The State of the Global Islamic Economy Report (GIE) 2022 reveals that the world’s Muslim population of 1.9 billion people spent around USD 2.0 trillion in 2021 on halal goods and services, which reflects a strong CAGR of 8% from 2015 to 2021. Although the projected CAGR from 2021 to 2025 is slightly lower at 7.5% due to supply chain disruptions caused by the COVID-19 pandemic and the Ukraine war, the global halal industry is expected to continually expand.

Industry growth is driven by several key factors, namely: the growing Muslim population and adherence to halal practices; rising demand for halal products from non-Muslim consumers; the implementation of national strategies for halal industry development, and the establishment of a digital halal ecosystem due to adoption of technology within the sector.

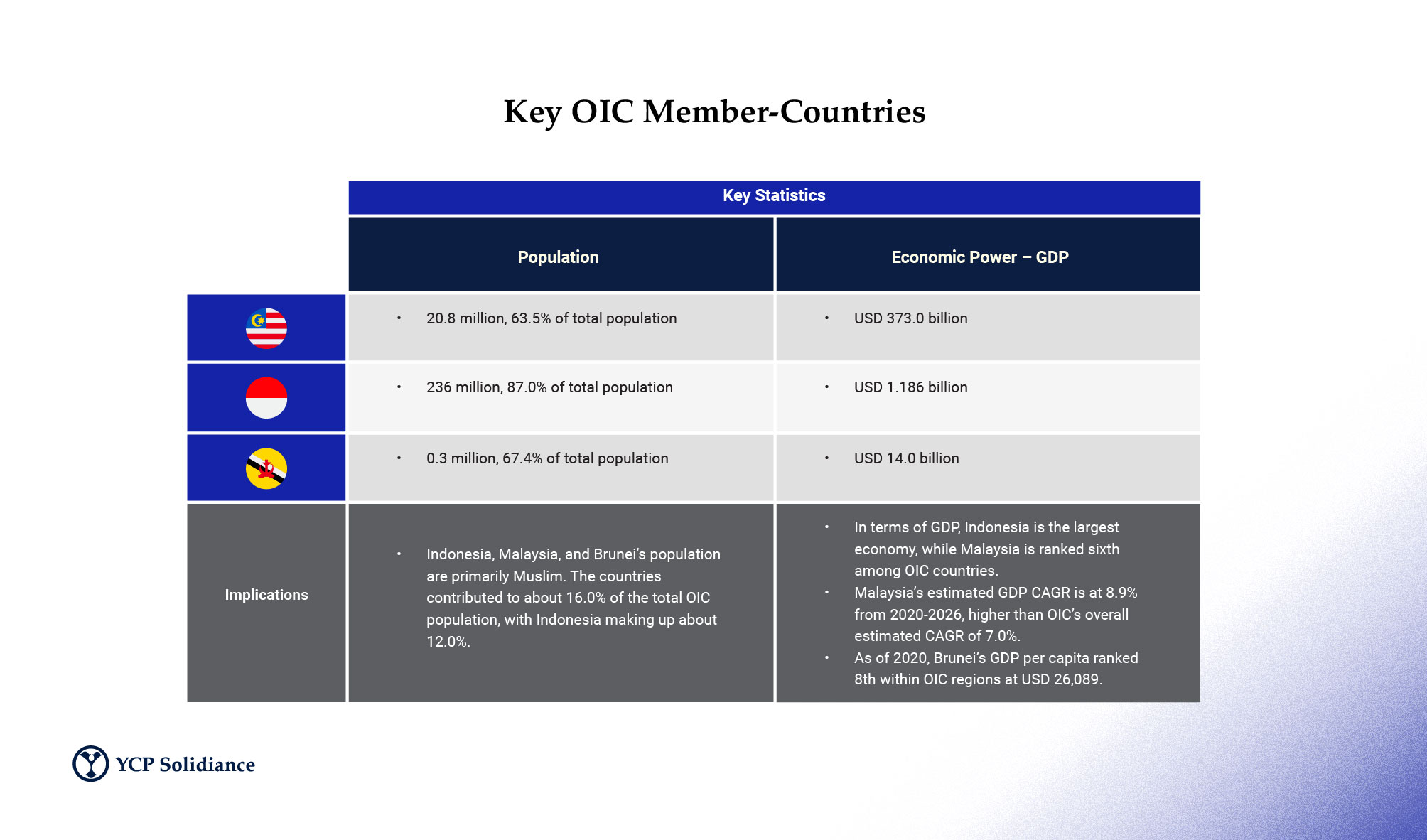

However, the global halal industry also faces significant challenges due to the lack of a standard regulatory system across countries, which can potentially increase production costs or limit market access. In the halal industry in Southeast Asia (SEA), where there are several key member-countries of the Organisation of Islamic Cooperation (OIC), the challenges faced are particularly evident.

Key Players in the Halal Industry in Southeast Asia

OIC countries are projected to experience faster GDP growth when contrasted with the global average, with a projected CAGR of 7% from 2020 to 2026. An overview of the halal industry growth in SEA can be seen in notable OIC member-countries Malaysia, Indonesia, and Brunei, which hold significant roles in the region’s halal industry. Malaysia is a founding OIC member and has a thriving halal sector, while Indonesia has the largest Muslim population in SEA. While not as large as the other member-countries, Brunei is an emerging player in the SEA halal industry.

This report provides an overview of the future outlook of the halal industry in SEA by looking into the leading players, challenges, and opportunities for growth in the region, taking a deep dive into halal consumer goods and Islamic finance in Indonesia, Malaysia, and Singapore as key examples in SEA. To learn more about how companies can enter, grow, and succeed in SEA’s halal industry, download our free report today.

Author

Septian Waluyan

Septian is a Partner based in Indonesia. He built his expertise in the consulting industry in Indonesia with a focus in Oil & Gas, Chemicals, Consumer & Retail, and Manufacturing.

Recent White Paper

See All