Author

Gary Murakami

Gary is YCP's Partner with a diverse portfolio of hands-on management services in M&A and post-merger integration advisory around Asia.

Southeast Asia’s mergers and acquisitions (M&A) landscape is robust and dynamic, with activity happening across several industries in the region. Such development presents players with potential M&A opportunities in key categories, like technology.

Specifically, the financial technology (fintech) sector in SEA provides new, promising avenues for regional M&A. The alternative financing segment is expected to become a significant proving ground for M&A players, where M&A opportunities will be plentiful in the Buy Now, Pay Later (BNPL) category.

We asked YCP Solidiance Partner Gary Murakami, who is a SEA financial services and M&A expert based in our Thailand office, for his insight into BNPL M&A opportunities in SEA. With experience in leading the M&A advisory practice at YCP, where he has supported over 100 projects in 10 countries across Asia, he provided critical insight on the landscape of fintech and alternative financing in SEA, the BNPL megatrend, and M&A opportunities materializing due to industry developments.

To contextualize your insight into BNPL M&A opportunities in Southeast Asia, what does the current landscape of fintech in the region look like? What is the significance of the alternative financing segment?

Both globally and in SEA, the growth of fintech has drastically impacted business dynamics and created opportunities for business ventures across several industries. Fintech solutions like digital payments and digital lending have contributed significant value to society, offering increased access to financial services, improving efficiency, and, ultimately, enabling the development of innovative business models.

Fintech’s transformative impact extends to the M&A industry, where players are finding investment opportunities in several categories. One such segment is alternative financing, which refers to non-traditional sources of funding for businesses and individuals. Aside from BNPL, other examples of alternative financing include peer-to-peer (P2P) lending, crowdfunding, invoice financing, etc.

In SEA, alternative financing is a particularly exciting area for M&A as it exhibits the most robust growth among all fintech segments. Much of alternative financing’s appeal can be attributed to how it offers businesses and individuals a more consumer-centric approach that provides alternative options, especially compared to traditional bank loans. This dynamic is attractive to consumers in SEA, where a significant portion of the region’s populace remains underbanked and unbanked,

What exactly is Buy Now, Pay Later (BNPL)? What should people know about the BNPL segment, and what does its landscape look like in SEA?

For those unfamiliar, BNPL is a type of short-term financing that enables consumers to purchase goods and pay for installments over time. Typically, BNPL services are integrated with retailers’ checkout process (both offline and online).

The primary value of BNPL lies in the payment flexibility and convenience it provides consumers, especially those who do not have the immediate means to finance their transactions upfront. When comparing BNPL to traditional banks, financing via BNPL is also appealing, as the process of receiving financing is almost immediate. Moreover, the process of registering with a BNPL is seamless, as it eliminates conventional red-tape with its own credit-checking technologies.

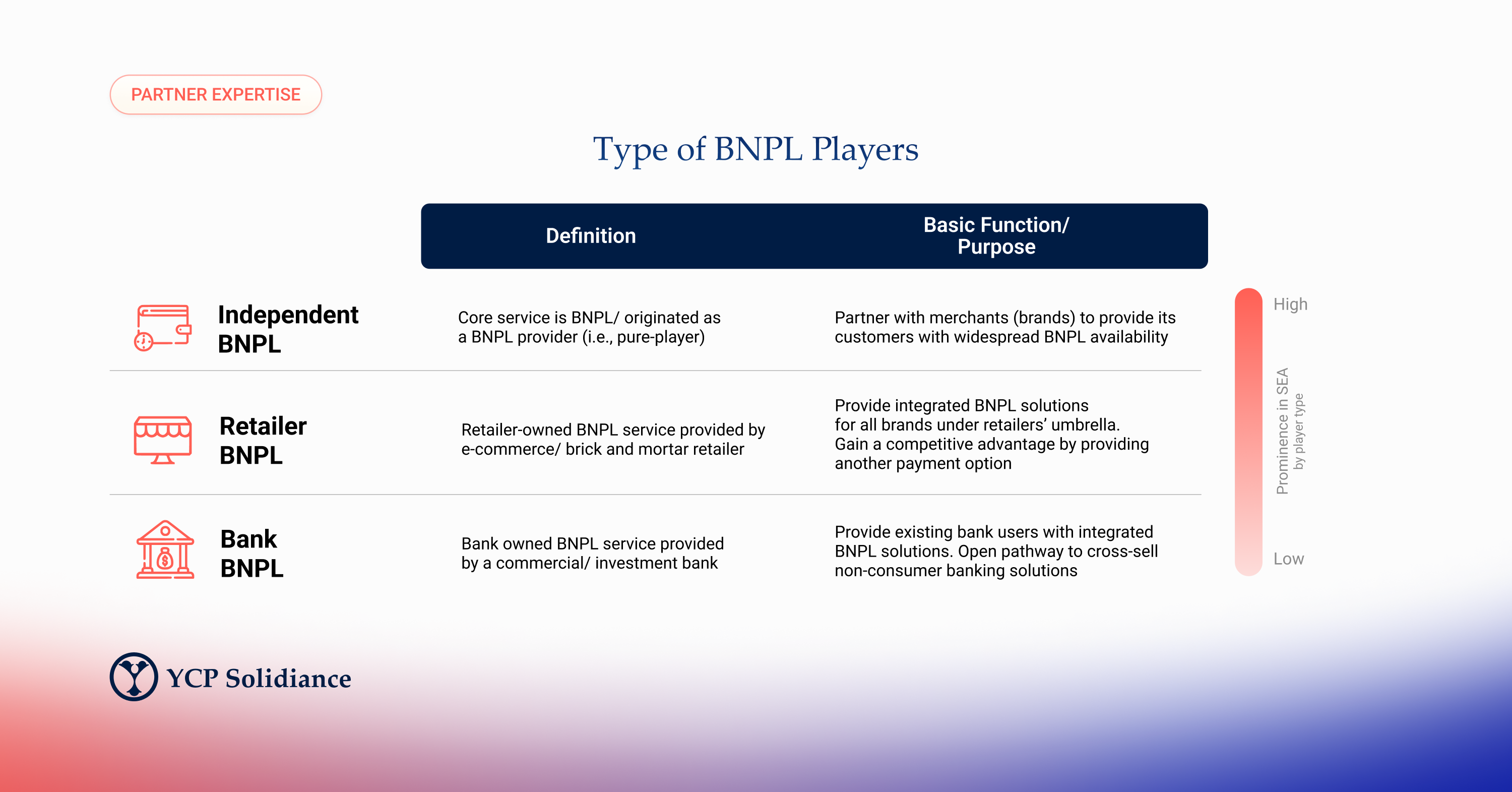

To better understand the current ecosystem of BNPL in SEA, players can be categorized into three types: independent, bank, and retailers, with major differences in focal service and ownership.

Generally, the most prominent type of BNPL in SEA are independent players, while bank and retailer BNPL players remain minute in the current landscape. Since independent BNPL players predominantly occupy the BNPL market, there is limited space for bank and retailer BNPL players to enter.

Within SEA, BNPL adoption is still relatively new compared to other regions globally. While the market is filled with local start-ups, no player truly dominates the market at present. The prominence of independent BNPL players will eventually shrink as banks and retailers foray into the BNPL space.

With these developments in mind, what BNPL M&A opportunities are emerging? How can M&A players capitalize on the BNPL market in Southeast Asia?

It is important to highlight that the regional growth of BNPL does not necessarily mean that players are earning. While BNPL is still growing in SEA, the segment is generally proven as an unsuccessful business, as most independent players have difficulty making money and generating profit. This is due to the risky business model, as BNPL providers essentially lend money to consumers without collateral. The M&A opportunities within SEA’s BNPL space will revolve around this development.

In the coming years, mega-trends surrounding banks and retailers will shift the paradigm of the BNPL industry. As part of the shift, M&A activity is expected to increase, ultimately facilitating the entry of banks and retailers into BNPL.

Factors like peer pressure among banks and gaining customer spending insight will encourage banks and retailers to pursue M&A opportunities to gain immediate access to the BNPL market. Additionally, banks and retailers will drive M&A activity to acquire BNPL platforms and their technology as it can help increase revenue, expand customer bases, and, overall, stay competitive against independent platforms.

Such developments will eventually result in banks and retail BNPLs overtaking independent BNPL players. In SEA, all banks, alongside major e-commerce firms/retailers, are expected to own in-house BNPL as a must-have product. Their entry into BNPL is also beneficial in the long term, as it provides synergies with a direct impact on various buyer types. For banks and retailers who want to enter via M&A opportunities, their entry into BNPL is a key component to a larger strategic goal.

The emergence of M&A in BNPL will carry several notable implications. For instance, BNPL M&A is poised to further accentuate prevailing industry dynamics, where activity will be primarily driven by major retailers seeking the strategic advantages M&A offers instead of organic growth. The strategic benefits that BNPL M&A offers retailers are mainly concerned with 1) their overall lack of familiarity with developing BNPL technology compared to independent players and banks and 2) the desire to stay competitive against e-commerce platforms that already utilize BNPL technology.

It is important to note that firms will likely decide against greenfield investments, as stabilizing valuations will also be a key driver of M&A activity. Currently, BNPL valuations are stabilizing at around P/B = 1.5x after experiencing a period of high volatility in previous years. What once was a segment where buyers paid over the top is no longer the case. This is good news for M&A players as it makes it easier to value BNPL companies and negotiate for fair acquisition prices accurately.

Gary is our Partner based in Thailand, and the Head of Mergers and Acquisitions (M&A) Advisory for Southeast Asia. At YCP, he has supported 100+ clients, from multinational companies to family-owned SMEs, in 10 countries across the Asia-Pacific. He has supported various topics under M&A, including commercial due diligence, financial advisory, post-merger integration, CFO service, and under management consulting, including market entry strategy, business process improvement, organization optimization, competitor benchmarking, industry research, and market forecasting.