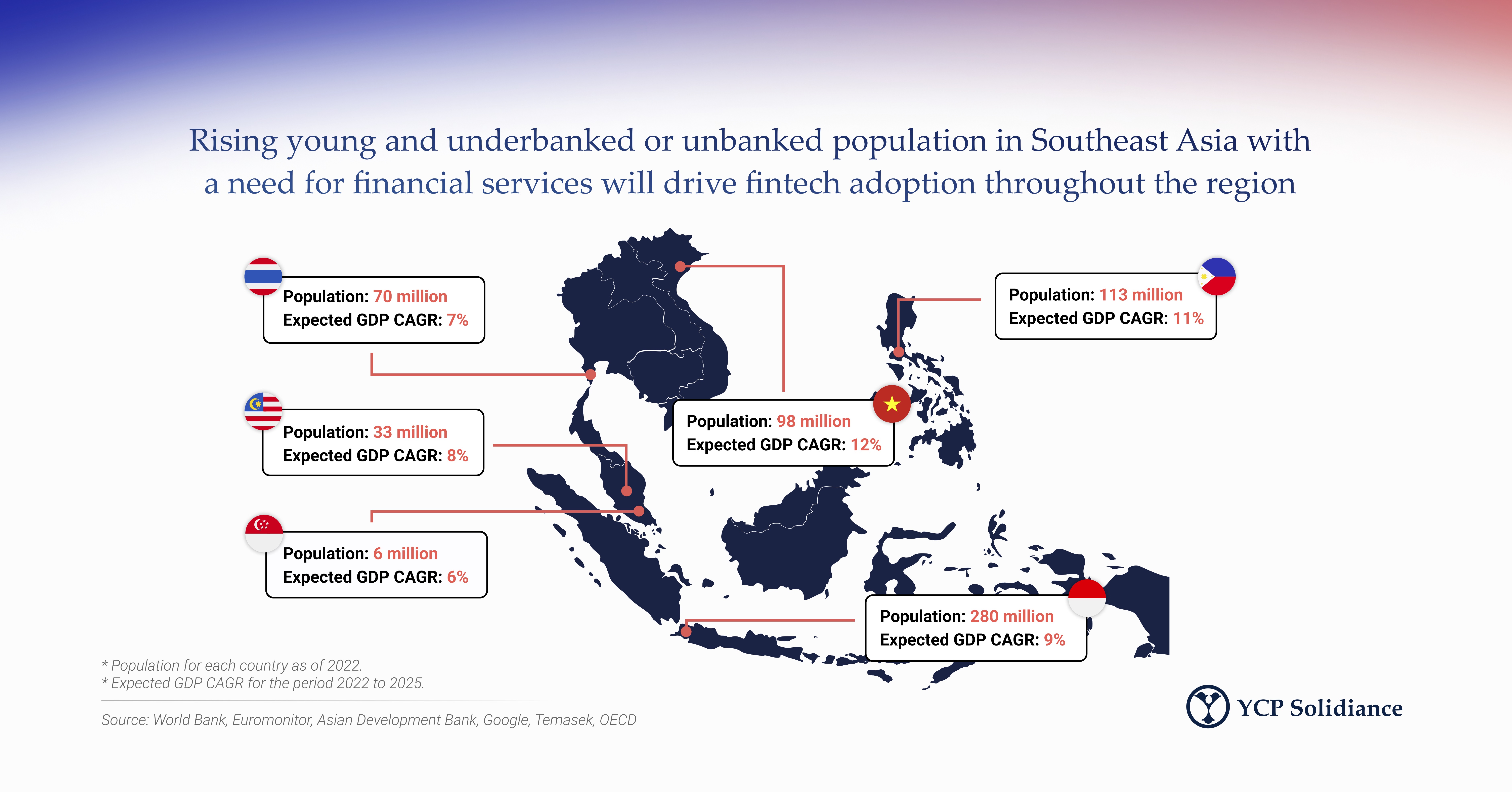

The growing population and rising GDP in Southeast Asia offer significant market potential for fintech companies. Vietnam and the Philippines are poised for the highest GDP growth at 12% and 11%, respectively, while the growing middle class across most Southeast Asian nations sets the stage for the adoption of innovative financial solutions.

However, underbanked and unbanked people, notably in Indonesia, the Philippines, and Vietnam, still remain a challenge despite the overall surge in population. This further highlights the need for enhanced financial inclusion programs geared towards these markets, which offer exciting opportunities for market players in SEA and beyond.

Our publication delves into the growth of the financial technology sector of Southeast Asia, exploring key segments that contribute to its success and the potential for further success in this dynamic region.

The combination of a rapidly growing digital economy and a younger, tech-savvy population spells out a flourishing future for the fintech industry in Southeast Asia. This report provides an overview of the current fintech landscape in the region and explores the outlook for five key segments:

Digital Payments: This method is at the forefront of financial innovation in SEA due to the growing popularity of mobile wallets and QR codes, and is expected to accelerate even further as cross-border transactions become more seamless and commonplace.

Digital Lending and Expanding Financial Inclusion: Digital lending is transforming Southeast Asia's digital financial sector as its primary revenue driver, expanding financial access for underserved communities through faster loan applications and approvals, as well as integrating financing options into everyday online activities like shopping and travel.

Growing SEA’s InsurTech Sector: Defined as the innovative use of technology for insurance, InsurTech is transforming the industry through personalized, on-demand, and data-driven products for underserved communities, such as microinsurance and parametric insurance. Through partnerships with traditional insurers, these tech-driven companies are rapidly advancing innovation and expanding market reach.

WealthTech Opportunities in SEA: WealthTech is making financial advisory and investment opportunities more accessible to everyone regardless of income level. Robo-advisors are offering personalized investment management, while digital platforms are simplifying the process for investors to access and manage their wealth portfolios efficiently.

Expanding Cryptocurrency in SEA: Adoption of cryptocurrency in the region is poised for growth, fueled by rising awareness of its benefits, as well as the evolution of regulatory frameworks that aim to provide clarity and address concerns. This will lead to the exploration of new use cases for cryptocurrencies, including cross-border payments and remittances.

Download our free white paper to learn more about the latest in Southeast Asia’s financial technology sector, and explore ways to harness the industry’s growth.

Author

Takahiro Okawara

As YCP Solidiance's Partner in Singapore, Takahiro's expertise focuses on new business launches, M&A supports, marketing, and strategic planning.

Recent White Paper

See All