Introduction to M&A

Southeast Asia’s economic recovery is fueling a growth in corporate mergers and acquisitions. The surge demonstrates the region’s increasing attractiveness to investors and companies looking to expand in emerging markets. The landscape is marked by a diversity of cultures, economies, and business practices, offering a rich ground for opportunities alongside unique challenges.

Particularly in the diverse and rapidly evolving economic landscape of SEA, Programmatic Mergers and Acquisitions (M&A), characterized by the frequent acquisition of small to mid-sized companies, has emerged as a pivotal strategy for business growth and market expansion. This region, marked by fast-paced growth and a complex array of markets at varying stages of development, presents unique challenges and abundant opportunities for companies. Executing programmatic M&A in SEA is especially critical due to the need for businesses to be agile and adaptive amidst diverse regulatory frameworks, cultural nuances, and diverse market conditions, necessitating a meticulous and well-orchestrated approach.

Strategic Benefits of Programmatic M&A in SEA

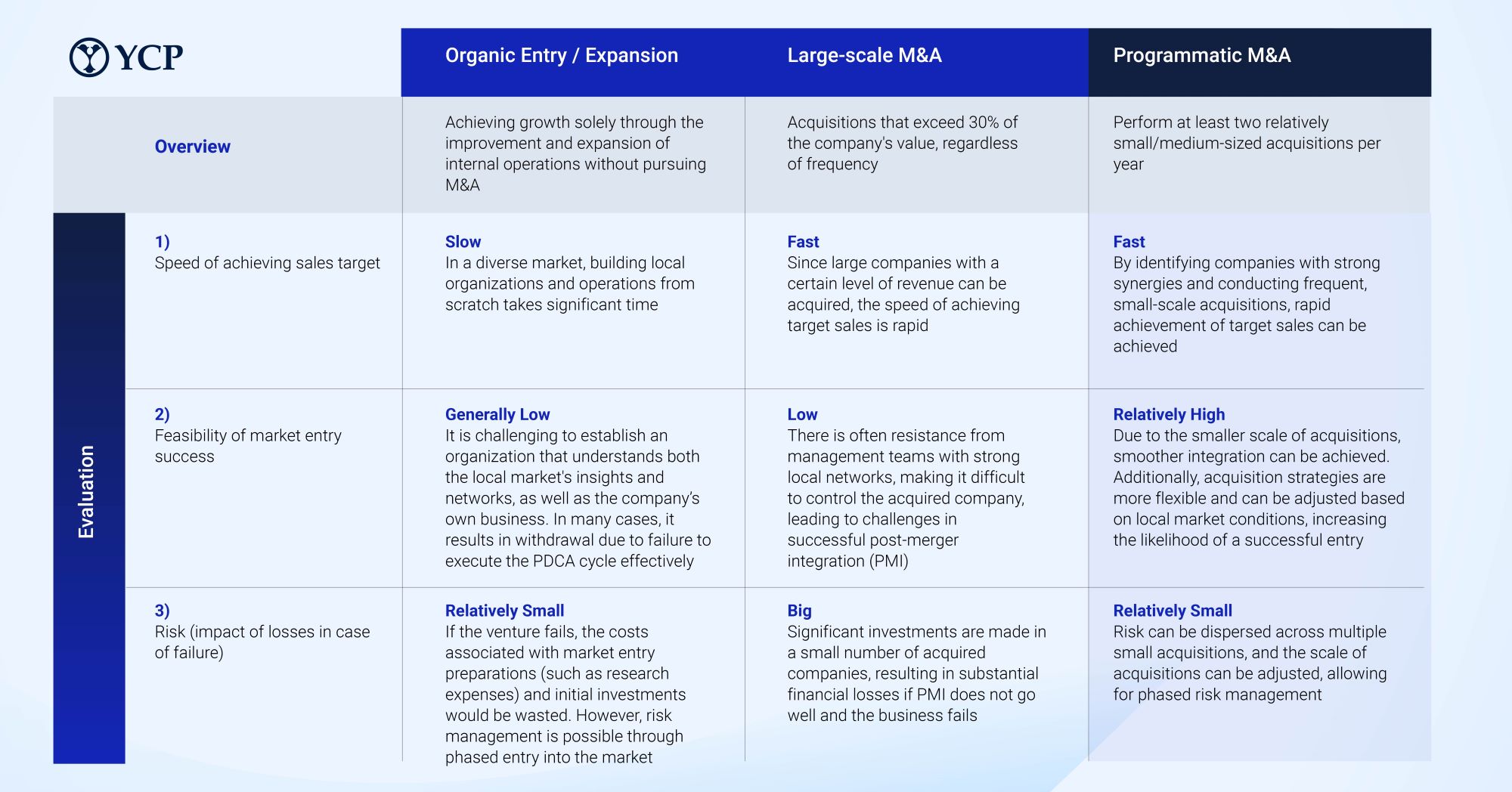

Large-scale M&A presents significant execution challenges, whereas organic entry is time-consuming. Programmatic M&A compensates for these shortcomings by providing a lower-risk approach that ensures execution speed.

To learn more about how businesses can leverage programmatic M&A to achieve sustainable success in Southeast Asia, download our latest white paper.

Author

Takahiro Okawara

As YCP Solidiance's Partner in Singapore, Takahiro's expertise focuses on new business launches, M&A supports, marketing, and strategic planning.

Recent White Paper

See All