The growing popularity of electrification has created a shift in the global auto aftermarket. As electric vehicles generally have lower maintenance compared to ICE vehicles, automotive aftermarket players are now scrambling to develop effective strategies that properly integrate and consider EVs and their long-term effect on business.

With its pronounced policies and promising sales numbers, China’s aftermarket is being cited as an ideal example to draw inspiration from, both within Asia and in Western markets like the United States. Our Managing Partner Pilar Dieter and Director Leon Cheng shared their insights and analysis on China’s EV boom at the Automotive Aftermarket Product Expo (AAPEX) 2021 last November, offering foreign investors and business players a glimpse at how one country can help shape the future of the global aftermarket.

Electric Vehicle Prominence in China

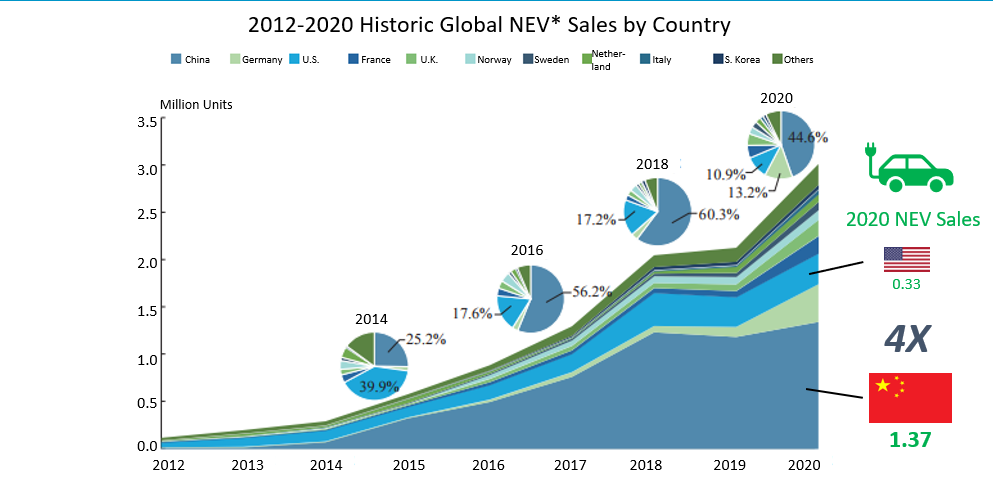

In 2020 alone, China’s EV sales averaged four times that of US numbers, and accounted for 44.6% of global sales. Through government subsidies, the Chinese government has been a driving force for the popularity of EVs over the past decade—in 2013, for example, subsidies would subtract approximately 8,700 USD from the purchase of a neighborhood electric vehicle or NEV (Since 2019, this total deductible has dropped to 3,600 USD due to increases in sales volume and lowered battery costs).

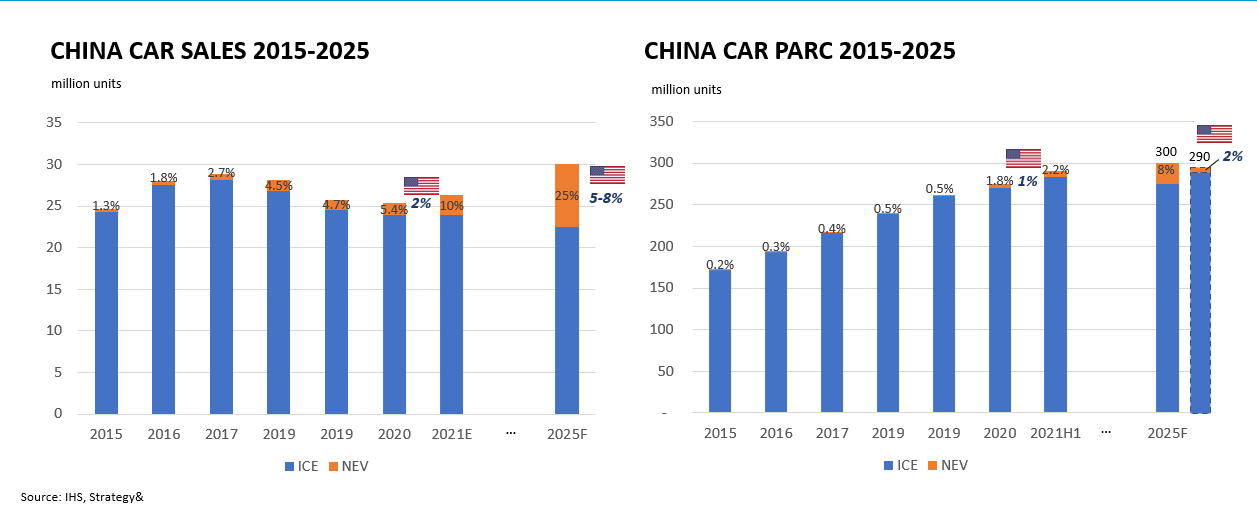

The Chinese government is now concentrating on policies that target original equipment manufacturer (OEM) production requirements in relation to the aftermarket. Due to these concerted efforts regarding EV manufacturing, production, and even auto component aftermarket sales, China’s car parc is expected to surpass the United States by 2025 with a higher electrification ratio and an aftermarket ready to swiftly respond to changing consumer and business demands.

Emerging Scenarios in the EV Aftermarket

Global players who want to learn from China’s EV history must also take note of several scenarios that show just how the aftermarket industry has shifted to cater to EV owners and manufacturers:

- OEM-Centric Ecosystem: By leveraging exclusive access to EV-related components, software, and data, EV OEMs have managed to control a portion of the aftermarket business. Prominent EV OEM and automobile manufacturer NIO currently offers several EV services that cater to problems such as battery solutions. By availing of NIO’s Battery Solution, customers can conveniently swap or charge batteries via exchange stations and roadside assistance, respectively.

- Digital Entrants Dominate: Tech conglomerates and start-ups alike have managed to enter the EV aftermarket by offering services beyond the scope of traditional players. Ranging from solutions such as a smart parking service that automatically handles parking transactions to road trip assistance wherein EVs are provided self-driving travel plans, the entry of software companies that specialize in digital solutions has effectively helped redefine the aftermarket landscape as well as consumer expectations.

- Independent Market: In contrast to EV OEMs, large independent aftermarket (IAM) intermediaries have also established control of the fragmented aftermarket via further investments in workshops that cater specifically to EV car owners. For example, China’s largest IAM maintenance platform, Tuhu, has managed to establish a network wherein consumers, local workshops, and branded global suppliers (like Continental and Valvoline) are interconnected.

The arrival of EVs on the global aftermarket will inevitably cause a disruption, but it also presents unique, profit-making opportunities for businesses to innovate. By establishing reform and enacting initiatives related to EVs at the early stages of adoption, automotive players who remain proactive have the chance to capitalize on the upcoming profit pool shift.

For more updates and insights on the emergence of EVs and its potential effect on the global aftermarket, subscribe to our newsletter here.