What should Singaporean businesses and professionals expect this 2022? As part of a new insights series, YCP Solidiance will be releasing several in-depth articles that feature emerging business trends in Singapore, guided by research and analysis from our team of professionals in the country.

Read the second installment below to understand how businesses will continue to utilize digitalization as a transformative tool for post-pandemic recovery in Singapore for 2022. To read future issues of this article series, subscribe to our newsletter here.

In 2020, data from Statista revealed that 15.2% of Singapore’s population consisted of citizens aged 65 years or older. The research also revealed that approximately a third of the total population will consist of elderly citizens by 2050. With Singapore recognized as one of the fastest aging societies in Asia, there is an urgent need to develop eldercare within the country.

The Singapore eldercare industry presents intriguing business opportunities, especially with the application of digital solutions and innovative technology. The eldercare business is quickly emerging as a prevalent trend that investors should pay close attention to in 2022 and in the years to come.

Growing Need for Eldercare

In the YCP Solidiance white paper The Future of Eldercare in Singapore, research showed that there was a significant gap in eldercare services that providers could capitalize on by leveraging new technology and innovative digital solutions. Here are some of the opportunities that eldercare services providers could potentially capitalize on, especially given the circumstances of the COVID-19 pandemic for elderly Singaporeans who live alone or cannot leave their homes:

- Telemedicine: With travel restrictions and limited movement still posing as a challenge amidst the global pandemic, the convenience of telemedicine is invaluable. Despite the emergence of successful eldercare start-ups that have popularized teleconsultations, like Homage Singapore, there is still an opportunity for new entrants as the telemedicine market is still in the early stages of development.

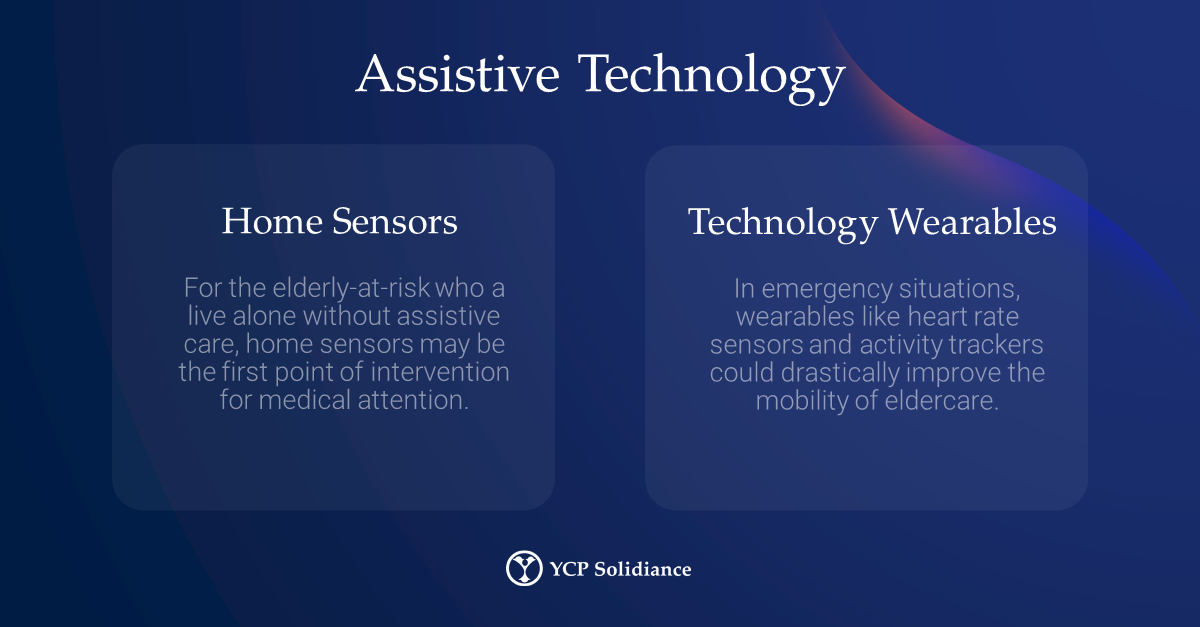

- Assistive Technology: In addition to leveraging technology for telemedicine, it may also be applied to assistive technologies that improve the day-to-day lives of the elderly. The development of assistive technology also helps communities refine their first-hand intervention and medical response through digital solutions such as home sensors and wearables (i.e., smartwatches, activity trackers).

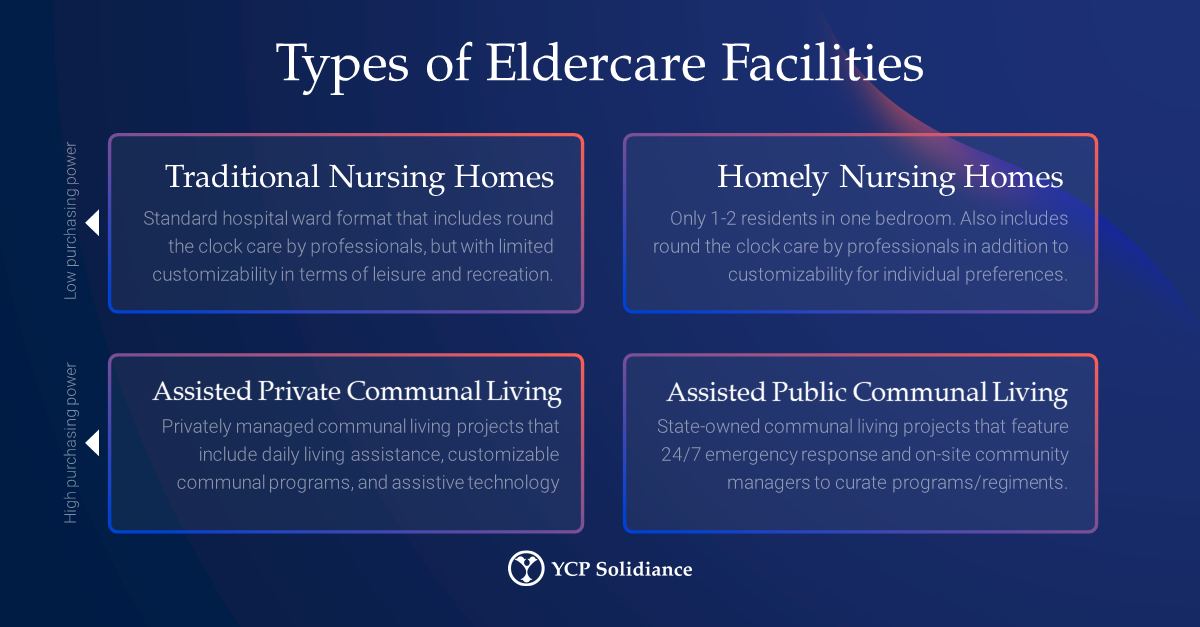

- Diversifying Eldercare Facilities: A large part of the eldercare landscape in Singapore are the living facilities available to the aged. Depending on several factors that vary from case to case, such as income or a patient’s medical needs, the type of living facility needed also changes. Thus, elder care providers must further diversify the current living models available, such as traditional nursing homes or assisted communal living (both private and public).

Exploring Related Opportunities

From telemedicine to diversified living models, the application of technology in eldercare presents several promising opportunities for providers. Although, because the adoption of these digital solutions naturally entails collaboration, other industries like manufacturing, tech start-ups, or even cybersecurity may also capitalize on this trend.

Furthermore, depending on how elder technology will develop in the coming years, solutions like health monitoring and mobility aids may prove to be beneficial outside of eldercare. The growth achieved in the eldercare industry may very well have a positive impact on the future of several closely related industries, like healthcare, manufacturing, tech, etc.