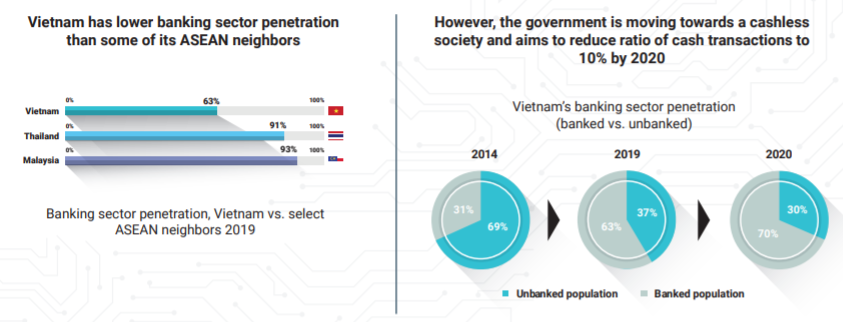

In order to minimize the gap with other countries in the region in terms of financial inclusion, Vietnam’s government has approved a financial scheme for the development of non-cash payments in Vietnam effective from 2016-2020. The plan aims to reduce the ratio of cash transactions to 10%, reaching 70% banked accounts by 2020, and the progress was already visible in 2019.

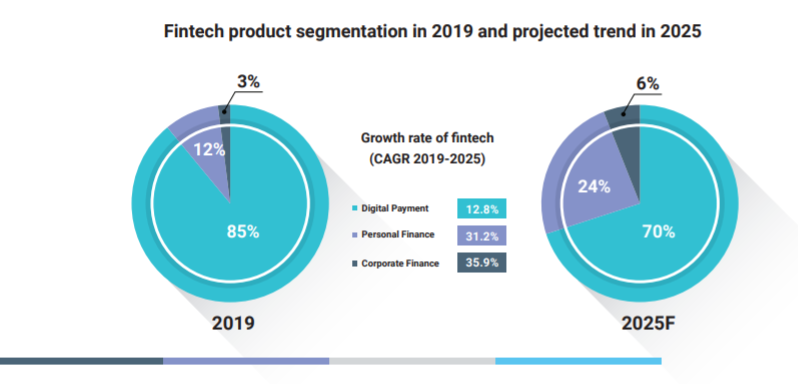

Digital Payment Leads the Fintech Market

Among different fintech product segments, the digital payment solution is currently leading with 85% market share. Some of the prominent players in the market include Momo, WePay, Moca, VNpay, and BankPlus, among others.

Emerging Segment: Personal and Corporate Finance

Although digital payment is currently leading in terms of players and investment, personal and corporate finance is expected to grow at a faster rate through 2025.

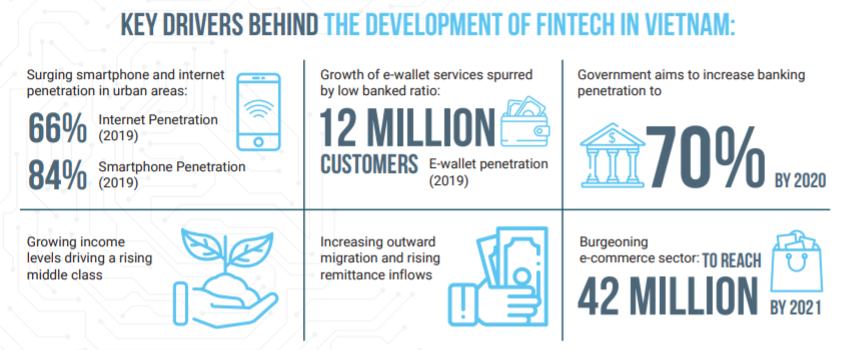

With a more affluent population seeking convenience and cost-saving lifestyle, personal finance solutions are increasingly growing in Vietnam. With the average 6.4% GDP growth in the 2000s, growing income levels from Vietnam’s middle-class have accelerated consumption. Increasing outward migration and rising remittance inflows, with 32% CAGR from 2010-2019, has also generated a strong impact on modern money transfer services.

Meanwhile, SMEs and start-ups play a critical part in driving corporate finance to be the fastest growth rate among fintech segments in the country. The rising establishment of new enterprises, with 54,000 market entrants in the first five months of 2019, has driven the demand for resources and capital. Therefore, Fintech solutions can help ensure adequate capital sourcing for start-up businesses, together with SMEs to facilitate and accelerate growth.

Government’s Role to Build the Future of Fintech

The government plays a crucial role in facilitating a conducive environment for fintech to flourish. In order to support fintech start-ups and facilitate the ecosystem, the Fintech Steering Committee was established in March 2017 by Central Bank and the National Payment Corporation.

Furthermore, to address legal loophole, new circular - Circular No. 23/ 2019 which amended and supplemented several related articles were issued and effective from 7 January 2020. Particularly, customer identification and verification (KYC) and individual’s monthly transaction limit of VND 100 million (~USD 4.3K) is requested by the government to closely monitor the payment transaction as well as protect users in using e-wallet solution.

The government of Vietnam has also put more effort to support and promote Vietnam as a tech hub in the region through some associations and programs, including NATIF, NATECD, SIHUB, FIRST, IPP, and Nafosted. Download the full report here to learn more.