As we look ahead to 2030, the continued rapid growth of fintech is undeniable. However, the spotlight is shifting towards Alternative Financing, where BNPL and P2P stand as pivotal players fulfilling customers' unmet needs. The prospect of these segments becoming primary channels for financing is not only promising but also indicative of a paradigm shift in the financial landscape.

Emerging markets in Southeast Asia, Africa, and Latin America are poised to capitalize on the benefits offered by BNPL and P2P. Unlike saturated markets in Europe and North America, these regions showcase robust growth, coupled with increased penetration of e-commerce, the Internet, and online banking. While the two segments might follow distinct paths of entry, they present significant opportunities for M&A activities.

Fintech Opportunity for P2P Lending

P2P lending thrives on its competitive advantage rooted in technological innovation. With a focus on cutting-edge technologies like AI and machine learning, P2P platforms can achieve market success. The emergence of startups, fueled by venture capital and private equity funds, will be a defining trend. Strategic investors, offering industry expertise, distribution channels, and partnership opportunities, will play a crucial role in shaping the future of P2P lending.

Key Drivers for P2P Lending

- Existing Factors: Lower interest rates, convenience for borrowers, the potential for higher returns for lenders, and increasing penetration of mobile and online banking.

- AI Adoption: Utilization of AI and Machine Learning to develop complex algorithms, ensuring higher quality services such as quick loan processes, disbursement, risk assessments, and lower overheads.

- Access: Improved digitization in developed and emerging economies, providing better access to credit and increasing the desire for loans.

- Consumer Behavior: Evolving consumer preferences for transparency, choice, and simplicity among a more educated and tech-savvy generation, likely changing payment preferences.

Barriers for P2P Lending

- Regulation: Stricter regulatory demands lead to operational challenges, especially in regions like China, presenting barriers to entry, particularly for non-SME loans.

- Existing Factors: Concerns around consumer protection, fraud, lack of insurance, and the constant risk of cyber threats are persistent challenges.

Fintech Opportunity for BNPL

In contrast, the path to success for BNPL players lies in organic growth. Building network effects through the accumulation of customers and merchants creates a virtuous growth cycle. Unlike P2P lending, BNPL success hinges on expanding retail footprints and establishing a reliable brand – a journey that takes time. For BNPL, venture capital and private equity funds may not be the primary focus, as strategic investors become increasingly attracted to the idea of M&A. Traditional retailers and financial institutions with extensive footprints can leverage synergies with BNPL platforms, ensuring swift adoption and success.

Key Drivers for BNPL

- E-Commerce Growth: Positive global e-commerce outlook reinforcing BNPL adoption in developed and emerging markets.

- Retail Acceptance: As consumers adopt BNPL, online and offline retail economies are pressured to provide BNPL platforms as a payment option.

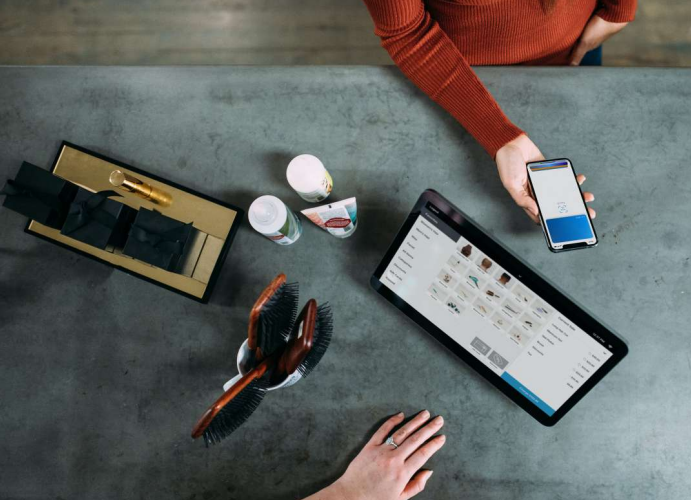

- New Technology: Continued technological innovation facilitating easier BNPL service offerings for merchants, including the development of new payment platforms and integrations with point-of-sale systems.

Barriers for BNPL

- Regulation: As the industry grows, stricter regulatory guidelines are anticipated, raising concerns about consumer protection and fraud.

- New Forms of Payment: The rise of new currencies, such as crypto, poses a challenge as customers may prefer them as a means of payment.

To get insight into other business industries across Asia and emerging trends, subscribe to our newsletter here and check out our latest reports below: