The skincare market in Indonesia is a sizable segment that accounts for approximately 30% of the country’s beauty industry. Skincare market penetration in Indonesia is driven by various factors, such as changing beauty trends, growing awareness of skincare benefits, and improved purchasing power.

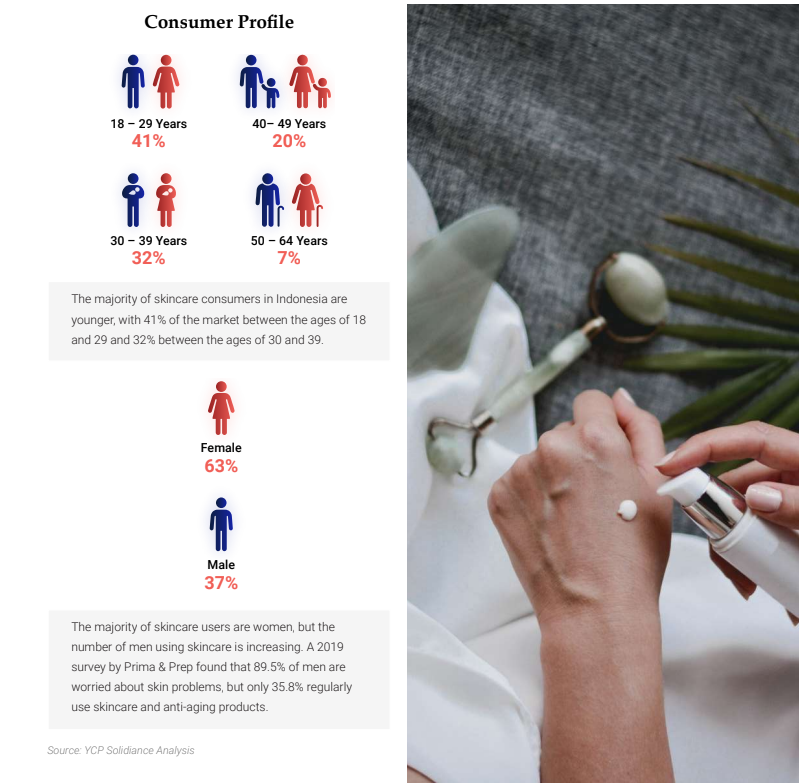

Indonesian skincare consumers predominantly fall within the younger demographic. Those aged between 18 and 29 constitute 41% of the market, while the 30-39 age group comprises 32% of consumers. While skincare traditionally caters more to women, there's a notable increase in men embracing skincare routines. Moreover, 39% of skincare users belong to households with high annual incomes, primarily residing in urban areas, where access to skincare products and information is more readily available.

Regarding purchase channels, Indonesian consumers are strongly interested in e-commerce platforms, offline retail outlets, and social media. E-commerce platforms offer convenience and efficiency, while offline stores allow customers to experience products firsthand and seek expert guidance. Initiatives like TikTok Shop bolster the popularity of social media, although recent governmental decisions have impacted its availability.

Indonesian Skincare Market Promotion

In promoting skincare products, online and offline strategies are crucial in driving market penetration. Skincare brands heavily rely on digital marketing, utilizing platforms like video portals, social media, and search engines to engage consumers.

Notably, marketers optimize social media advertising and influencer marketing to gain their potential customers' attention. Skincare industry players optimize key opinion leaders (KOLs) and skincare experts to influence consumers. One successful player in this strategy is Scarlett, who targets major KOLs and micro-influencers. Meanwhile, brands like Somethinc focus on online campaigns to educate their followers about skin concerns and product ingredients, enhancing consumer awareness and loyalty. Additionally, digital ads are a prevalent marketing tool for numerous skincare brands, predominantly leveraging platforms such as Instagram, TikTok, and YouTube to promote their products and reach a broader audience.

In addition, online stores are also highly beneficial for skincare industry players. Comments features on online stores give customers an opportunity to leave reviews. Customers' positive reviews help brands obtain potential customers' trust and maintain their existing customers' loyalty.

Though online promotion strategy has been popular, offline marketing activities also significantly offer tangible experiences and community engagement opportunities. Luxury brand Lancôme, for instance, orchestrates offline product launch events where influencers and consumers partake in skin consultations and facials, subsequently generating buzz through news articles and social media coverage. Similarly, Emina, catering to teenage girls, fosters customer relationships through the Emina Girl Gang Ambassador program, building a sense of community among its clientele. Furthermore, participation in bazaars like Jakarta x Beauty and Pop-Up Market proves effective for emerging local skincare brands, providing exposure and direct interaction with potential customers physically.

The skincare market in Indonesia presents a thriving landscape with immense growth potential. As consumers become increasingly conscious about skincare and beauty, online and offline marketing strategies are pivotal in shaping brand awareness and fostering consumer interest. Brands that effectively leverage digital platforms alongside traditional marketing channels are better poised to capture the attention of Indonesian consumers, driving engagement and ultimately boosting sales.

To get insight into other business industries in Asia and what trends to look out for across these markets, subscribe to our newsletter here and check out these reports: