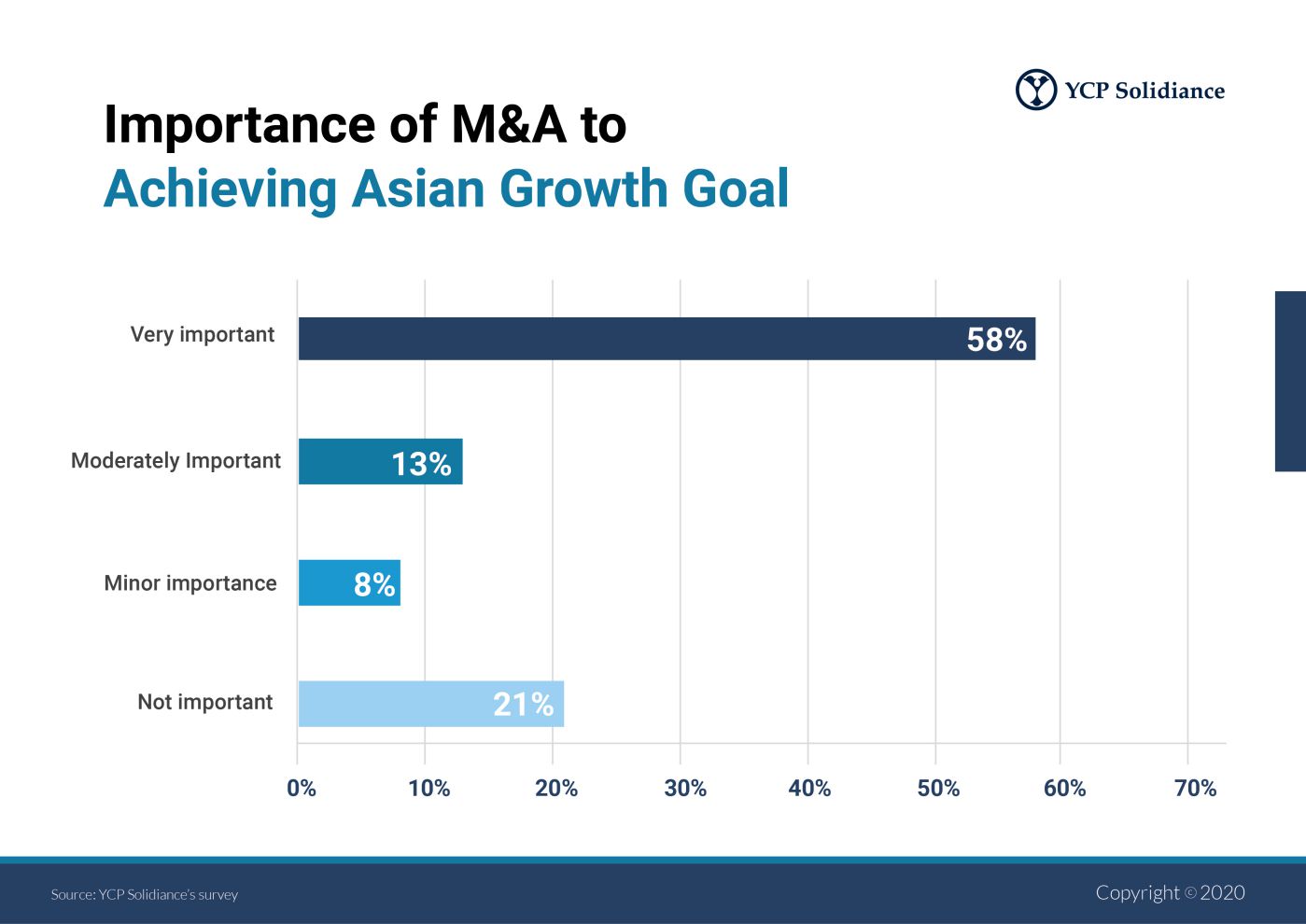

Asia has been a growing target for investments by western firms over the last decade, including both organic investment and mergers and acquisitions (M&A). However, following the introduction of tariffs between the US and China in 2019, a level of uncertainty and turbulence is now coloring investment decisions across the region.

Along with the compounding effect on trade that will undoubtedly be unleashed due to the Coronavirus (COVID-19), the aggregate FDI into the region witnessed a huge drop off from 2018 into the first half of 2019 and China saw a 58% decrease in US investment. There has been some movement away from China recently to other neighboring Asian markets or even North America, known as the “China+1” strategy.

Going Forward: Integrated Strategy is Needed to Succeed in the Asian Market

The report suggests that despite the challenges resulted from trade tensions, economic interests in Asia remained high. The current situation has not caused most companies to alter their basic investment strategies and continue to view Asia as a primary region for growth and expansion in the near to mid-term future.

Author

Pilar Dieter

Pilar is YCP Solidiance's California office Managing Partner and experienced advisor with Fortune 500 firms seeking growth opportunities in Asia.

Recent White Paper

See All