In the context of the global esports industry, Asia was responsible for generating a total revenue of 543.8 million USD in 2020, as per data from research firm Niko Partners. Within the region, the Philippines stands out as one to watch, as several business opportunities relating to esports are expected to arise in 2022.

Currently, Philippine esports is an intriguing market that has experienced tremendous growth in terms of esports business interest, but industry development is still in its early stages which allows for new investors to enter the market. From major investment into local tournaments by international companies to a celebrity figure launching an independent esports organization, stakeholders involved in esports in the Philippines are hard at work towards helping the country realize its potential within a burgeoning industry.

Philippine Esports Ecosystem

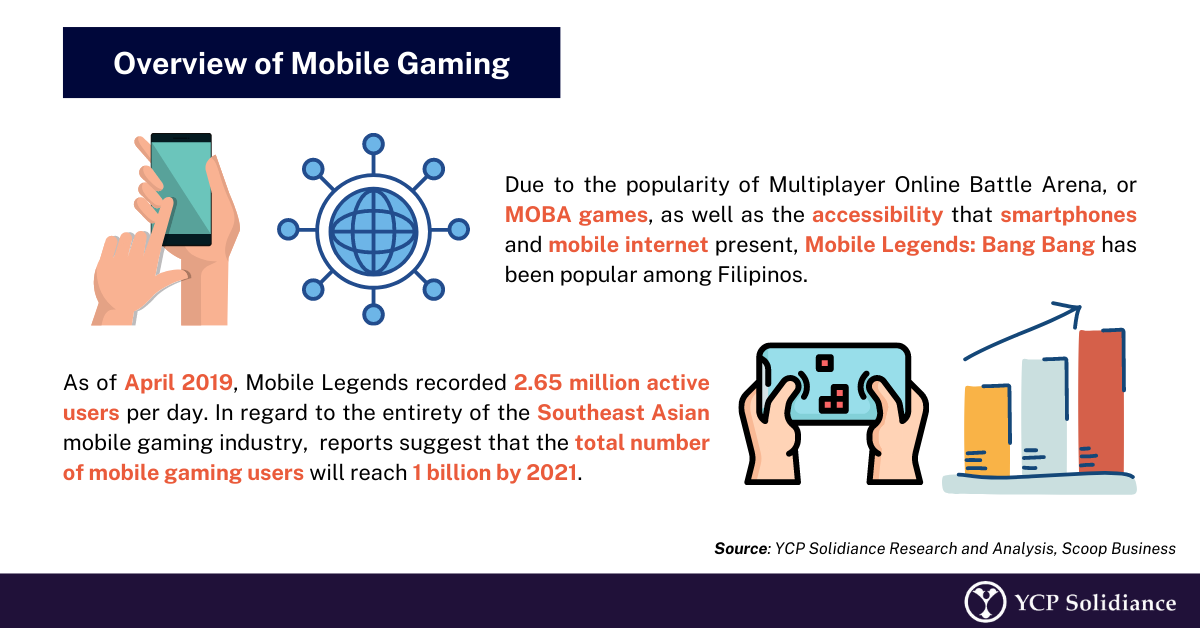

Currently, the Philippine esports market has over 43 million active gamers; a figure which has steadily risen 12.9% year-on-year since 2017. While the esports ecosystem in the Philippines features a diverse set of mediums, such as first-person shooters (FPSs) or role-playing games (RPGs), Multiplayer Online Battle Arena (MOBA) games stand out as being the most popular genre for gaming in the Philippines.

The popularity of esports in the Philippines can be contextualized via the number of daily active users in mobile gaming and viewership of major esports events. In the YCP Solidiance white paper The Next Level: The Rise of Esports in the Philippines, data revealed that popular MOBA mobile game Mobile Legends peaked at 2.65 million active users daily from the Google Play Store during April 2019.

Meanwhile, in terms of viewership, Philippine esports also played a major role in the recently concluded M3 World Championship for Mobile Legends, held last December 2021, wherein one half of the event’s most watched match featured a major Philippine esports organization: ONIC Philippines. During ONIC PH’s playoff match against Indonesian esports organization RRQ Hoshi, the M3 World Championship managed to register a peak viewership of approximately 3.1 million viewers as per data from Esports Charts.

Significant and Ongoing Esports Initiatives in the PH

As evidenced by the number of active users in MOBA games, as well as the role that Philippine esports played in record-setting viewership, the Philippines possesses the potential to be a significant market for the esports industry both at a domestic and international level.

To bolster esports tournaments within the country, Chinese tech enterprise vivo is organizing the “vivo Battle of the Legends: Mobile Legends Bang Bang Tournament,” wherein 16 teams comprising of Filipino citizens residing within the Philippines will compete for a 175,000 PHP total prize pool.

Besides pop-up events, efforts are also being made to establish programs that cater to gamers at a grassroots level. Just last December, Filipino-based esports startup AcadArena secured 3.5 million USD in funding during its seed round. As an organization, AcadArena has established competitive amateur esports leagues across the Philippines, while also developing initiatives like an esports scholarship fund. In a similar attempt to harness the potential of Filipinos in esports, boxer and politician Manny Pacquiao formally launched his own esports organization under the name of Team Pacquiao GG, or TPGG for short.

Beyond these initiatives that help grow the local esports industry, YCP Solidiance has identified three key areas that stakeholders should focus on, namely the following:

- Content – If esports leagues are the main product, then the competition itself is what dictates esports content. To develop the quality of local competition, different league formats should be explored, such as a promotion-relegation system that rewards high-level play and helps facilitate entry of new organizations into the esports scene.

- Packaging – For Philippine esports to become a profitable investment, local leagues will need to attract viewers. As such, those directly involved in the esports will need to invest in several areas like broadcast talent, storytelling, and extra content such as videos or podcasts that tackle topics that are closely related to the competition itself.

- Accessibility – While Philippine esports has gained some recognition over the years, some negative connotations still surround the industry, and this has prevented esports from fully capturing the attention of mainstream Filipino audiences. For the Philippines to realize its potential in esports, a multi-faceted approach aimed toward educating Filipinos about the benefits of esports must be initiated by several bodies, like the government, private companies, and educational institutions alike.

These developments are an indication of a solid commitment to further grow the domestic landscape of PH esports in 2022 and beyond. More importantly, these developments in conjunction with the general enthusiasm around local esports is reassurance that foreign and domestic investors alike are quickly recognizing Philippine esports as a promising and worthwhile business venture.

For further insight on Philippine esports and potential business opportunities relating to this industry, subscribe to our newsletter here.