Author

Gary Murakami

Gary is YCP's Partner with a diverse portfolio of hands-on management services in M&A and post-merger integration advisory around Asia.

Businesses, including merger and acquisitions (M&A) markets, were put on hold by the COVID-19 pandemic. Regardless of the COVID-19 impacts, Asia remains the fastest-growing region globally, making it a favorable investment destination.

Together with Aon, YCP Solidiance recently organized a webinar titled Keys to Successful M&A in Asia to share insights on M&A trends and challenges in Asia, ways to optimize your M&A deals, and the overview of warranty and indemnity insurance. The session was conducted by Gary Murakami, YCP Solidiance Partner, and Ee Yen Lin, Associate Director of Aon, and moderated by Dennis Lien, YCP Solidiance Director.

Emerging Needs of M&A Deals in Asia

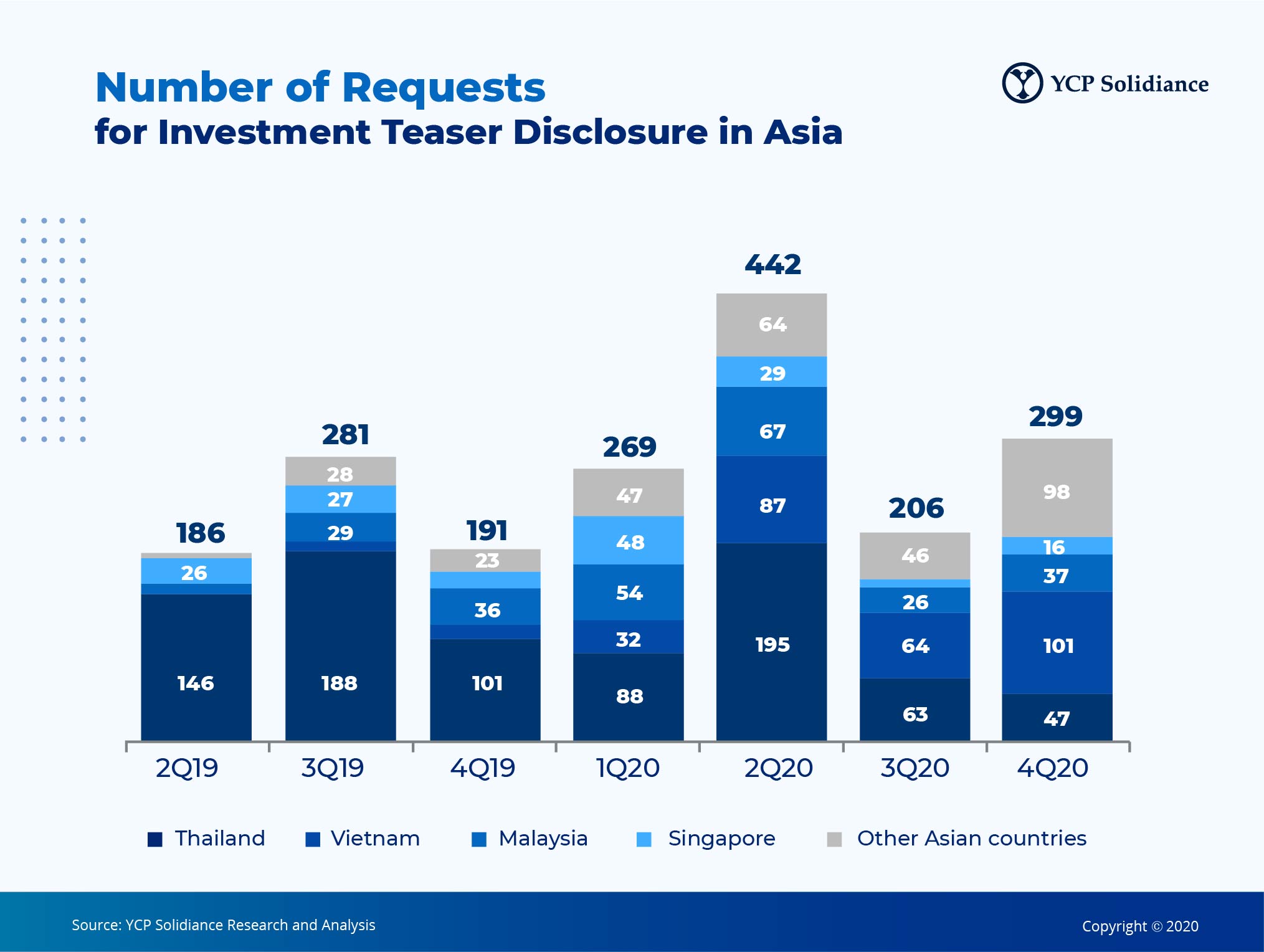

Insufficient connection with local companies, limited in-house resources for M&A deal sourcing, and inadequate suitable M&A deals are slowing down M&A activities, which resulted in several bottlenecks. Due to the high chances of a deal break following due diligence, it is crucial to have appropriate sell-side data, deal sourcing, and deal origination. According to our study, there is a significantly high risk of bottlenecks in Asian M&A negotiations. Therefore, a balanced mix of high-quality advisory and practical execution is recommended.

Warranty and Indemnity Insurance

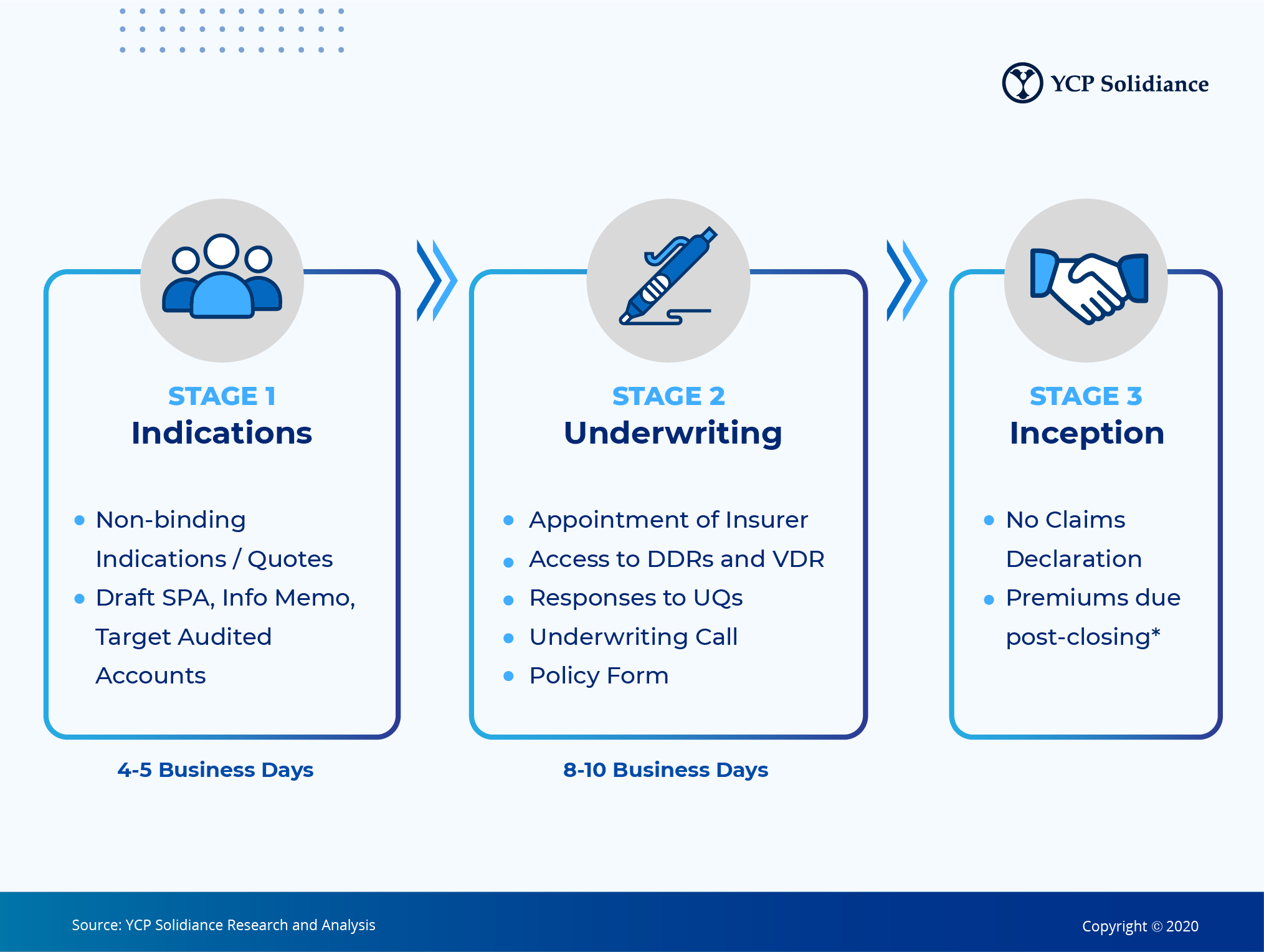

The webinar highlighted how warranty and indemnity (W&I) insurance could lead sellers to a faster negotiation process. Besides, W&I insurance provides sellers a clean exit and maximum profits as there is no recourse against sellers and shareholders, allowing sales profits to be distributed in full to shareholders.

W&I insurance settles a known fixed cost on the transaction, thus optimizing valuations. With the W&I policy as the only ultimate recourse, sellers can propose broader representations and indemnity coverage, which leads to the increased purchased price. Asian-based large companies and public companies have been using W&I insurance to distinguish their bid and advance negotiations in their overseas investments.

The coverage of W&I insurance is attuned to each transaction to retaliate a breach of warranty under an indemnity. As for its exclusions, W&I insurance policies are exclusive of anti-bribery/anti-corruption, contamination or pollution issues, criminal fines or penalties, structural property defects, transfer pricing, and underfunded pension plans.