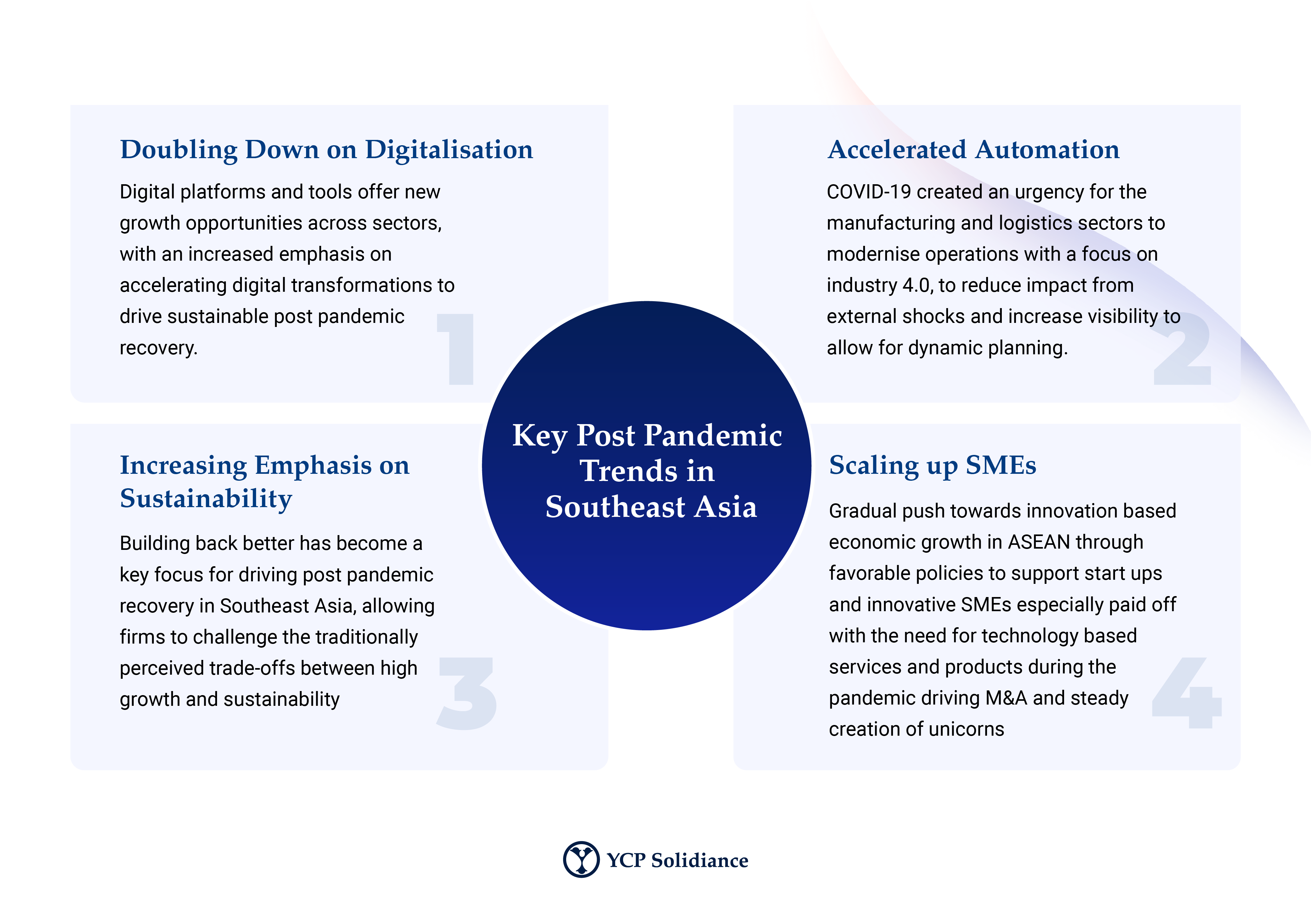

Due to the pandemic, many businesses and professionals throughout Southeast Asia have had to significantly adjust their operations. More of the same can be expected moving forward, especially as many within the region are still in the process of recovering from the pandemic. In context of the business and economic outlook in Southeast Asia, expect these four trends to dominate: (1) Further digitalization, (2) Automation, (3) Sustainability, and (4) Scaling up of SMEs.

To understand the ways in which businesses can leverage digitalization in order to economically recover from the global pandemic, and how Southeast Asia as a whole intends to navigate the post-pandemic world, read this excerpt from our latest white paper, Road to Recovery: Post Pandemic Business Outlook in Southeast Asia, which you can read in full here.

Last November 30, 2021, YCP Solidiance hosted “Road to Recovery: Post Pandemic Business Outlook in Southeast Asia,” in partnership with the Singapore Business Federation. The webinar was attended by over 100 participants from across the region, all wanting a deeper understanding of how businesses could bounce back from the effects of the global pandemic and stay ahead of the curve in the ever-changing and diverse landscape of Southeast Asia.

The event began with an overview of the key macroeconomic trends in Southeast Asia from YCP Solidiance Partner Naithy Cyriac, who provided an extensive picture of how the current economic landscape of the region could transform business going forward.

Macroeconomic Outlook

With strict travel and movement restrictions placed in Southeast Asia compared to our Western counterparts, cases had been declining over the last few weeks of 2021. However, the recent discovery of the Omicron variant has disrupted the promising recovery recorded towards the end of 2021 in the region, with the Philippines, Vietnam, and Thailand especially observing recent spikes in cases in January 2022.

However, ASEAN countries have ramped up vaccination drives across the region, with more than 50% of the population fully vaccinated, except for Indonesia, Myanmar, and Laos.

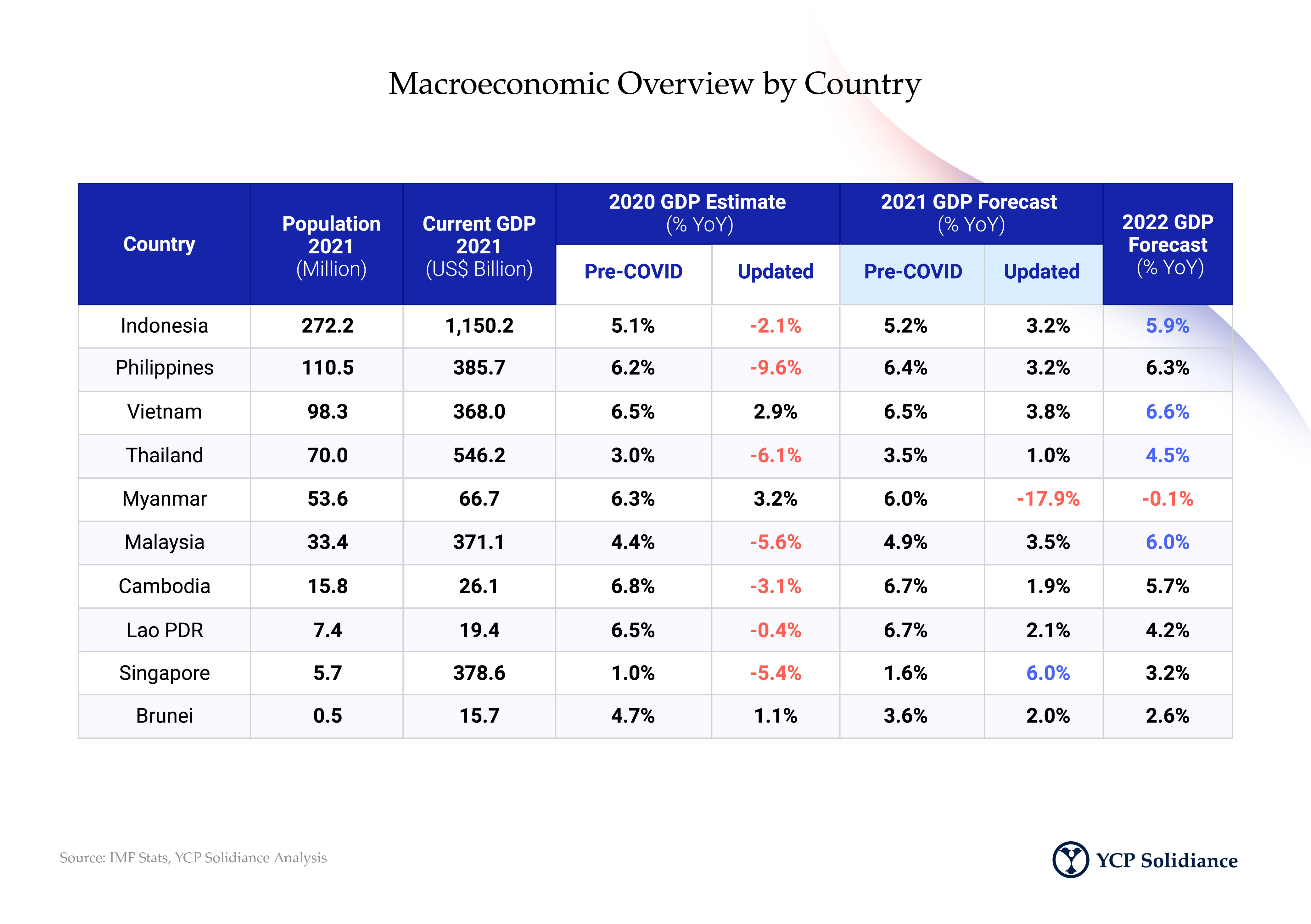

Economically, only Singapore exceeded the pre-pandemic growth forecast in 2021, with other countries in ASEAN projected to show signs of recovery towards the end 2022 and beyond. However, the Regional Comprehensive Economic Partnership (RCEP) between ASEAN and its five free trade agreement partner countries (Australia, New Zealand, Japan, South Korea, and China) is expected to support the region’s recovery and accelerate growth.

Focusing on Four Key Trends

With the new Omicron surge once again disrupting economic, financial, and social norms, businesses are being forced to transform their strategies and operations, with four key trends highlighted to help accelerate recovery.

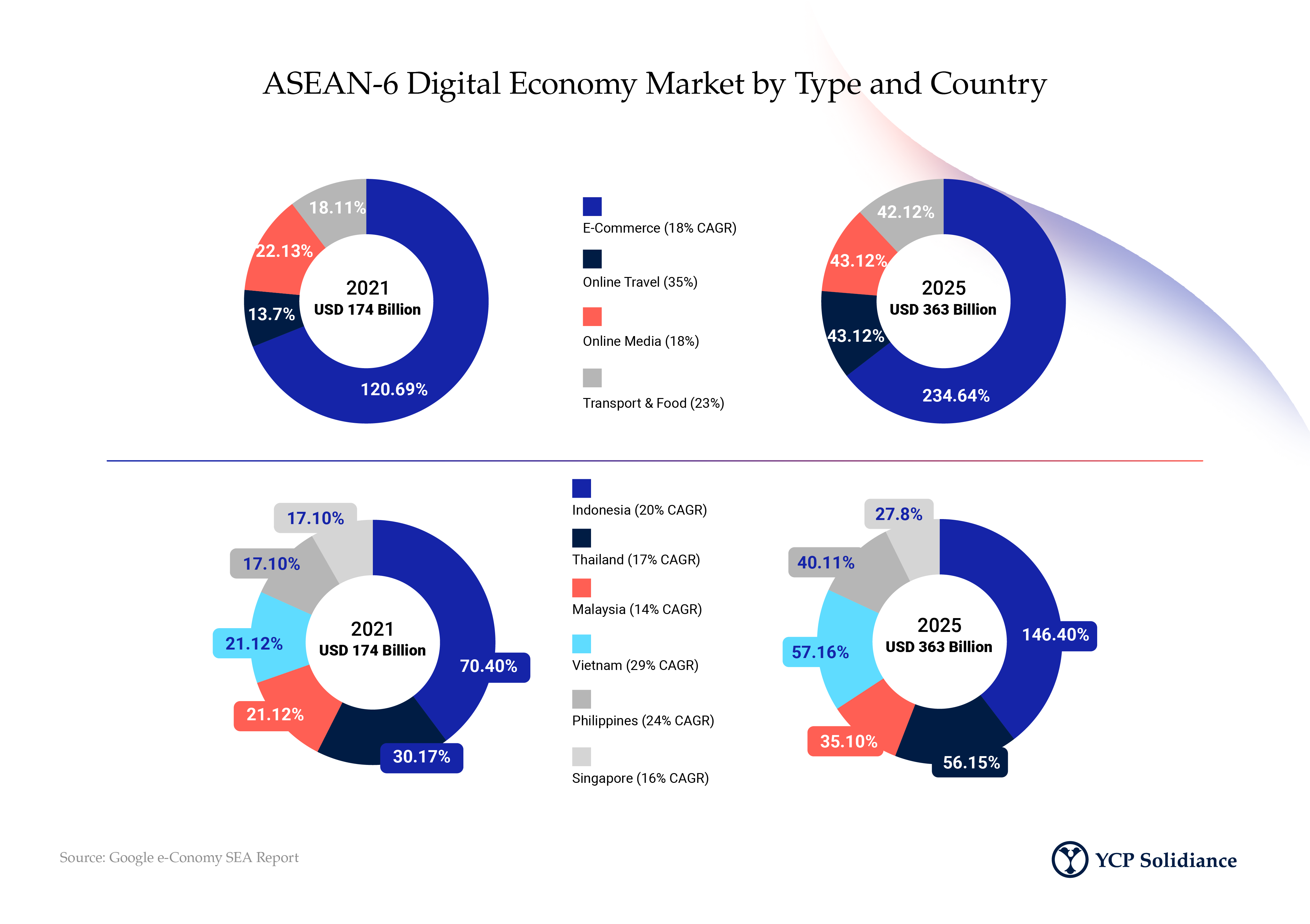

The COVID-19 pandemic has highlighted the need for enhanced public-private sector cooperation and created an urgency for governments to establish favorable policies to facilitate private sector innovation crucial for accelerating recovery. What followed was an exciting panel discussion with our esteemed group of experts, who all had insightful takeaways on each of the four key trends. The learnings shared during this event will help enterprises, companies, and start-ups strategize accordingly to fit the ever-changing landscape of Southeast Asia. Southeast Asia has a relatively young population and a rapidly growing middle class—and due to shifting consumer behavior brought about by the COVID-19 pandemic, is now positioned as the world’s fastest-growing internet economy at a sizable value of USD 174 billion as of 2021.

The internet economy in ASEAN-6 (Indonesia, Thailand, Malaysia, Vietnam, the Philippines, and Singapore) countries, in particular, grew at a 37% CAGR from 2017 to 2021, with the bulk of this rise observed in 2021—a 49% growth year-on-year compared to 2020, and driven by 40 million new internet users in the past year. Indonesia currently leads the region at a USD 70 billion value, but Vietnam and the Philippines—both countries with rapidly growing numbers of online users—are expected to drive further growth in areas like digital financial services.

ASEAN has positioned itself as a global manufacturing hub. With medium- to high-tech manufacturing value on the rise, this industry accounts for 21% of regional GDP (at a value of over USD 600 billion in 2020), driven by vital sectors such as automobiles, electronics, textiles, F&B, and chemicals.

Scaling Up SMEs

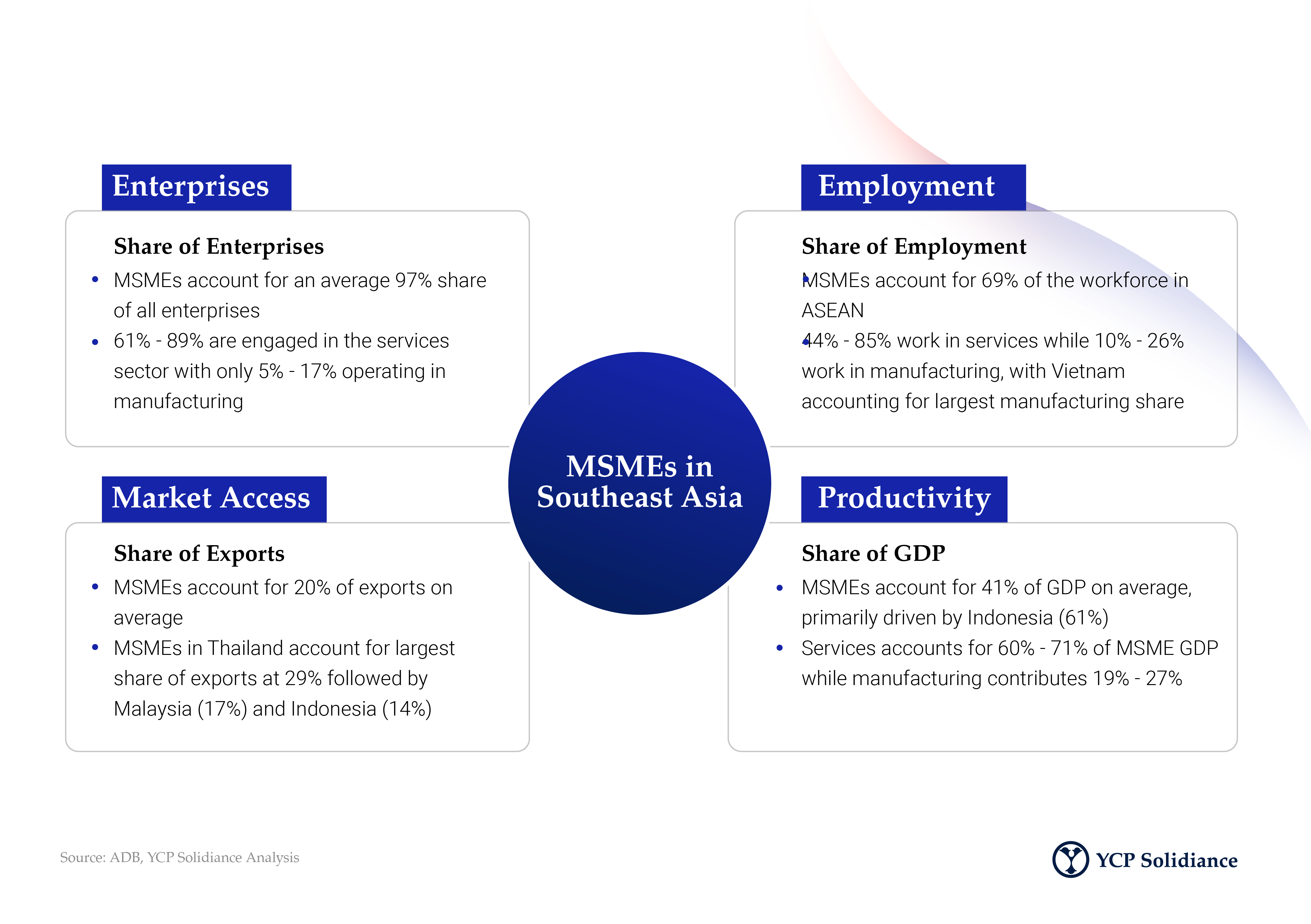

Small and medium-sized enterprises, more commonly known as SMEs, account for 97% of all enterprises, 69% of the workforce, 41% of GDP, and 20% of exports on average for Southeast Asia.