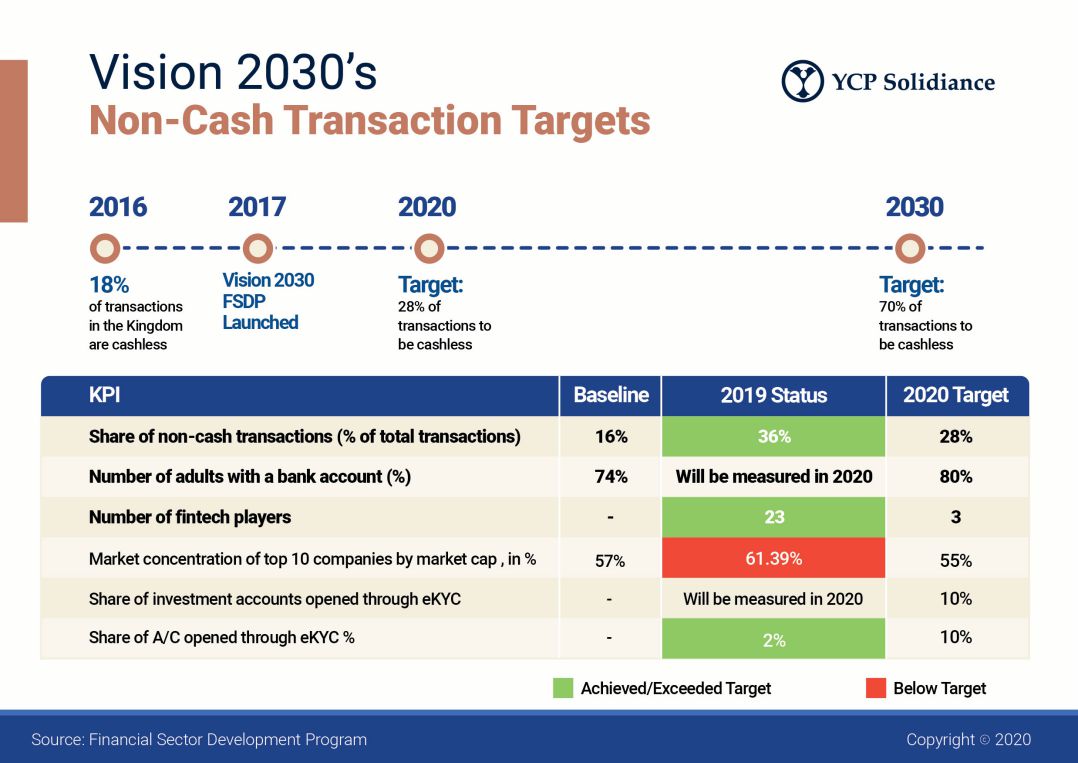

As the cost of cash is high, countries around the world are starting to go cashless because it’s safer, faster and more efficient. Saudi Arabia has set a target to achieve 70% of non-cash transactions by 2030 and an interim goal of 28% by the end of 2020 under the Financial Sector Development Program (FSDP). The plan is a part of Saudi Vision 2030 to reform and diversify its economy away from oil dependency and establish a vibrant country for people to live.

There are three key pillars for a cashless economy to truly take hold in the Kingdom. First is a digitally enabled and financially literate population that understands how to utilize digital payment solutions to start moving the needle towards a cashless economy. The second pillar is a digitally-enabled payment infrastructure that should be built under a collaboration between government and other related stakeholders, once citizens begin to make cashless transactions. Lastly, is entrepreneurial fintech ecosystems, comprising digitally innovative banks and a strong start-up culture with accelerators and venture capitalists funding, to further fuel the adoption of cashless transaction methods in Saudi Arabia.

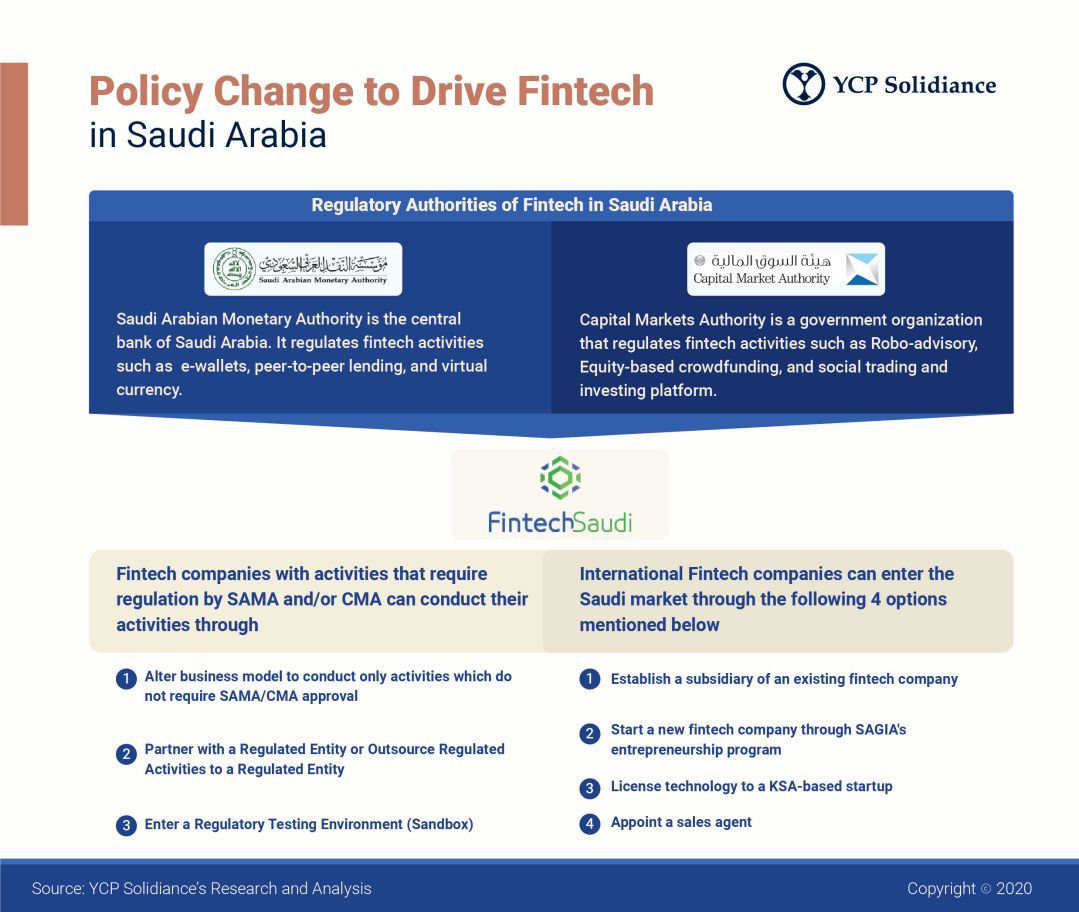

Opportunities to Drive Fintech Forward