As of April 2020, Saudi Arabia has reported more than 20,000 cases of COVID-19. With its massive impact, the pandemic is expected to continue disrupting the way Saudis live over the next 12-18 months. Governments around the world have increasingly recognized the need to embrace fintech and drive contactless payment infrastructure, particularly during this COVID-19 crisis. In a recent live webinar, our Partner Erika Masako Welch talked about the importance of Saudi Arabia to go cashless by exploring the impact of the pandemic, Saudi's cashless ambition, and key drivers towards a cashless society.

Why Go Cashless?

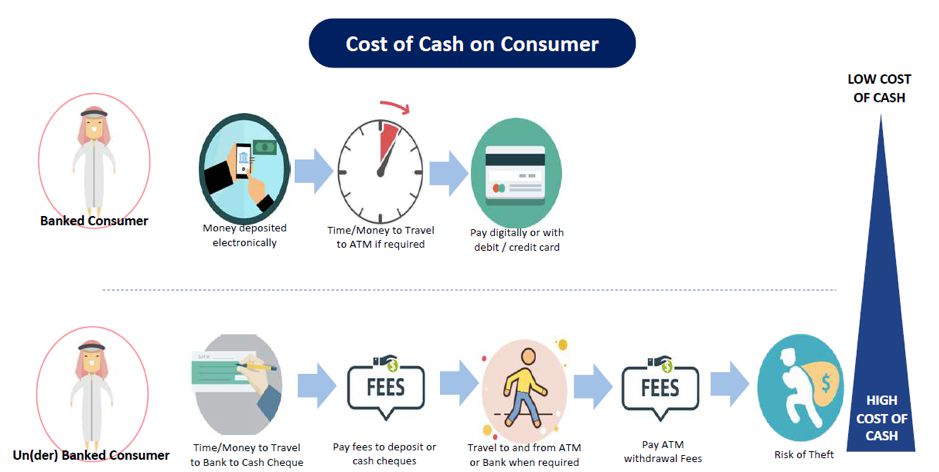

There is an accelerated drive for governments and companies to push towards a post COVID-19 “Low Touch Economy” due to the high cost of a cash-based economy during a pandemic. The inability to access cash, lower transaction volumes, and the spread of germs are among the risks posed by cash.

Sources: Mastercard Analysis; YCP Solidiance's Research & Analysis

Saudi Arabia has presented its ambition to establish a cashless society through the Financial Sector Development Vision Realization Program (FSDP). The Kingdom aims to achieve 70% of noncash transactions by 2030, with an interim goal to achieve 28% of non-cash transactions by the end of 2020.

Drivers Towards a Cashless Kingdom

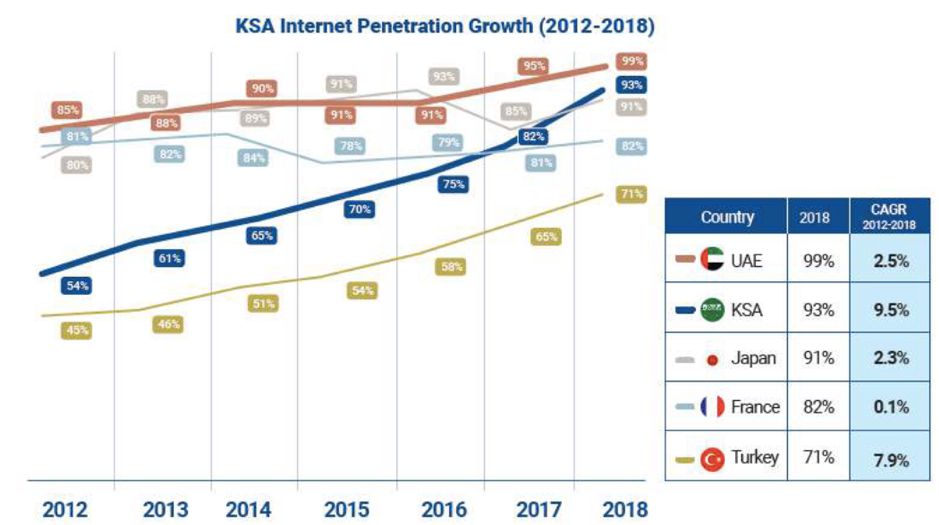

For a cashless economy to truly take hold, the webinar highlighted that Saudi Arabia needs these three key elements. First is a young, wealthy, and digitally-literate population. The young generation of Saudi, which comprises 70% of its 33.7 million population, is one of the most digitally-savvy in the world. However, the Kingdom still lags behind countries in terms of credit card penetration and digital payment method, with around 62% of e-commerce shoppers still prefer cash-on-delivery.

Sources: World Bank Data; YCP Solidiance Research and Analysis

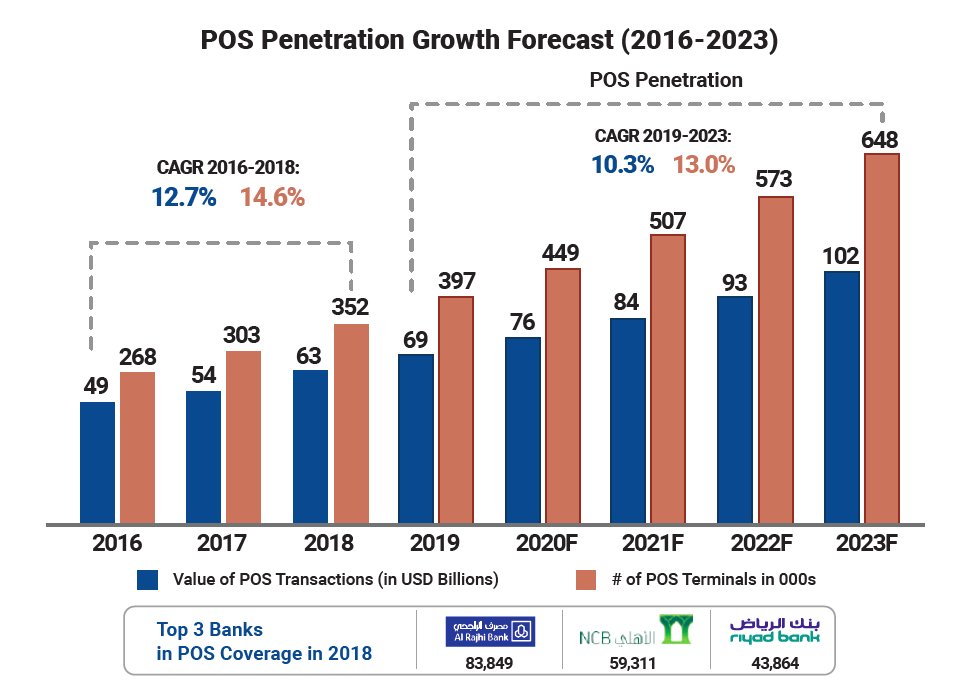

The second element is a digitally-enabled payment infrastructure. The Central Bank (SAMA) and Saudi Payments Company are the main actors behind mobilizing initiatives. The government has also set a target to nearly double the POS coverage to 648,000 terminals by 2023, supported by the implementation of 5G by major telecommunication companies in the Kingdom.

Source: YCP Solidiance's Research and Analysis

The last element is entrepreneurial fintech ecosystems, aimed to drive job creation in sustainable new digitally-focused industries and stimulate economic growth. Fintech Saudi was launched back in April 2018 to support the development of the fintech industry and address key concerns in developing fintech startups in the Kingdom, including lack of infrastructure, talent, and supporting regulations. Commercial banks are also building partnerships with fintech startups to drive fintech innovations and digital transformations further.