India’s automotive industry is undergoing considerable change. Two-wheelers have traditionally been the most dominant form of transportation in the country and still are, but a fast-emerging middle class has made passenger vehicles more popular—and with this rise, emphasis is being placed on the automotive aftermarket as well to service the needs of these vehicles.

The effects of the COVID-19 pandemic have clearly been felt in India’s aftermarket and auto components sectors, with digitalization proving to be the long-term answer for the market. For stakeholders and businesses to fully understand the needs of the Indian market, they must first look at its diverse current landscape, as featured in this excerpt from our publication Charging Towards Digital Dominance: Challenges for India’s Auto Components Sector and How to Overcome Them, which can be read in full here.

Boasting the fourth-largest auto market in the world, India stands at the forefront of automotive production. The sector typically contributes 25% to the country’s manufacturing GDP, employing 5 million people from 2018 to 2019.

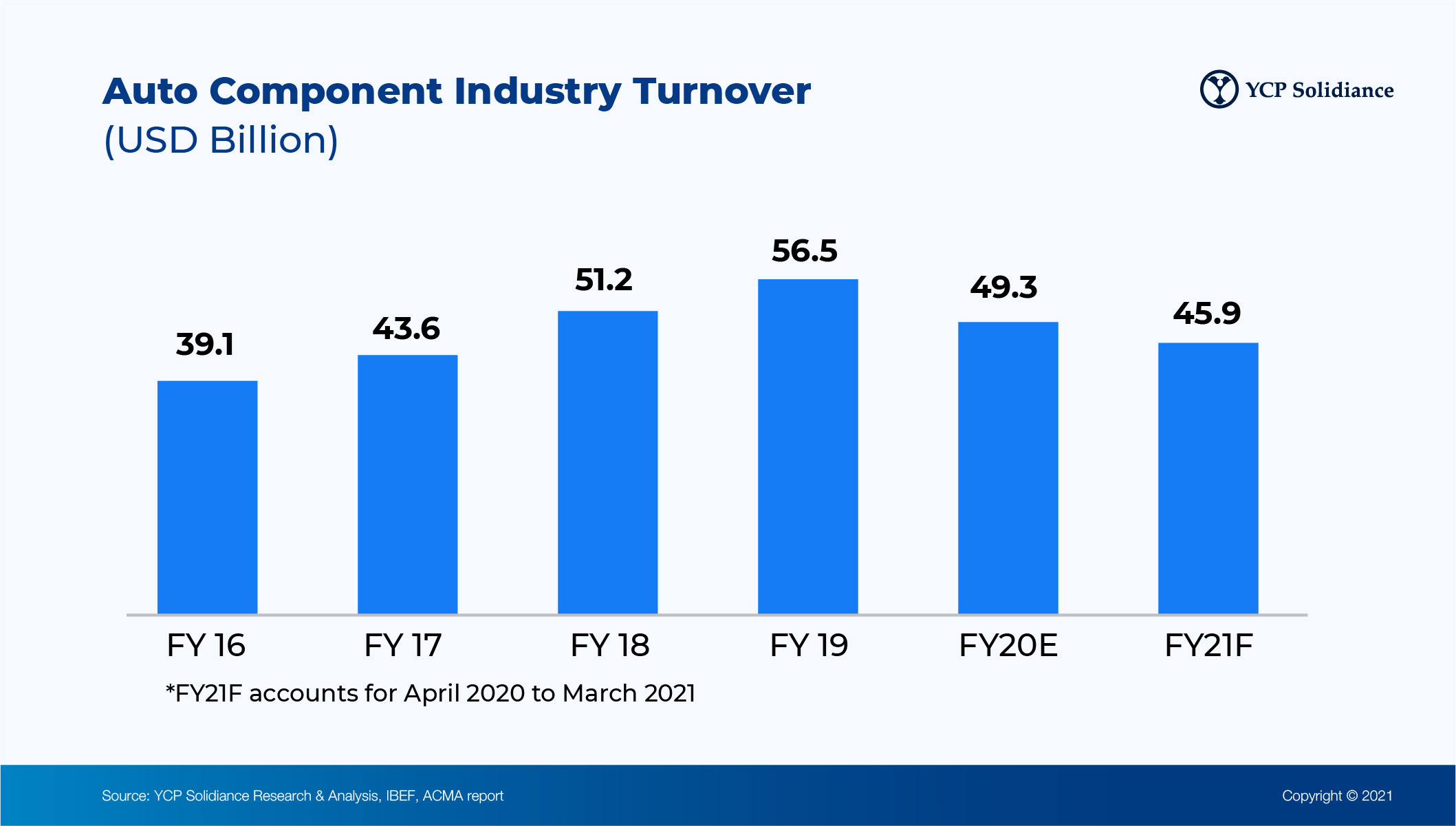

However, the Indian auto components sector faced massive setbacks due to coronavirus-related lockdowns in 2020. Strict social distancing measures and halted supply chains slashed total turnover of the sector by 11.7% to USD 49.2 billion in financial year 2019-2020.

Still, the sector is prime for resilience and growth. This is proven by the Production Linked Incentive (PLI) Scheme approved by the Union Cabinet to incentivize efficiency, and eliminate gaps. This contains an outlay over a five-year period of INR 57,042 crores (equivalent to USD 8.1 billion).

Digitalization is seen to be the present solution receiving the most traction within the industry.

Industry Turnover Growth

Following the Automotive Mission Plan 2026 that aims to place India amongst the top three global auto giants, the auto components sector expects to reach USD 80 billion in exports by 2026, with 23.9% annual growth.

However, growth projections for total turnover have been slashed by about half since 2020 due to the COVID-19 pandemic.

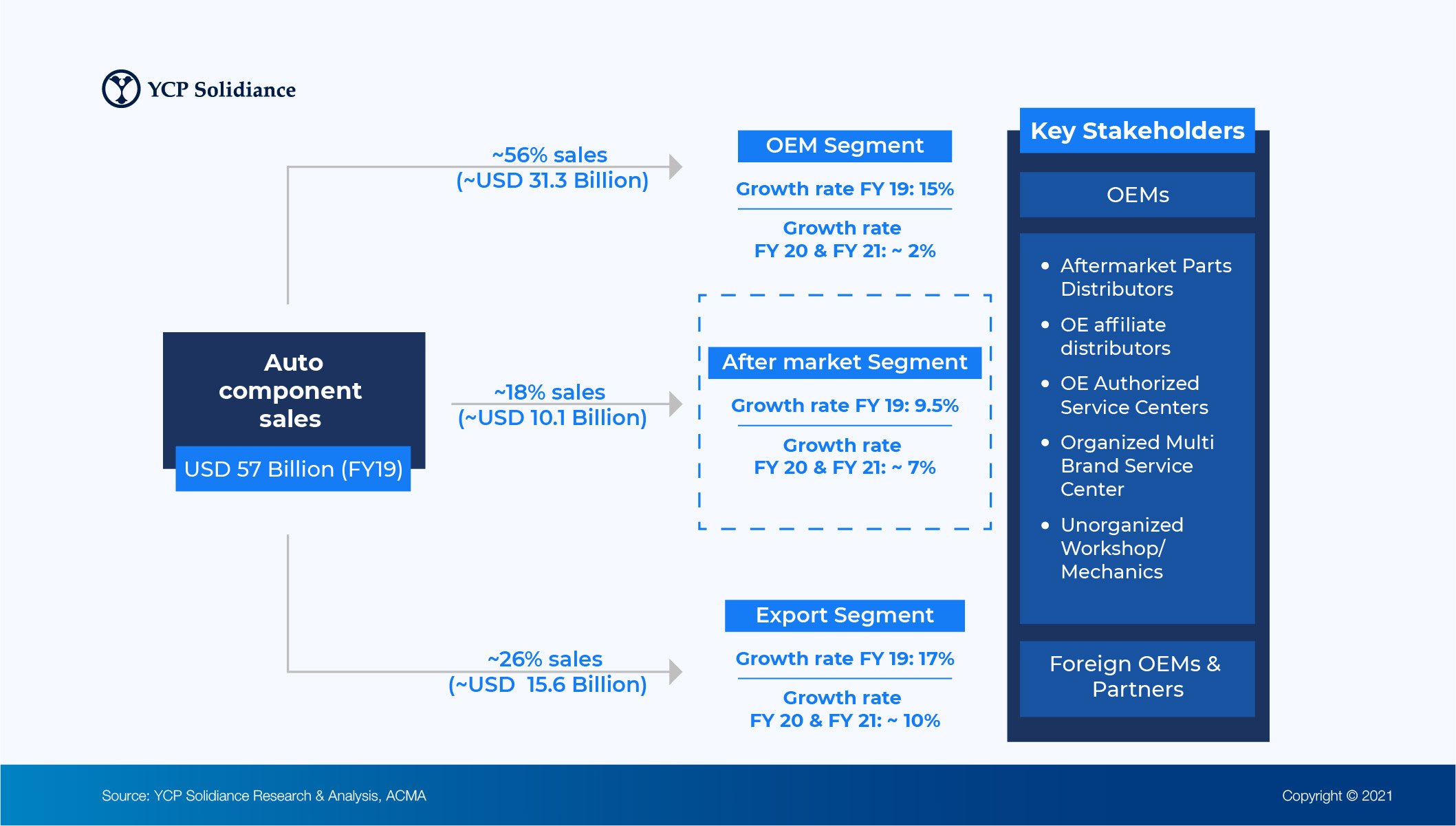

According to the ACMA report for FY2021, auto component sales to OEMs declined by 3% (USD 8.7 billion) while aftermarket sales declined by 7% (USD 13.3 billion). Additionally, the exports and imports were down by 8% and 11% respectively.

Yet, support efforts such as the 2019 FAME II scheme to encourage electrical vehicle adoption, planned GST cuts, and the Production Linked Incentive (PLI) Scheme have enabled the industry to stay afloat amidst these uncertain times.

October 2020 brought yet another crucial tailwind for the industry. The Japan Bank for International Cooperation (JBIC) and a handful of commercial banks agreed to a loan agreement with the State Bank of India (SBI) for funding the suppliers and manufacturers of Japanese automotive sectors.

Key Segments

In FY19, OEM segment had the largest turnover with a share of 56%, followed by the export segment with a share of 26% and finally, the aftermarket segment with a share of 18%. The turnover of the aftermarket segment is expected to reach USD 32 billion by FY2026, from USD 10.1 billion in FY2019.

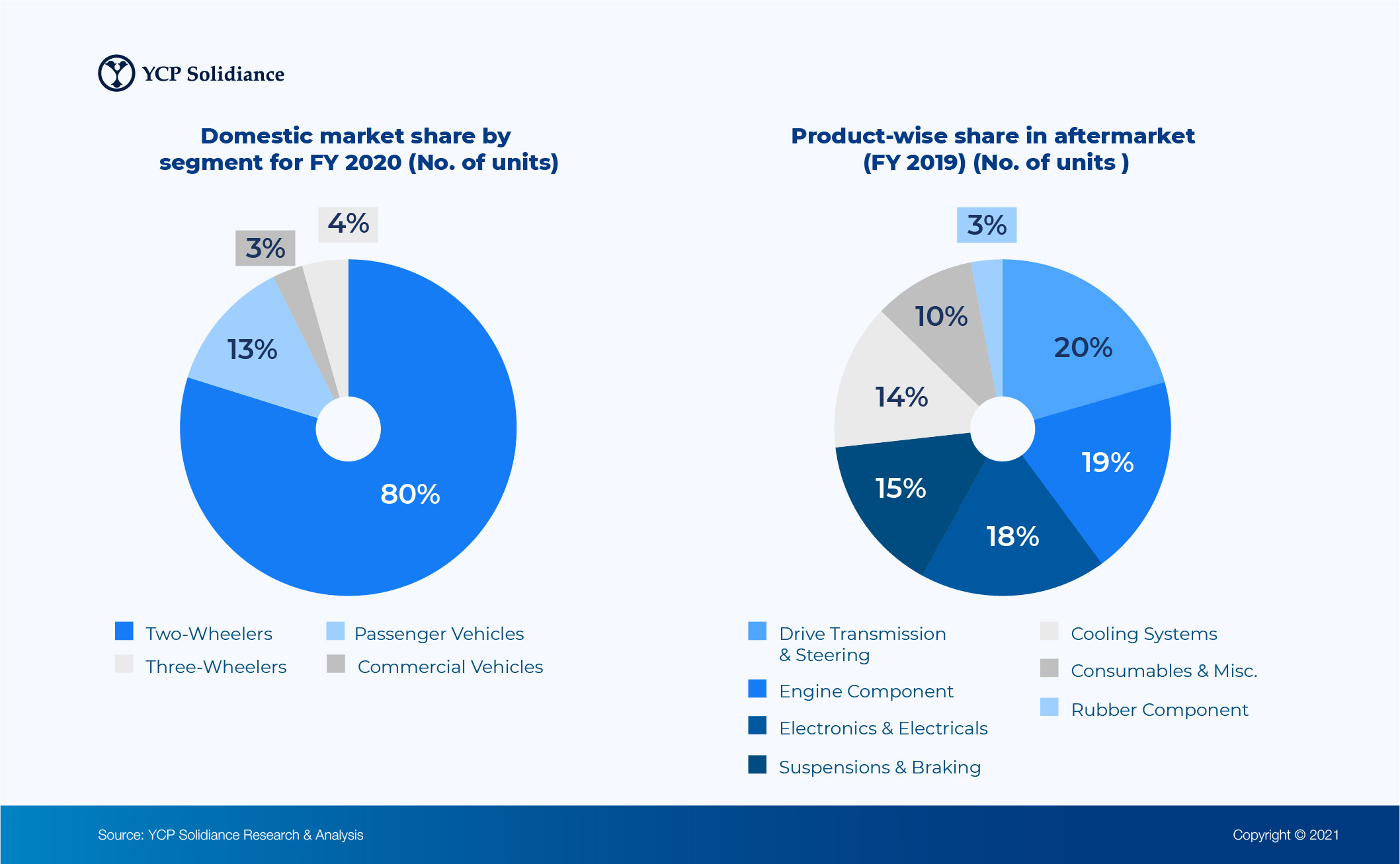

Product-Wise Share and Vehicle Classes

In FY 2020, the production of two-wheelers, passenger vehicles, commercial vehicles, and three wheelers reached ~21 million, ~3.4 million, 0.75 million, and 1.1 million respectively. The two-wheeler market boasts the largest market share at ~80%, given the preferences and needs of India’s rural market. However, the rising middle-class has given way to an emerging passenger vehicle market with a share of ~13%.

The Driving, Transmission and Steering product category accounted for the largest part of the aftermarket at 21%, followed by Engine Components at 19% and Electricals at 18%. New braking rules with mandatory ABS, as well as BSVI regulations to curb emissions are expected to raise market share for Braking and Engine/Exhaust parts respectively.

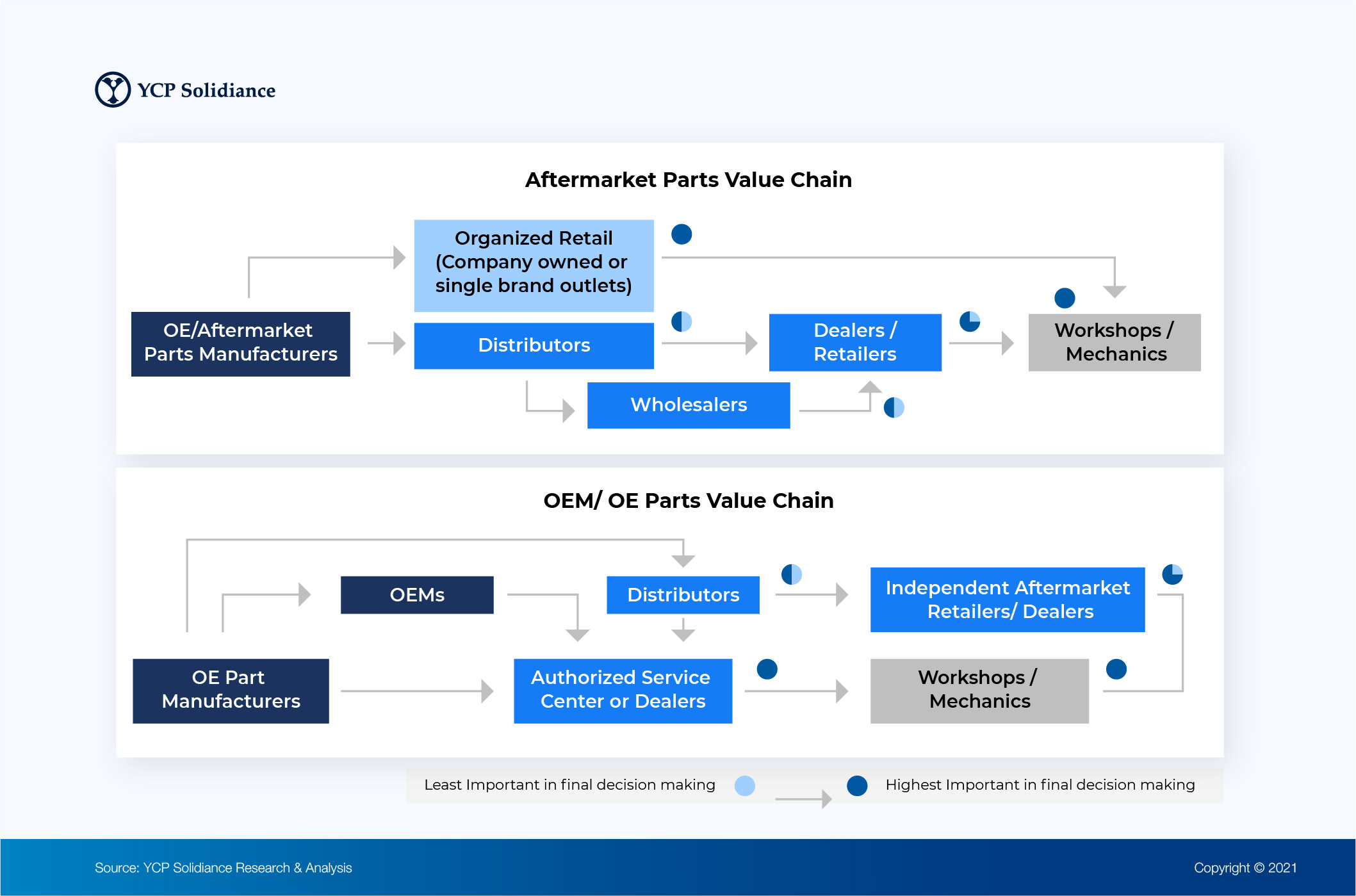

Route to Market Models

There are two major Route to Market (RTM) models.

In the first RTM model, auto component manufacturers majorly use distributors and organized retail to reach the mechanics, workshops, and subsequently the end users. In the second RTM model, the OE/Genuine part manufacturers reach end users through both (i) OEM Dealerships and (ii) Distributors & Retailers.

BS VI engines have different requirements in the field of engine electronics, with an increased requirement for monitoring and greater complexity in the engine makeup. Additionally, new engine and exhaust parts have made cars more complex, resulting in challenges with serviceability as roadside mechanics and local workshops do not have the sophisticated skills needed for these repairs.

Key Aftermarket Channels (For Passenger Cars)

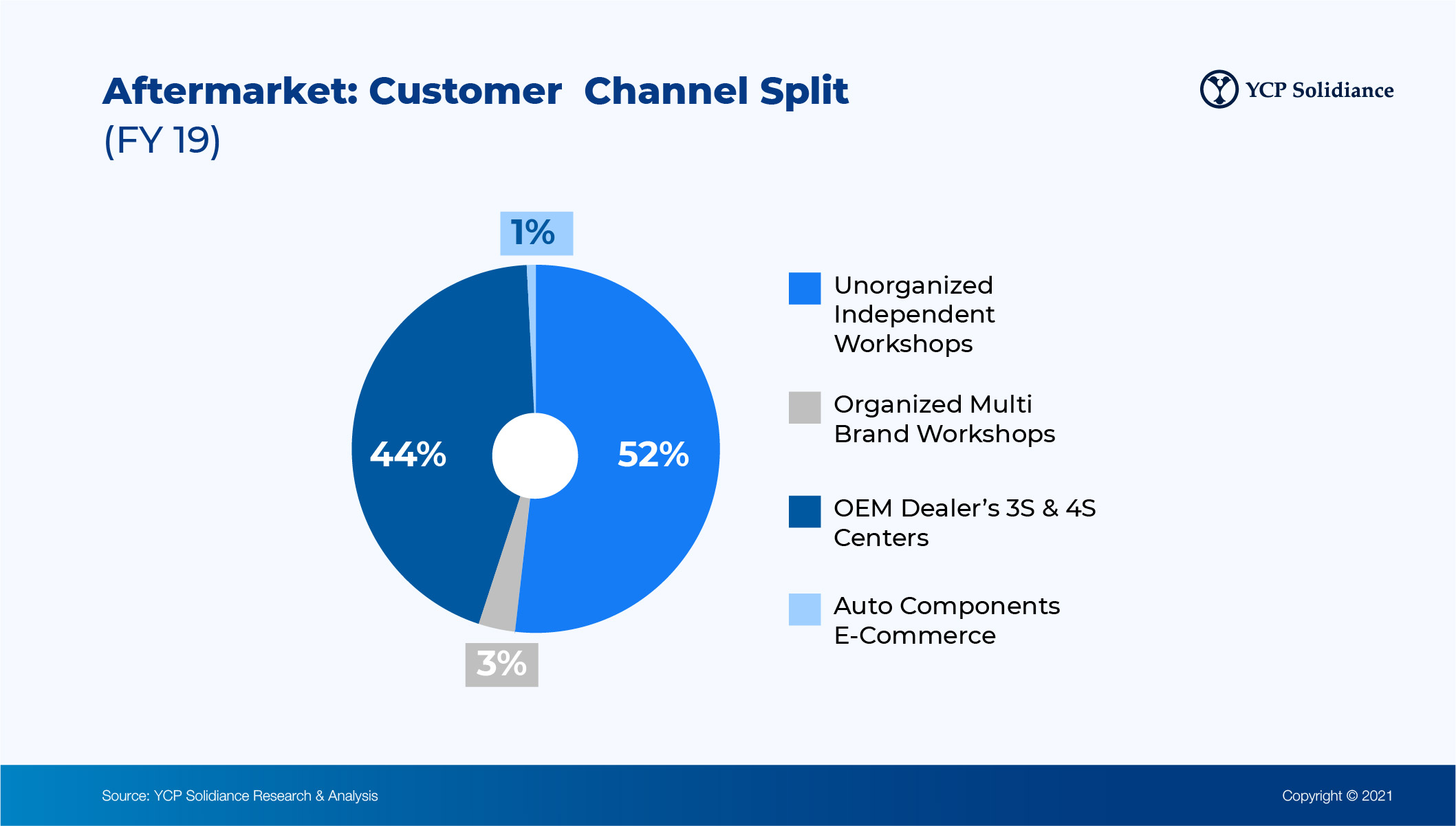

Currently, automotive aftermarket sales are majorly driven by traditional stores and workshops, with the unorganized sector catering to 52% of total aftermarket sales in FY2019.

The servicing of passenger vehicles post-warranty (>3-4 years old) is mainly done by small independent workshops (the unorganized sector) because of the huge cost difference of after-warranty services between authorized OEM workshops and the unorganized local workshops.

The online auto component aftermarket in India is expected to grow at a CAGR of 7% and is projected to reach a value of USD 30 million by 2020. There are huge, untapped opportunities to explore within the B2B space due to the speedy growth of local workshops, both organized and independent, along with consumers’ inclination towards getting their vehicles serviced in these places.

The sector has more than 420 players in the organized sector and more than 10,000 players in the unorganized sector. SMEs within the sector are largely based out of Tier 2 and 3 cities.