Unicorn companies are defined by The Economic Times as “any start-up that reaches the valuation of USD 1 billion.” As Southeast Asia embraces its digital economy, it has seen a surplus of unicorn companies in three particular sectors, called the “pillars of start-ups" by YCP Solidiance Manager Brett Zambarrano: e-commerce, fintech, and logistics.

The Straits Times reports a total of 35 unicorns in ASEAN, a number that is consistently increasing across the region. 19 of these companies reached their current status in 2021—an unprecedented achievement that only spotlights just how digital technology has influenced and shifted consumer behavior over the past five years, spurred on even more by the effects of the global COVID-19 pandemic.

When it comes to the growth of unicorn companies in ASEAN, Indonesia stands out as an attractive investment market, boasting 11 unicorn companies and a record 2021 filled with blockbuster IPOs from some of the country’s most popular tech giants such as Bukalapak and GoTo (the merged GoJek and Tokopedia). With more and more Indonesians embracing the digital economy, expect 2022 to be another year full of growth for the country’s unicorn companies.

Indonesia’s Unicorns and The Power of Digitalization

Indonesia’s unicorn companies are thriving due to the country’s rapid digitalization—according to the YCP Solidiance white paper “Road to Recovery: Post Pandemic Business Outlook in Southeast Asia,” Indonesia’s digital economy is valued the highest amongst the ASEAN-6 countries at 70 billion USD for 2021. Data Reportal’s Digital 2022 report for Indonesia also states that as of January 2022, the country has over 204 million internet users at a 73.7% internet penetration rate.

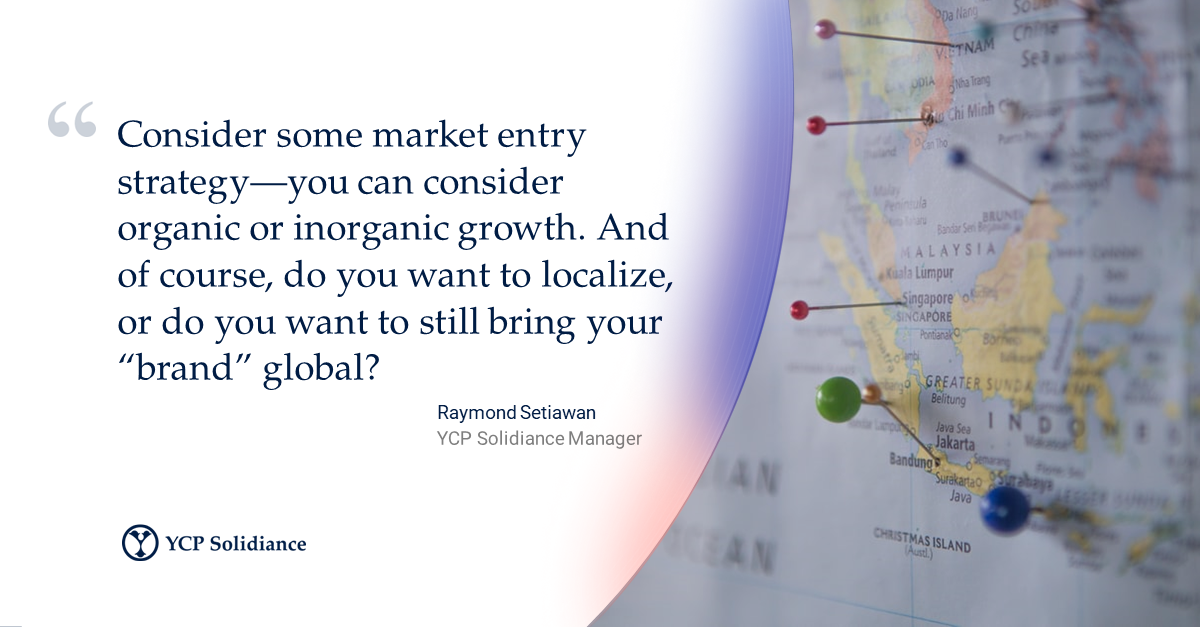

While Indonesia’s high internet awareness plays a role in the number of unicorn companies within the country, YCP Solidiance Manager Raymond Setiawan, who is based in and handles clients in Jakarta, offers other factors that make Indonesia an attractive market for unicorn growth:

“The first factor is market attractiveness, which itself will consist of several sub-factors. The first one would be market size and market growth—the two most important for a company to become a unicorn very fast,” he says, citing the monumental rise of GoJek, considered to be the pioneer super app in Southeast Asia and one of the country’s two decacorns (over USD 10 billion in value). “The second factor would be investment availability. Investors will tend to not invest when you have small market size. For example, if you talk about other SEA countries, their market size compared to Indonesia would be very small.”

Emerging Unicorn Trends

When it comes to emerging trends for unicorn companies, Raymond emphasizes that fintech and logistics are gearing up to be the best place for investments as Indonesia’s e-commerce market is already heavily saturated. “In Indonesia, I believe people have started to be more aware of financial knowledge,” he emphasizes. “We also have several influencers that educate the market in terms of financial education. Fintech is gaining more traction mostly in urban areas, especially in metropolitan Jakarta.”

When it comes to the logistics industry, he highlights a key trend influenced by lockdowns due to the COVID-19 pandemic. “Cold chain logistics will be the trend for the next five years. We have several clients that are all talking about the cold chain, and the government would like to align with the broad network for fresh and agriculture products. They could directly ensure the logistics of the fresh product to the market.”

The Food & Beverage sector, which has been bolstered by the increase in awareness and usage of online delivery and payments over the past few years, is also seeing monumental success. Raymond cites examples such as the Hangry Group and Kopi Kenangan, which is currently one of the country’s most popular unicorn companies.

Growing the Unicorn Ecosystem

Aside from its high internet awareness, Raymond also emphasizes another key factor that makes Indonesia ideal for start-up founders. “What makes Indonesia a good place to grow a unicorn company is also its talent availability in the market. Currently we have more and more [unicorn companies], so talent availability is at a deficit because most of them are already in these companies. We need more talent, such as engineers and product managers.”

While a current shortage of digital talent may be a problem for companies looking to expand, Raymond also emphasizes government efforts to ensure that more Indonesian workers are trained to be digital-ready. Among some of the current initiatives are the Communication and Informatics Ministry (Kominfo)’s digital talent development program, which aims to upskill workers by introducing them to digitalization basics.

For more intermediate digital upskilling, the government’s Digital Talent Scholarship program, held in cooperation with 197 private sector partners, aims to educate at least 600,000 digital talents a year for the next 15 years. The program teaches skills in cloud computing, artificial intelligence, and Internet of Things (IoT), and coding to help potential digital talent be up-to-date and well-educated in the tech space.

Recommendations for the Future of Unicorns in Indonesia

Raymond has the following recommendations for Indonesian start-up companies aspiring for, near to, and have achieved unicorn status:

For start-ups wanting to achieve unicorn status:

- “The first thing investors consider is the people—the founder itself, not the business model. So many people could come up with the same idea, but the execution is one of the hardest parts. For start-ups [who want to be unicorns], the first one they need to solve would be a founder that should have leadership and communication skills, and so on.

- “The second one, they could reassess their business model. If they want to become a unicorn, the goal is to be a global company. They need to reassess their business in terms of how they participate in the digital ecosystem, because more and more platforms will become very integrated—so they should see which part they take in the digital ecosystem.”

For companies close to becoming unicorns:

- “I believe this is one of the cases where their growth is not very aggressive or stagnant. Most of them would need to reassess the market, their business model, and their unique value proposition—what kind of unique service they want to emphasize to the market, and then they will need to ensure that it has a captive market, because you want to be scalable.”

For unicorn companies looking for growth, or to become decacorns:

- “For a unicorn to go even further means they would want to capture the regional market. Before they consider entering another market, they should ensure that the local market is already utilized to the maximum. Second, they would need to do a market feasibility study, and then also assess the customer and competition in the market—how major is the readiness of the customer, as well as the market share that is already captured by the competitor.”

To gain further insight into how Indonesia's start-up pillars are growing, as well as that of the rest of ASEAN, subscribe to our newsletter here. You may also read our other reports on Indonesia's start-up and unicorn economy: