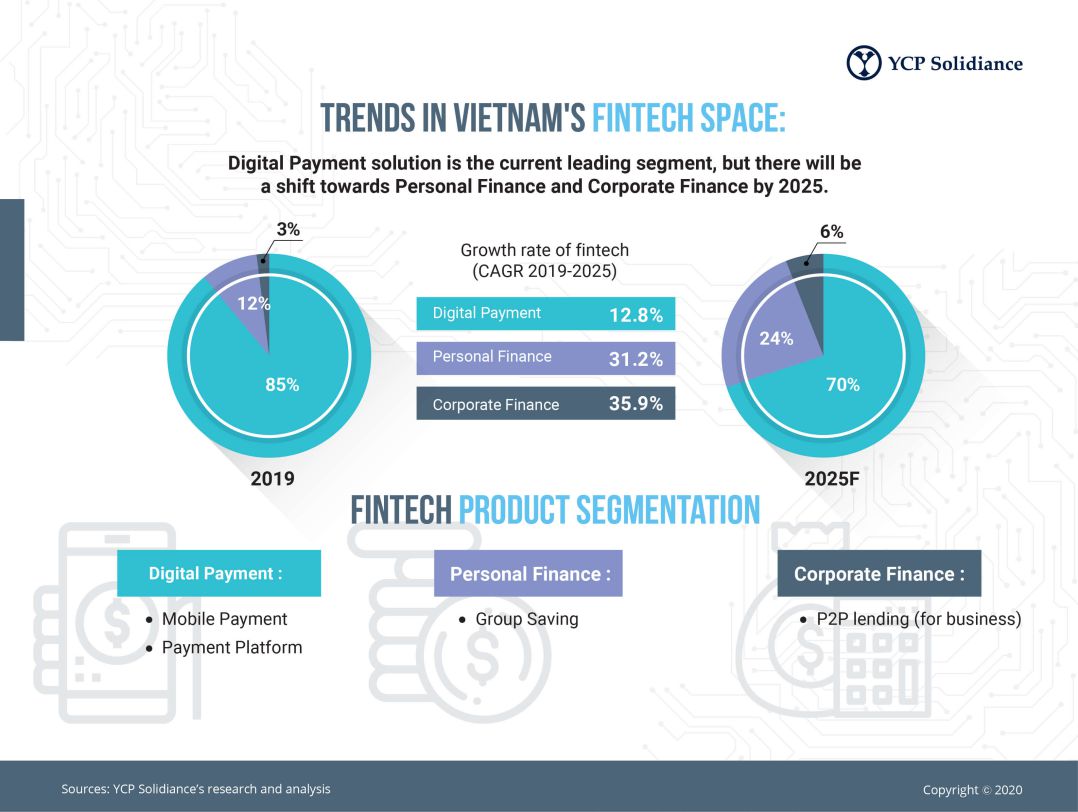

Vietnam is one of the fastest-growing adopters of smartphones in Southeast Asia. The introduction of 4G – along with lower-priced smartphones and service costs – will also act as enablers and provide the necessary means for digital payment and other fintech services. Among different fintech product segments, the digital payment solution is leading the Vietnam market with 85% market share. However, there will be a shift towards Personal and Corporate Finance by 2025.