Last October, OpenGov Asia reported that the Philippines’ central bank, the Bangko Sentral ng Pilipinas (BSP), announced that it would initiate the second phase of the Sustainable Finance Framework, a long-term initiative which aims to promote and support green banking in the country. The Bankers’ Association of the Philippines (BAP) also expressed its commitment to support and help achieve the goals outlined in the future-forward framework.

As defined by the European Commission, sustainable finance “refers to the process of taking environmental, social, and governance considerations (ESG) into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects.” With the effects of the COVID-19 pandemic forcing many industries to shift towards prioritizing efficient yet green-thinking solutions, the Philippines’ financial sector should also follow suit to help address economic changes within the archipelago.

The Philippines’ Sustainable Finance Roadmap

Beyond the aforementioned framework, the BSP is also working on several sustainable finance-related projects. Under the Sustainable Central Banking Programme, the central bank recently established the Sustainable Finance Roadmap, a project which outlines the principles necessary for developing a sustainably, eco-friendly Philippine economy.

From a long-term perspective, establishing a roadmap early on will be beneficial to both public and private sectors as stakeholders will be better informed of how the government intends to enact solutions and preventive measures, such as fiscal policies and re-regulated tax rates which ultimately aim to prevent environmental, economic, and financial catastrophe.

The Role of E-Money and Online Transactions

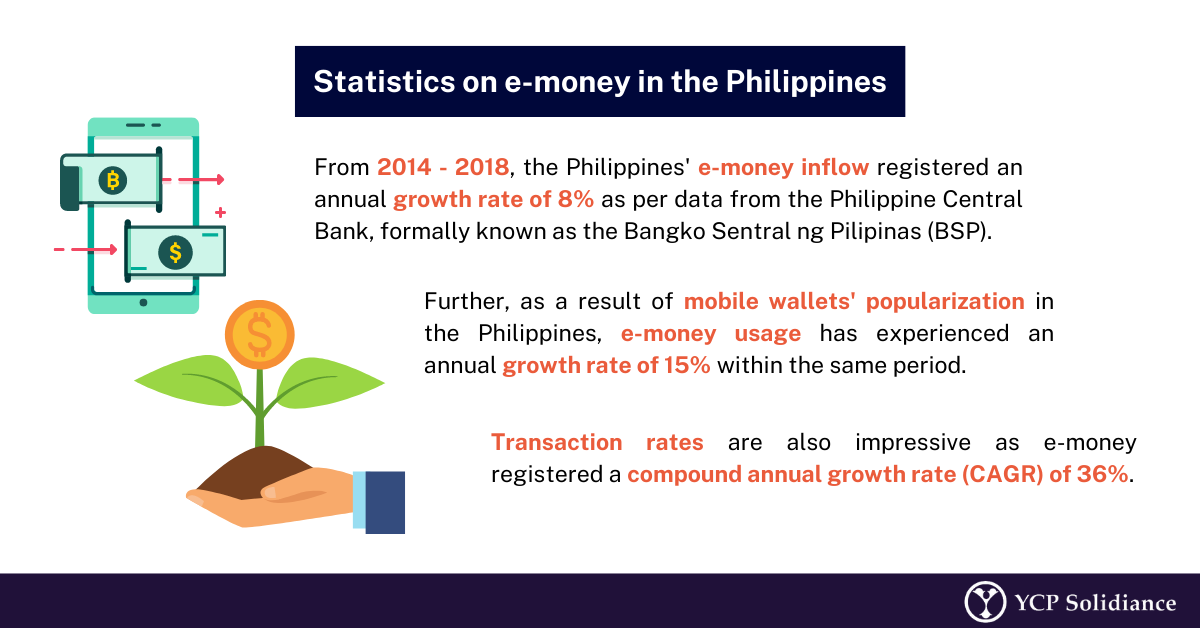

Moreover, the role of e-money in working toward sustainable finance should be an area of interest for the Philippines’ financial providers. In recent years, Filipinos have adopted e-money; a trend which has placed digital transactions as one of the primary modes of payment alongside cash. In the YCP Solidiance white paper “The Digitization of the Philippine Wallet: E-Money’s Emergence in the Philippines,” data revealed that from 2014 to 2018 the number of e-money transactions within the country had registered a compound annual growth rate (CAGR) of 36% in terms of inflow, outflow, and usage.

Given that e-money is expected to become even more prominent in the years to come, e-money’s role in financial sustainability could potentially be significant. Largely driven by prepaid cards and mobile wallets, the adoption of e-money may help promote financial sustainability as cashless transactions are paperless, which could lessen and positively impact the financial sector’s carbon footprint.

Furthermore, the in-app accessibility of mobile wallets could also play a noteworthy part. For example, GCash, one of the country’s top mobile wallet players, currently carries GInvest, an option which allows customers to digitally avail of investment options. The platform and similar applications could potentially include investment opportunities for consumers which are specifically geared toward environmental and sustainability efforts. Doing so would not only bolster government initiatives, but more importantly, it would help activate citizens in the country’s goal of becoming financially sustainable.

As the Philippines continues to move forward with its plans of promoting sustainable finance, the participation of public and private sector will be heavily dependent on the proactivity of the government and related financial bodies, such as the BSP and Department of Finance. While the journey to becoming financially sustainable will be difficult, the recent developments in Philippine finance are encouraging.

For more updates on the Philippines’ progress to becoming financially sustainable, subscribe to our newsletter here.