Financial technology continues its rapid development within Singapore, as evidenced by several fintech startups like locally founded service Endowus. After only 20 months of launching its digital wealth management platform, Endowus registered approximately 730 million USD in assets managed by July 2020, as per an article by Nikkei Asia.

Given the growth of companies like Endowus, Singapore’s fintech sector has greatly benefited as other companies attempt to replicate similar success. Such activity is not only paving the way for the public and private sectors alike to take advantage of the benefits that fintech offers, but perhaps more importantly, it is also accelerating the overall development of the domestic fintech landscape.

Singapore Fintech Landscape

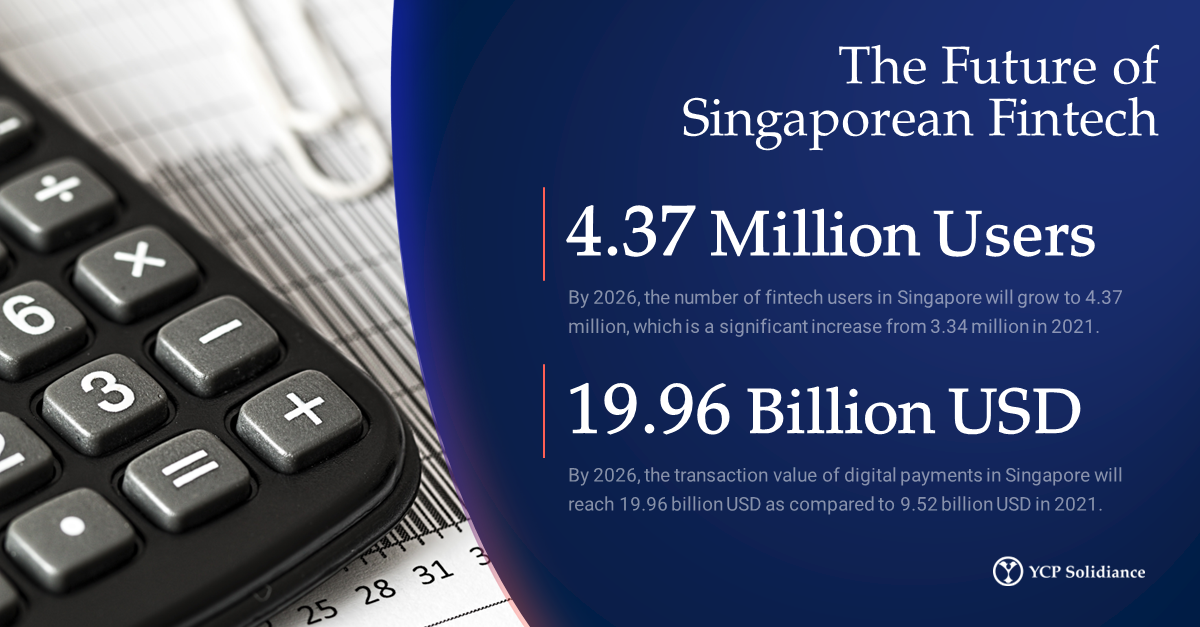

Currently, much of the growth that Singapore’s fintech landscape is experiencing can be attributed to a high level of interest surrounding the industry—and for good reason. Consumers now recognize the importance of fintech and the benefits that the industry’s many facets provide, one such example is the opportunity for passive income, which can be earned through automated investment services like Endowus, or even trading via cryptocurrency market.

Considering that fintech may be applied to several relevant industries, businesses specializing in different areas of fintech expertise have emerged across Singapore—in particular, the application of fintech in environmental, social, and governance (ESG) investments. As the nation and the businesses within it work to become more sustainable, companies like fintech firm Hashstacs are creating a platform called the ESG Registry. This blockchain-based platform enables users to register and keep track of several relevant ESG statistics, such as office building electricity use and carbon dioxide emission data of logistics companies.

Aside from application to business operations in the private sector, fintech is also trending amongst the public. Anticipating that the Singaporean population becomes more financially literate over time, fintech engagement will likely become a regular practice for many. This indicates that fintech is not merely a trend, but that it is here to stay in the long-term. Expect fintech adoption to increase in the coming years.

Building a Collaborative Ecosystem

For fintech to continue flourishing in Singapore, one of the key steps will be to sustain collaboration – both in an international and domestic context. Seeking out partnerships will not only bolster adoption but will also encourage accelerated industry development.

To its credit, the Singaporean government has proactively sought to strengthen fintech through international partnerships. As early as 2018, Singapore and India’s Government of Maharashtra entered an agreement to collaborate on fintech projects by utilizing technology like blockchain and mobile payments. Moreover, this April 2022, Singapore and Australia crafted the Australia-Singapore FinTech Bridge Agreement to establish both parties’ commitment to fostering stronger bilateral fintech cooperation. These agreements signify Singapore’s long-term desire to position itself as a fintech hub, not only in Asia but across the world.

Meanwhile, fintech collaboration in a domestic context can already be seen at the most basic level: participation and engagement. For as long as fintech firms continue to engage with audiences, industry growth will undoubtedly follow. Possible opportunities for further partnership can also be explored, such as the integration of fintech solutions among SMEs (i.e., mobile payments to facilitate transactions, cross-application function between fintech platforms and related services).

If Singapore’s financial technology industry continues to mature via its application in several industries, as well as various parties’ efforts to build a cohesive digital ecosystem, the country is likely to find itself in a prime position to become a global fintech hub. As early as now, businesses and professionals should take the time to learn, explore, and invest in the possible opportunities that the industry presents.

To learn and understand more about the implications of other business trends in Southeast Asia, subscribe to our newsletter here and check out these reports: