Despite an ongoing global chip shortage, the Indian automotive industry is growing rapidly wherein car sales volume for 2022 is projected to increase by 12.5%, as reported by Deccan Herald. In 2023, car sales volume is projected to grow by an additional 4%, further bolstering the country's automotive industry.

Considering the steady increase in automotive car sales, India’s automotive aftermarket industry is set to benefit as demand for such services will undoubtedly increase. Thus, automotive aftermarket businesses in India find themselves in an advantageous position heading into 2023.

Current Landscape of the Indian Automotive Aftermarket Industry

To meet the growing needs of automotive consumers, the aftermarket sector in India is going through a transitionary period. Specifically, many of the stakeholders involved are exploring how to leverage emerging trends, most notably digitalization. Doing so provides two main advantages, namely: (1) the drastic transformation and adaptation of Indian automotive aftermarket businesses to modern times, and (2) the increased and wide-scale accessibility of automotive services to both offline and online consumers.

Of the stakeholders in the automotive aftermarket industry, service providers that are still offline, especially independent and unorganized workshops, stand to benefit the most by undergoing digitalization. Currently, one of the challenges that these stakeholders face is the disconnect between customer needs versus the services available. As such, digitalization can help bridge this gap through the implementation of digital solutions.

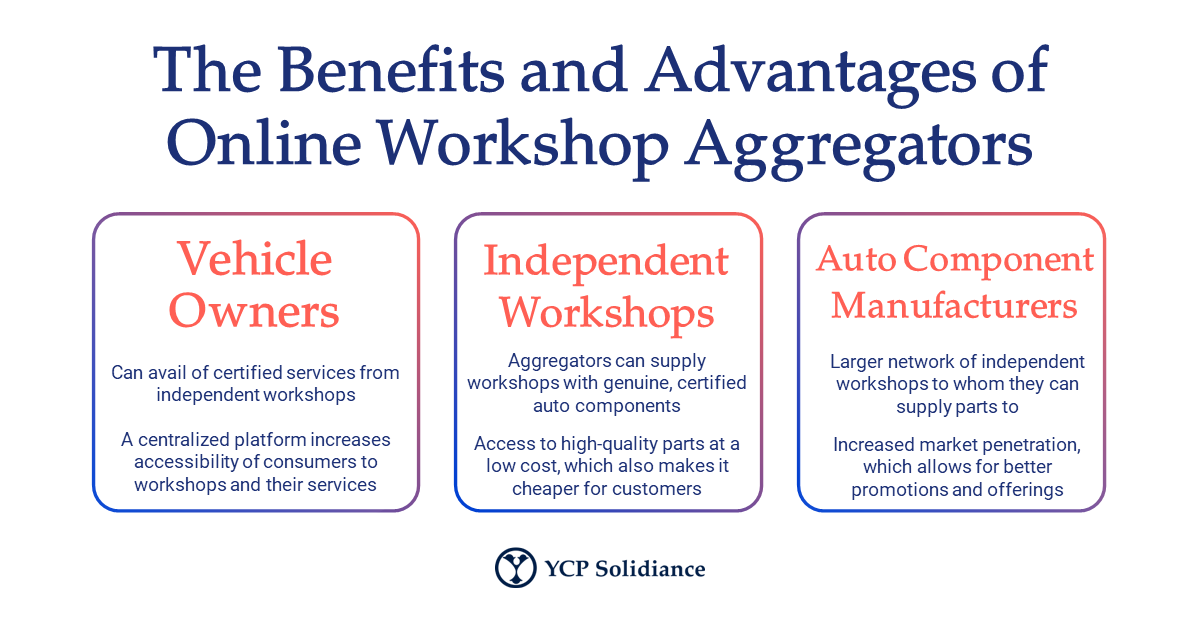

The YCP Solidiance white paper “Charging Towards Digital Dominance: Challenges for India's Auto Components Sector And How to Overcome Them” discusses how digitalization in the automotive aftermarket in India may be used to create and enable online workshop aggregators. By creating an ecosystem consisting of various online aggregator platforms wherein consumers, independent workshops, and auto component manufacturers are connected via one network, the automotive aftermarket industry becomes more organized and streamlined. Consumers can now avail of services offered by previously offline, independent automotive aftermarket workshops through this structure.

The Outlook of India’s Automotive Aftermarket Industry

Beyond the effort of the private sector in accelerating their own development and capitalizing on the increased number of car sales in India, the public sector will also play a significant role in growing the automotive aftermarket. In the coming years, the collaboration between the public and private sectors will be the main driver of ensuring sustained development.

For instance, recognizing the automotive industry’s potential in India, the government launched a Production Linked Incentive (PLI) Scheme for the Automobile and Auto Components sector. Through an outlay of 3.5 billion USD and financial incentives that can reach up to 18%, this scheme will help boost domestic manufacturing of automotive technology, while also hoping to attract potential investments from foreign and domestic players alike. Moving forward, stakeholders should expect similar policies and frameworks to launch as India is projected to become a major force in the global automotive landscape.

As the Indian automotive aftermarket and businesses within the industry focus on capitalizing on the opportunities emerging due to increased consumer demand, the involved parties must remain proactive—be it in following trends like digitalization or fostering public-private cooperation. Further, players should act with both short- and long-term success in mind to ensure that India can maintain its status as a global powerhouse in the automotive industry on several levels, whether as consumers, manufacturers, or service providers.

To further get insight into similar automotive industry trends currently emerging across Asia, subscribe to our newsletter here and check out these reports: