Given that businesses and societies across the globe continue to digitally transform, consumers are becoming more reliant on the use of digital payment systems. The popularization of digital platforms to facilitate transactions include factors such as convenience, accessibility, and contactless payment—all of which are considerations that become progressively relevant amidst the ongoing COVID-19 pandemic.

In the Philippines, the Promotion of the Digital Payments Act, which is formally recognized as House Bill 8992 and Senate Bill 1764, is currently under review. This bill seeks to actively promote the use of digital payments in the Philippines, while also expanding economic participation among unbanked individuals.

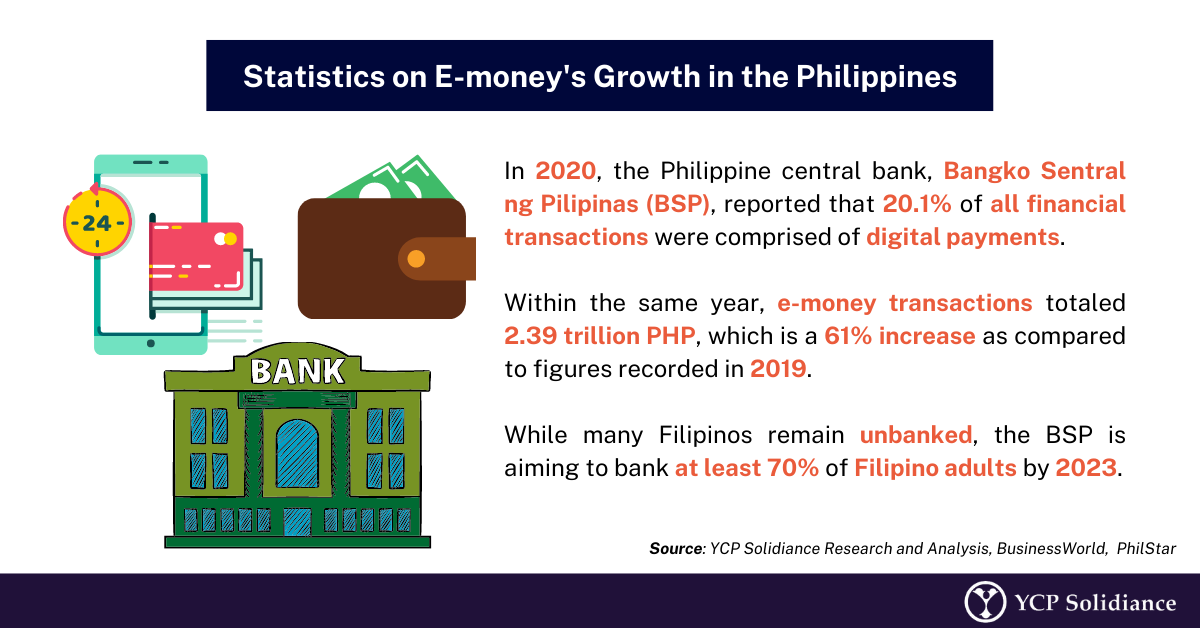

According to an article by Business World, the Bangko Sentral ng Pilipinas (BSP) estimated that only 28.6% of Filipino adults have access to a formal bank account, which means that a large majority of the Philippine population are unbanked. While that figure may have potentially increased due to an influx of digital payments during the pandemic, the urgency to attend to the needs of unbanked Filipinos remains.

As per research from the YCP Solidiance white paper "The Digitization of the Philippine Wallet: E-Money’s Emergence in the Philippines," from 2014 to 2018 mobile wallets in the Philippines registered impressive CAGRs across several aspects, namely: amount inflows (8%), amount usage (15%), and usage (36%). These statistics suggest a trend wherein nationwide adoption of digital payments within the Philippines will be inevitable in the coming years, accelerated even more by social distancing measures implemented because of the global pandemic.

Implementing a Vision

At its core, the Promotion of Digital Payments Act champions the acceleration of digital payments adoption as well as financial inclusion within a country that is severely unbanked. To accomplish this, the bill outlines several key measures and steps, some of which include the following:

- Participation of Local Government Units (LGUs) – To ensure the use of digital payments, big and small merchants and business alike must be able to accommodate such transactions. Thus, LGUs will pay close attention to this criterion when approving or renewing business permits. Furthermore, the active participation of LGUs in this process will enable them to aid small and micro-merchants who lack the capacity for digital payments.

- Government Agency Involvement – Beyond LGUs, major governing bodies such as the BSP, or even the Department of Information and Communications Technology (DICT) will need actively participate to guarantee that all sectors (non-government affiliated agencies, LGUS, local businesses, etc.) transition toward digital payments smoothly.

- Improving Infrastructure – Aside from establishing specific processes and protocols that will promote the use of digital payments, it will also be important to improve the overall infrastructure surrounding these systems. Aspects of infrastructure include, but are not limited to digital payment terminals, e-wallets, cybersecurity, internet connectivity, etc.

While nationwide implementation and adoption of digital payment systems will take a considerable amount of time, especially when considering the extensive preparation needed, its benefits indicate that it is a positive step in the right direction for the Philippines. Furthermore, by emphasizing the need to eliminate digital exclusion among the Filipino population, the transition toward digital payments and transactions will undoubtedly become a welcome development among Filipinos across several sectors.

For instance, as discussed in the article Business Trends in the Philippines for 2022, addressing digital exclusion will be important for the future of businesses that digitalize as doing so will prevent an accessibility gap among prospective stakeholders. For business to fully capitalize on their potential, concerned parties must ensure that the current technological capacity can accommodate services such as digital payments.

Thus, in context of the popularization of digital payment systems in the Philippines, expect for government offices, businesses, and consumers alike to play an active role in the coming years.

For updates on the progress of digital payment systems in the Philippines, subscribe to our newsletter here.