The recovery of the manufacturing industry in the Philippines has been slow but steady, as loosened quarantine restrictions promise better returns via demand and production. Business Mirror reports that export of manufactured goods grew by 35% in May, with the Philippine Manufacturing Purchasing Managers’ Index (PMI) rising to 49.9 in May and 50.8 in June. These figures are highly significant, as they signal expansion in the sector as opposed to the contractions that have marked the past year due to COVID-19.

With majority of Filipinos still on the waiting list for their vaccinations, manufacturing’s upturn spells good news for the country’s middling economy. Financiers who want to jump into the sector must choose their investments wisely, opting for business sub-sectors that have shown growth even throughout the 2020 fiscal year, and are set to establish the tone for the post-pandemic future.

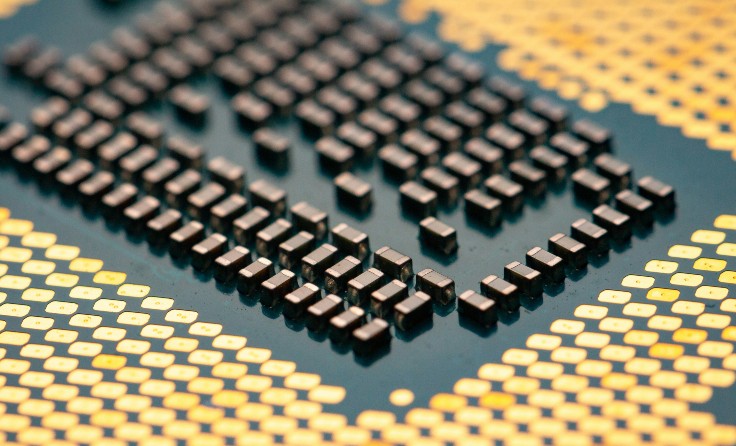

Electronics as a Key Growth Driver

Representative Joey Salceda, who chairs the House Committee on Ways and Means, expressed in an article on the Business Mirror that electronics would help the Philippine economy weather the pandemic, as May 2021’s positive export figures were brought on by the strength of electronics manufacturing at 69%. Semiconductor manufacturing, a large component of this sector locally, contributed a strong 2.53 million USD to this number.

The sector is now being poised as a primary revenue driver for the overall manufacturing industry, according to the Philippine News Agency. The Semiconductor and Electronics Industries in the Philippines Foundation (SEIPI) in particular has been very proactive in helping the sector grow organically, first by implementing Industry 4.0 strategies to propel the sector forward. Digital transformation is an area where electronics thrives, and SEIPI representatives hope to bring this same prosperity to other manufacturing sub-sectors.

To push electronics’ reach further, the group has created the Product and Technology Holistic Strategy (PATHS) that aims to identify profitable areas for the electronics industry to compete with its regional counterparts. Investors who want to join in this industry boom can aid in digital innovation efforts, as well as logistical schemes for further export growth and efficiency.

The International Trade Administration has recognized the Philippines as the third-largest pharmaceutical market in the ASEAN region after Indonesia and Thailand, citing the sector’s stable growth over the past decade. Currently, 14 out of the world’s top 20 pharmaceutical firms have manufacturing facilities in the Philippines.

According to the Manila Bulletin, the local pharmaceutical industry nets an estimated PHP 146 billion per year and employs more than 60,000 Filipinos. The pandemic may have slowed operations slightly due to oscillating lockdown guidelines, but the planned deployment of “pharma zones” in the country’s Bulacan province aims to accelerate the sector’s growth to not only provide more jobs, but help pharmaceutical manufacturing potentially contribute a larger 4.5% to the Philippines’ GDP.

Presidential Proclamation No. 1070, released in early 2021, aims to expand already-existing business zones in Malolos, Bulacan, to form the First Bulacan Business Park (FBBP), a mixed-use ecozone of medical research, manufacturing, and tourism businesses. FBBP is envisioned to host pharmaceutical manufacturing facilities to help stabilize the COVID-stricken economy and lower the country’s reliance on medical imports. Already negotiations are underway with several foreign investors to speed up the development of these facilities, with opportunities for potential partnerships in the fields of construction, logistics, and human resources.

The Role of Digitalization

Ultimately, these two promising sectors must focus on digital acceleration to fully realize their potential growth. YCP Solidiance emphasizes the importance of investing in digital solutions and literacy to become “builders of the world,” which is especially important in economies like the Philippines’ that rely on a large variety of sub-sectors to thrive. Potential investors and partners for electronics and pharmaceuticals must note the specific digital requirements of each industry and what can be done to aid its acceleration.

For more insights on the latest business and economic trends across Asia, subscribe to our newsletter here.