The developing epidemic situation has been posing significant challenges to the Chinese government since the beginning of 2020. Although the growth of new infections has slowed significantly, many foreign countries are still concerned about the potential economic impact. The very volatile stock markets in different countries during the period may reflect this sentiment.

Our solid presence across Greater China enables us to observe the situation and through this article, we aim to shed some light on the following topics:

- What Is Happening in Wuhan and Other Cities?

- Potential Economic & Industry Impacts for Mainland China

- Actions the Chinese Government Has Already Taken

- Future Initiatives by the Government

- Conclusion: What Can Global Investors Expect?

1. What is Happening in Wuhan and Other Cities?

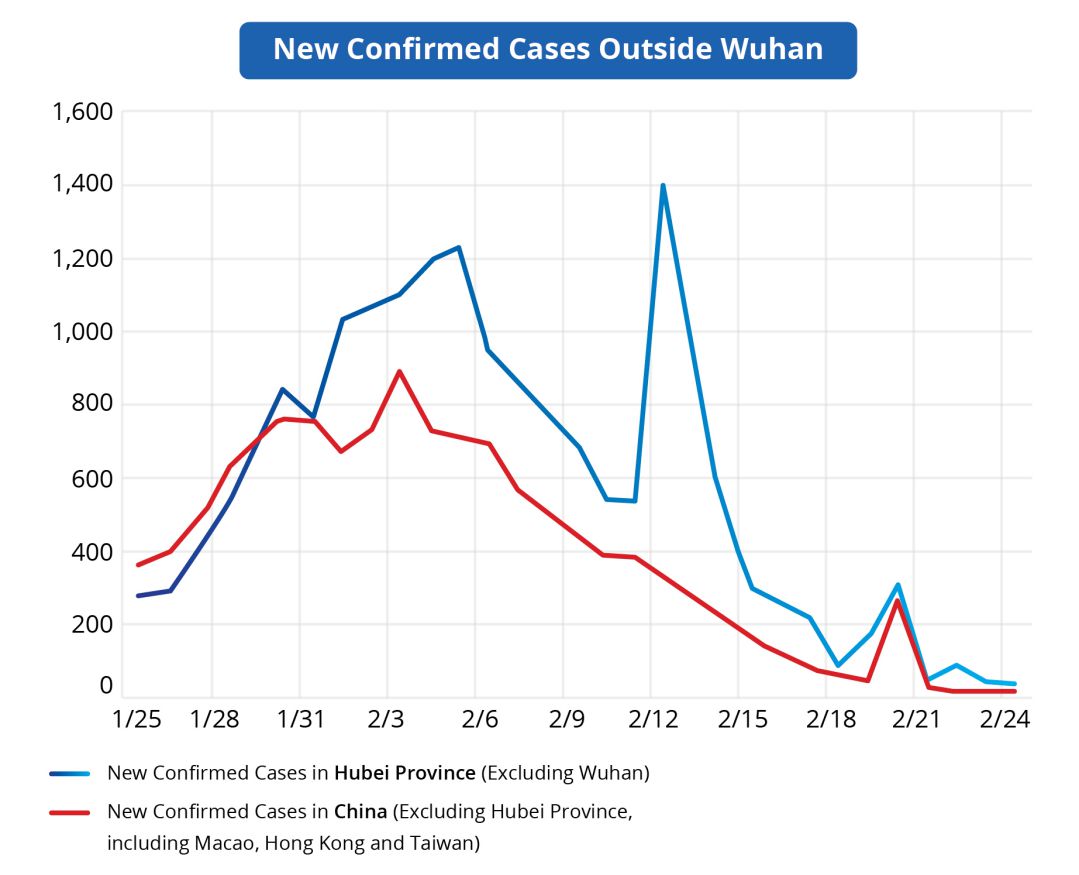

Foreign businesses look at China as a country where thousands of new COVID-19 cases are being reported every day, but the situation in most cities has started to calm down.

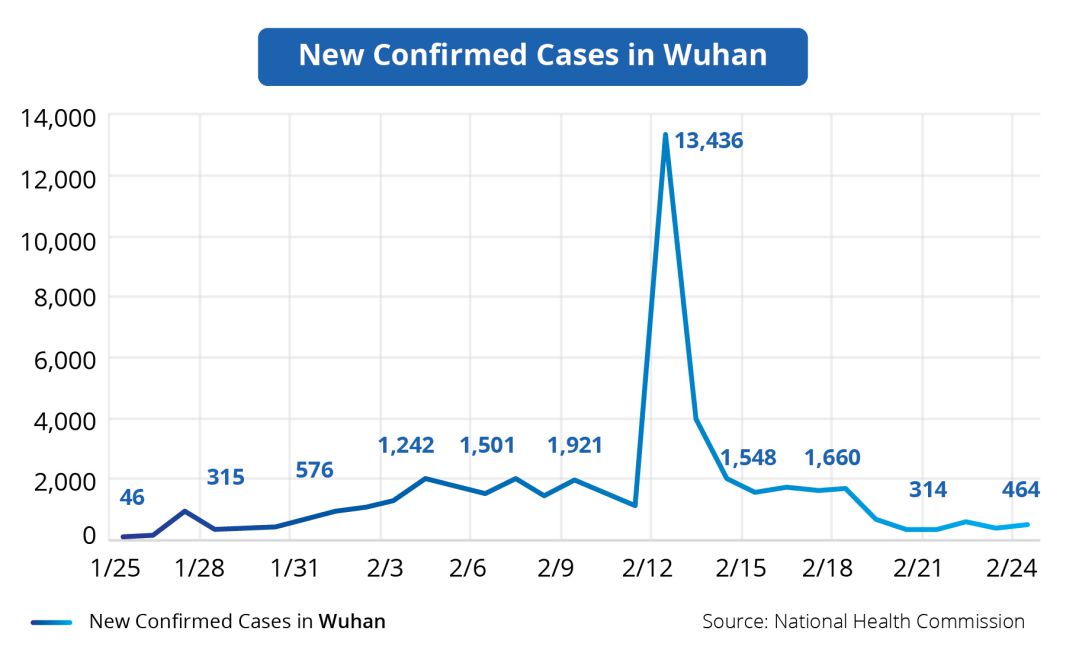

At present, the newly confirmed cases of Coronavirus infections are mainly concentrated in Wuhan, but have since been steadily declining in the area of Hubei and other provinces. According to the data from the National Health Commission on February 24, Hubei has identified 499 new cases, of which 464 cases were located in Wuhan.

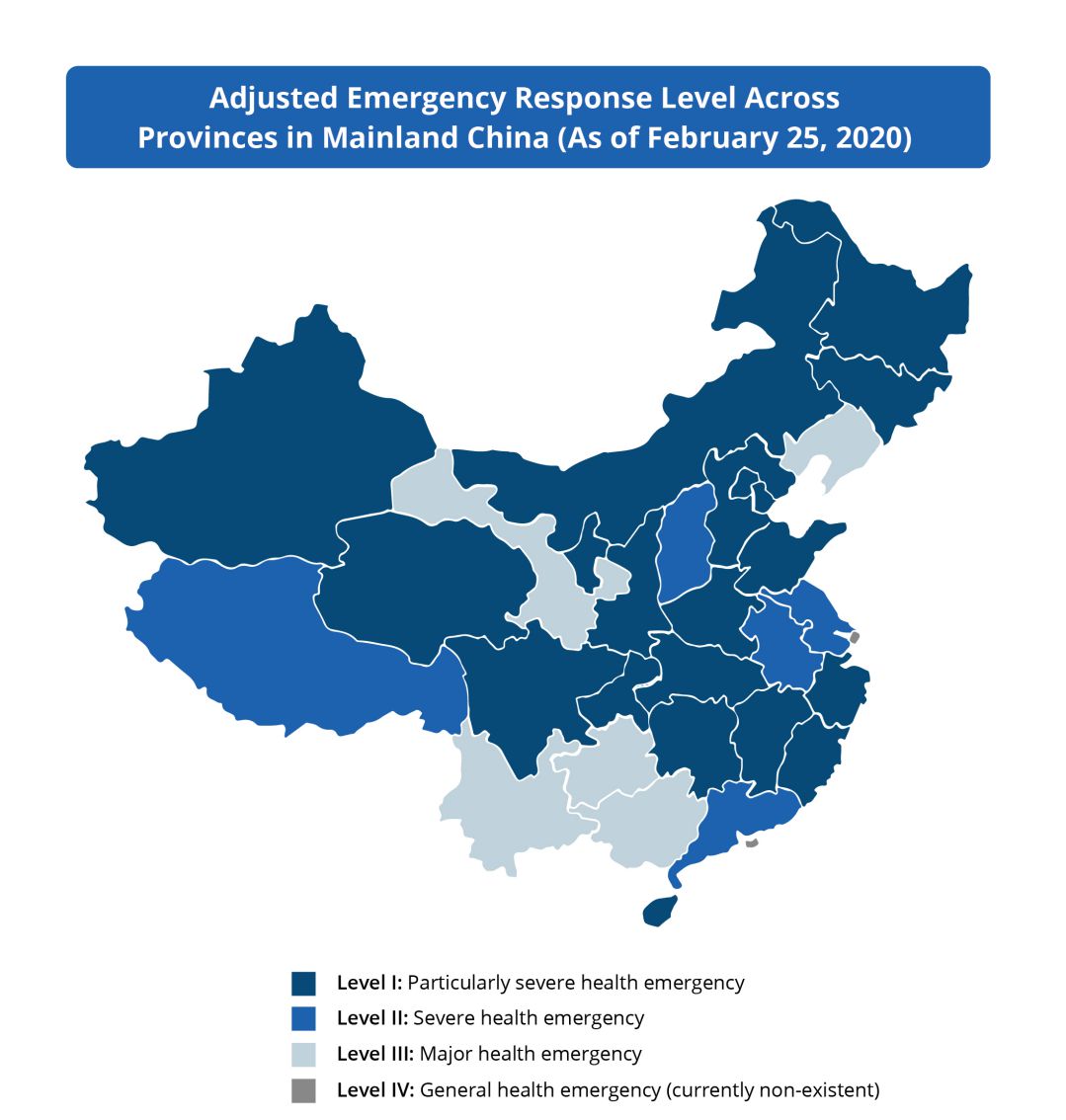

Between February 21 to 24, many provinces have lowered the emergency response from Level I to Level II and III, as shown in the diagram below:

2. Potential Economic & Industry Impacts for Mainland China

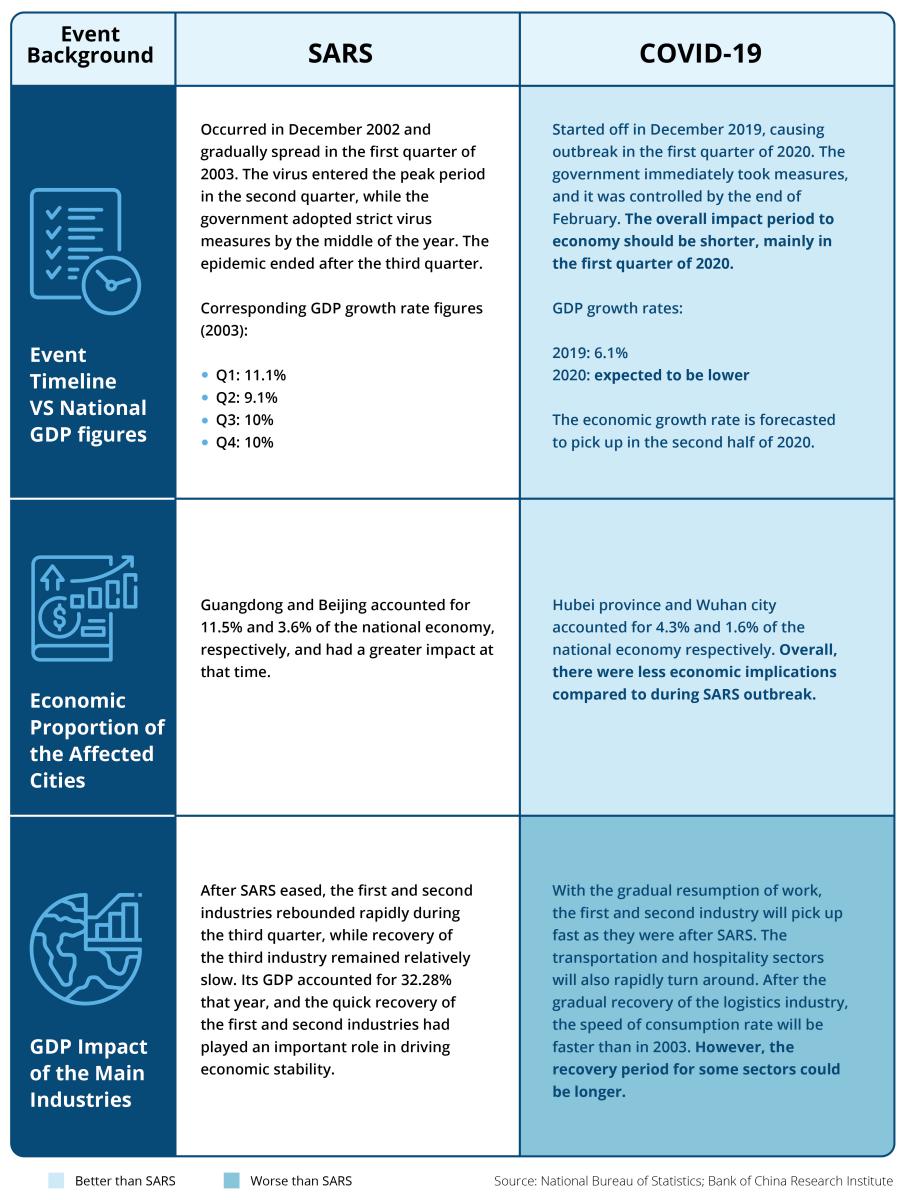

Throughout 2020, the Chinese economy is expected to slow in the first half and stabilize in the second half, while the overall impact that COVID-19 has on economic growth is expected to be approximately one per cent. The 2019 GDP growth rate was 6.1% and is estimated to hit 5% in 2020, according to S&P Global Ratings. Although the country's economy will slump in the first quarter, ongoing development of growth policies as well as consumption and production plans may bring opportunities for recovery in the second quarter. Taking reference to the SARS situation, our analysis is shown in the following table:

COVID-19 Impacts on Key Industries

a) Direct impact : Real estate, transportation, accommodation, tourism, and other industries are expected to recover soon after the outbreak is over.

- Real Estate: From February 10 to 16, 2020, the number of commercial housing transactions across large and medium-sized cities nationwide was 3,024 units. The same data from February 11 to 17, 2019 was 18,641 units, showing the drop in the real estate trading market.

- Transportation / Accommodation / Tourism: As the COVID-19 outbreak coincided with the Spring Festival holiday, its impacts on transportation, accommodation, and catering industries was very significant.

b) Indirect impact:Financial Services Industry

- Banks: Due to COVID-19, businesses’ credit demand has been weakened, affecting lending volumes of commercial banks. The decline in corporate profitability and the narrowing of profit margins will also lead to little increase in corporate deposits and affects the deposits business of commercial banks.

3. Actions the Chinese Government Has Already Taken

a) Financial Control Policies

The "Notice on Further Strengthening Financial Support for the Prevention and Control of COVID-19" was issued to introduce necessary measures to strengthen financial support for the prevention and control of COVID-19, including the appropriate reduction of loan interest rates, and increase of credit loans to support relevant enterprises to overcome the impact of this epidemic disaster.

- On February 3 and 4, the PBOC launched RMB 1.2 trillion and RMB 500 billion open market reverse repo operations to inject funding and lowered the 7-day reverse repo rate by 10 basis points from 2.5% to 2.4%.

b) SME Social Security

Country-Level: The Chinese government has issued several policies, such as:

- The General Office of the Ministry of Commerce issued the "Notice on Helping Foreign Trade Enterprises to Cope with Difficulties and Reduce Losses amidst Epidemic".

- The State Administration of Taxation has extended the tax declaration, expanded the coverage of online tax administration, and further improved the prevention and control of the virus situation via the tax system.

- The Ministry of Human Resources and Social Security issued the “Periodic Reduction and Exemption of Corporate Social Insurance Fees”.

Province-Level: About 20 provinces have issued various policies to support SMEs. For example, the Beijing Municipal People's Government issued multiple policies in response to the impact of COVID-19, to promote the sustainable healthy development of SMEs.

4. Future Initiatives by the Government

Moving forward, the key focus of the government and the PBOC will include:

- Continuing to introduce phased and targeted tax reduction and exemption policies, supporting the resumption of industry production.

- Centralizing the use of government funds to cover critical expenditures used for epidemic prevention and control as well as to safeguard poverty alleviation.

- Increasing transfer payments and direct the funds to areas heavily affected by the epidemic (e.g., ensure grassroots wages, operation, and primary livelihood).

- Expanding the scale of issuance of local governments’ special bonds known as “funding goes with the relevant project” (“资金跟着项目走”).

The PBOC also aims to relax fiscal and monetary policies which cover the following:

- Maintain reasonable and sufficient liquidity, lower market interest rates, and reduce funding costs.

- Better use of structural monetary policy tools - nearly 1,000 companies have received special re-financing and various types of loan facilities.

- Give full strength to the work of financial policy; China Development Bank supports manufacturing enterprises, EXIM Bank for foreign trade enterprises, and Agricultural Development Banks for swine production related enterprises.

5.Conclusion: What Can Global Investors Expect?

Investors do not need to be overly pessimistic. After the news of COVID-19 broke in January, the Chinese equity market’s A-shares experienced a significant short-term decline. Although A-shares are expected to face downward pressure, the possibility of a continued and substantial plunge is unlikely. The current market valuation is still lower compared to 2003’s SARS outbreak – showing a certain safety margin for investors where valuation will provide strong support:

- COVID-19: As of February 2020, the P/E ratio of the Shanghai and Shenzhen 300 Index is 12 times, SSE composite A-shares index P/E ratio is 15 times, and the SZSE composite index A-shares valuation is 27 times earnings.

- SARS (2003): Valuations in these markets were much higher in early 2003 leading up to SARS in March 2003; the SSE composite index A-shares P/E ratio was 34 times and SZSE composite index A-shares P/E ratio was 42 times.

- Post-SARS market recovery (2003):

- The stock market declined significantly at the peak of the epidemic (April - May 2003), and the SSE composite index experienced a 7.5% decline from April 16 to 24. In May, the number already started to recover.

- MSCI China index hit bottom in April 2003 and almost railed off from the MSCI world index. However, it managed to recover six months later.

Based on our analysis, despite the current situation, the market is expected to rebound and operate in accordance with its own long-term logic. Although the COVID-19 epidemic may cause short-term volatility for the equity markets, we believe that it is unlikely to derail the long-term upward trend of the market.