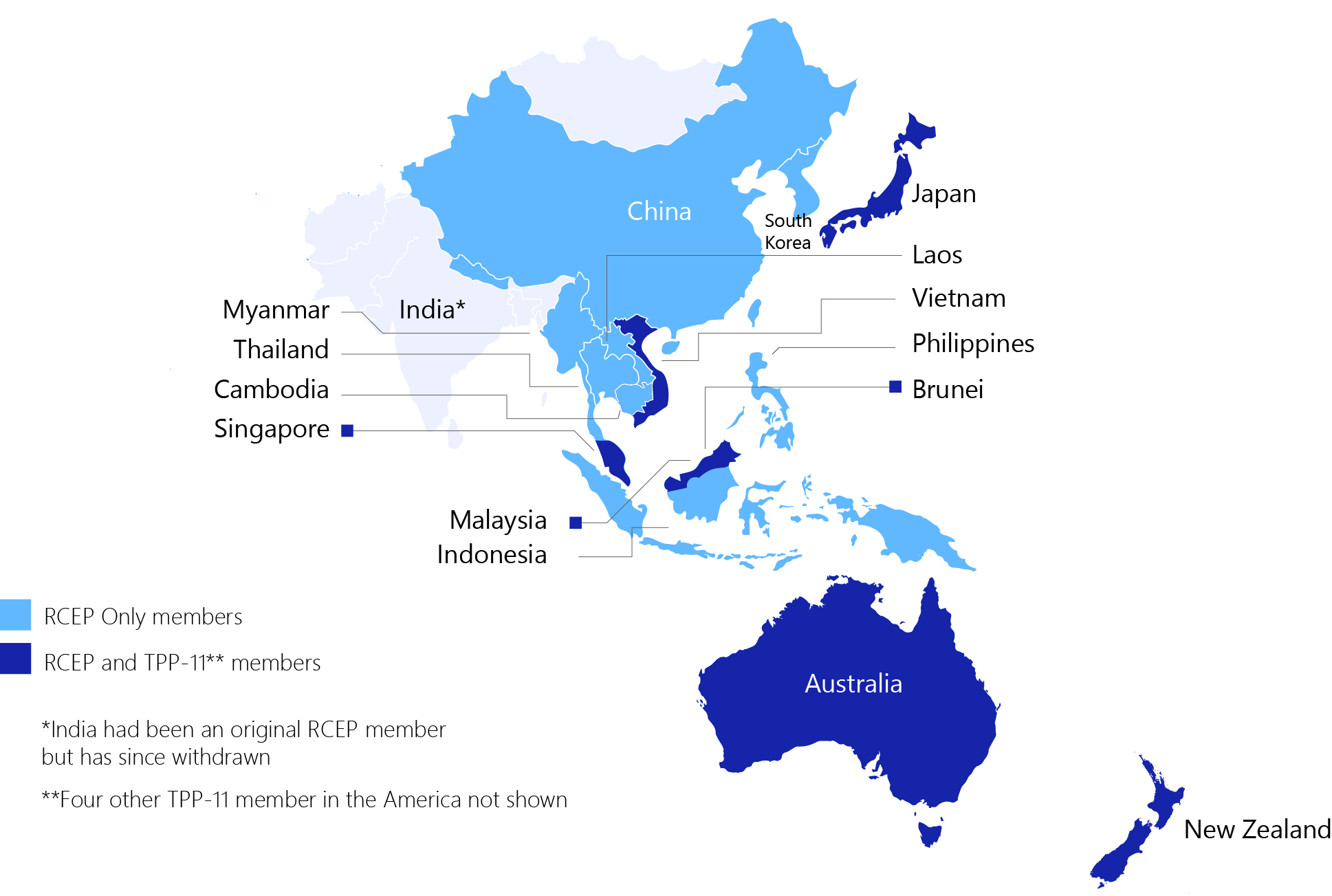

As Southeast Asia’s supply chains grow increasingly complex, businesses face rising operational costs, regulatory challenges, and the need to optimize liquidity while managing risk. Our latest white paper, “Supply Chain Finance in Southeast Asia: A Deep Dive into the Financial Strategies, Technologies, and Innovations Transforming Global Supply Chains,” explores how supply chain finance (SCF) solutions are becoming essential in addressing these challenges.

Companies across the region are seeking ways to improve financial agility and operational resilience, though many still struggle with supply chain finance regulatory risks, digital gaps, and limited access to credit. SCF is now a fundamental part of modern supply chain operations, driving efficiency and promoting sustainable supply chain finance practices.

The report also examines how SCF is applied in Southeast Asia, focusing on the unique challenges faced by businesses in emerging markets. Moreover, it highlights why many supply chain finance programs fail to meet expectations and offers insights into overcoming these obstacles.

Developed by YCP’s expert consultants, this white paper provides strategic insights on:

- Navigating Regulatory Complexities: Discover how businesses can comply with local regulations and overcome legal obstacles to unlock the full potential of SCF.

- Leveraging Digital Infrastructure: Learn how advanced technologies improve SCF integration, streamline transactions, and reduce errors.

- Building Sustainable Supply Chains: Understand how to incorporate ESG principles into SCF programs to drive both financial and environmental benefits.

- Inclusions for SMEs: Explore strategies ensuring smaller suppliers gain access to crucial liquidity through receivables discounting and other loan-based supply chain finance solutions.

Download the full white paper to gain expert guidance and a clear roadmap for harnessing the power of SCF to optimize your business’s supply chain operations.