Client

The client is a Fortune 500 multinational company focused on medical imaging and sensing devices.

Issue

The client's parent company was undergoing a restructuring so the medical devices business unit had to be spun off to become an independent entity on its own. This presented some legal and regulatory issues to its current set-up in Indonesia. The client looked for advice on how to "re-enter" the Indonesian market and create a new entity, or identify a M&A target to acquire for ease of entry.

Approach

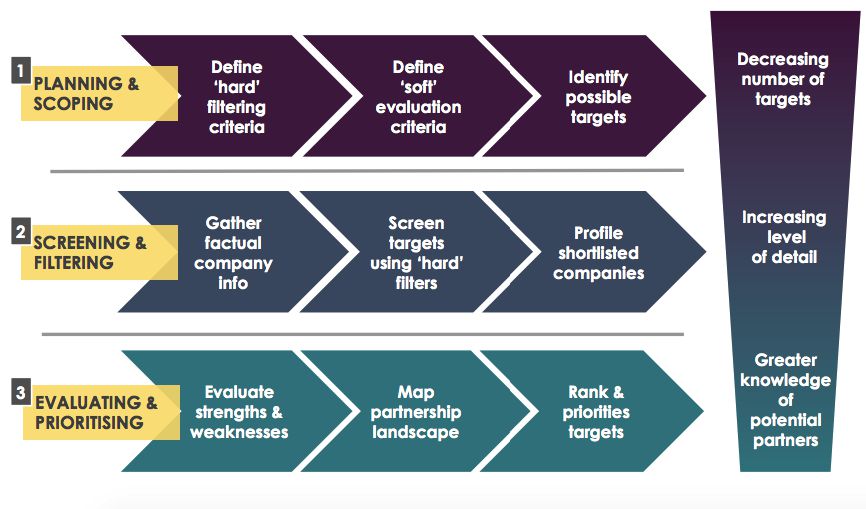

YCP Solidiance conducted a deep-dive analysis of the regulations affecting the medical devices industry, in particular on manufacturers, distributors and importers, and determined the key issues that needed to be addressed by the client, and the resultant risks involved and mitigating factors. The team also conducted a very extensive research on all available companies that the client can legally acquire in Indonesia and we spearheaded the first and second contact with these M&A targets and conducted early-stage negotiations on behalf of the client. We then eventually arranged formal meetings with the client and the M&A targets, which resulted in positive outcomes.

Engagement ROI

The client was able to identify two M&A targets, and entered into negotiations with them for a 100% acquisition. This approach saved the client more than EUR 100 million in investment if it were to re-establish a brand new corporate structure entity in Indonesia.