In the past years, the electric vehicle (EV) industry in Thailand has undergone accelerated development. Although there is some resistance to fully adopting EVs due to factors like consumer preference, both the public and private sectors are remaining proactive by investing in the holistic development of the industry.

As the market opens to new entrants, it will be important for stakeholders to inform business decisions with accurate information regarding the current landscape of Thailand’s EV industry. Moreover, potential investors should become familiar with the investment opportunities that are present within the country. For instance, there exists an opportunity for interested parties to explore investments in infrastructure which will help drive EV adoption. Read this excerpt from our latest white paper, Electric Vehicle Development and Deployment in Thailand: Moving Towards an Acceleration of EV Adoption, which you can read in full here.

Current Landscape of Thailand’s EV Industry

Thailand has shown fast-paced growth in Southeast Asia for EV sales, with projections relatively strong for the next five years. As of 2020, there were 1,897 electric vehicles sold in Thailand with a projected growth rate of ~45% to reach ~12,500 units in 2025. The electric vehicle sales value in 2020 was estimated at ~134 million USD, and it is expected that market value will reach ~886 million USD by 2025, driven by strong investments from both the public and private sectors.

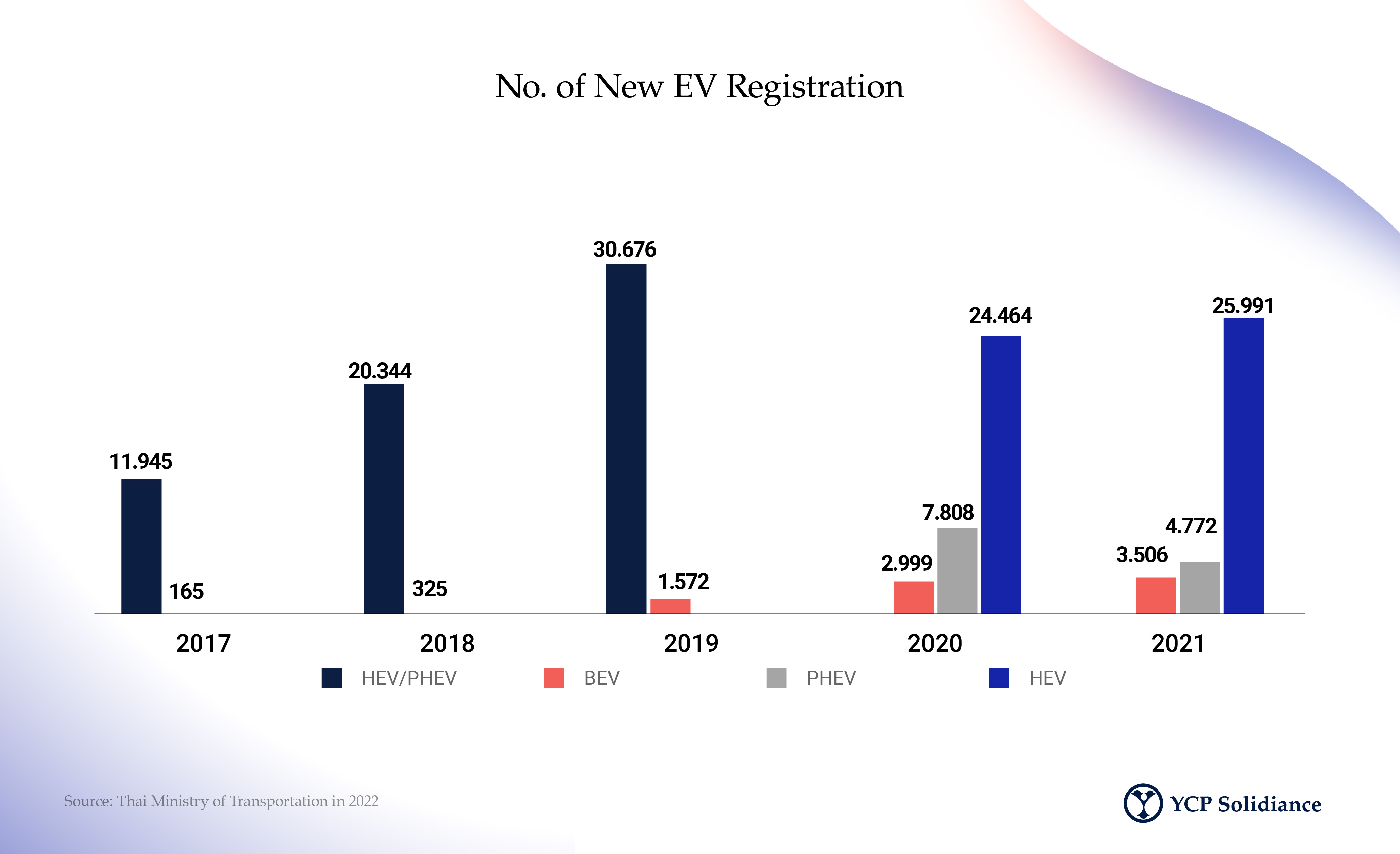

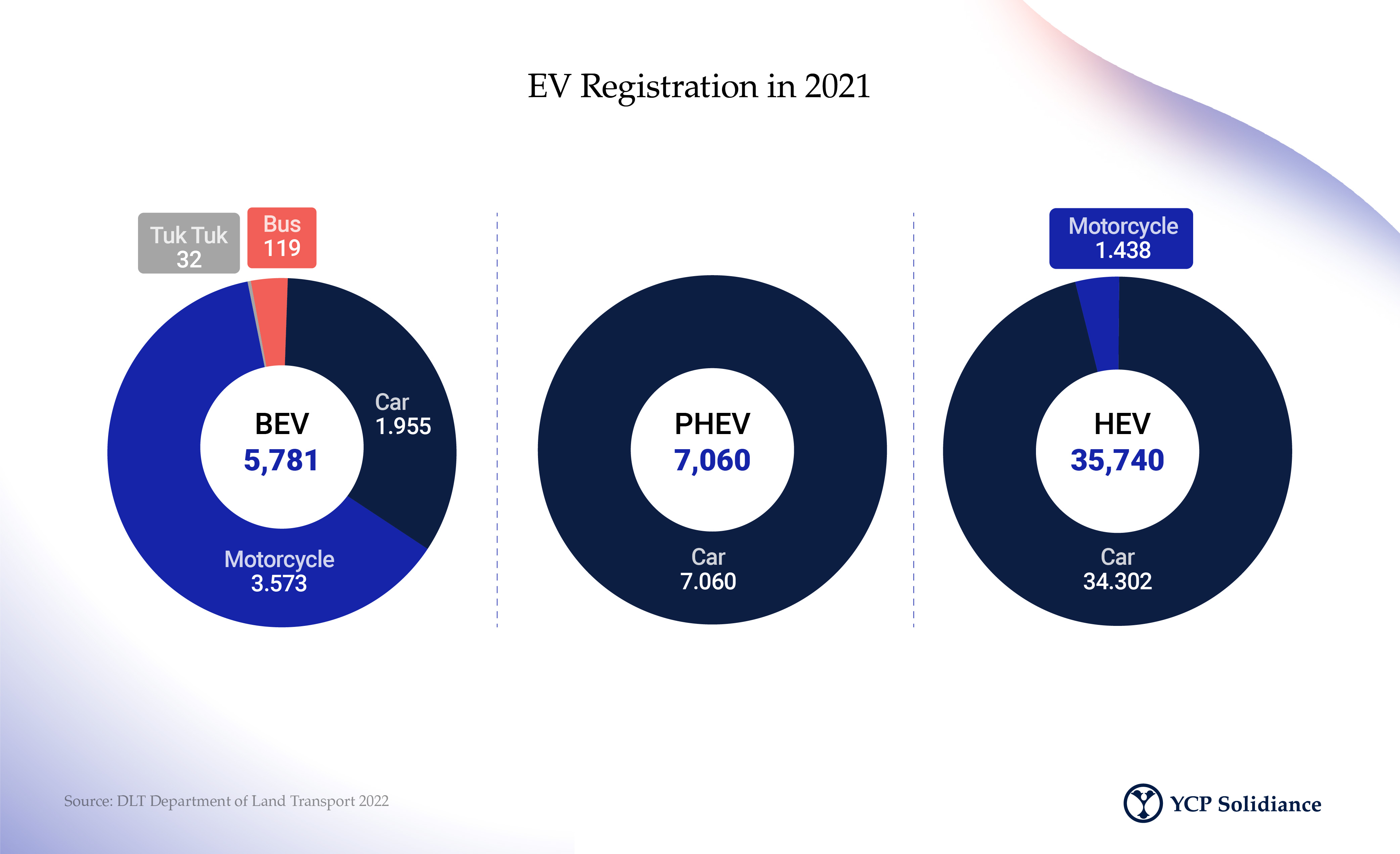

The Hybrid Electric Vehicle (HEV) still dominates the market in 2021 with over 26,000 newly registered units, followed by the Plug-in Hybrid Electric Vehicle (PHEV) at ~4,800 units, and the Battery Electric Vehicle (BEV) at ~3,500 units.

There are 22 EV models available in Thailand as of 2022. The car market is dominated by German and Chinese brands such as BMW, Audi, Porsche, BYD, and MG. Chinese brands have a major advantage price-wise due to the Free Trade Agreement (FTA) between Thailand and China, enabling 0% import tax for Chinese vehicles.

Development of EV Infrastructure in Thailand

To further drive the adoption of electric vehicles in Thailand, the government and associations such as the Electric Vehicle Association of Thailand (EVAT) are promoting the development of EV charging infrastructure.

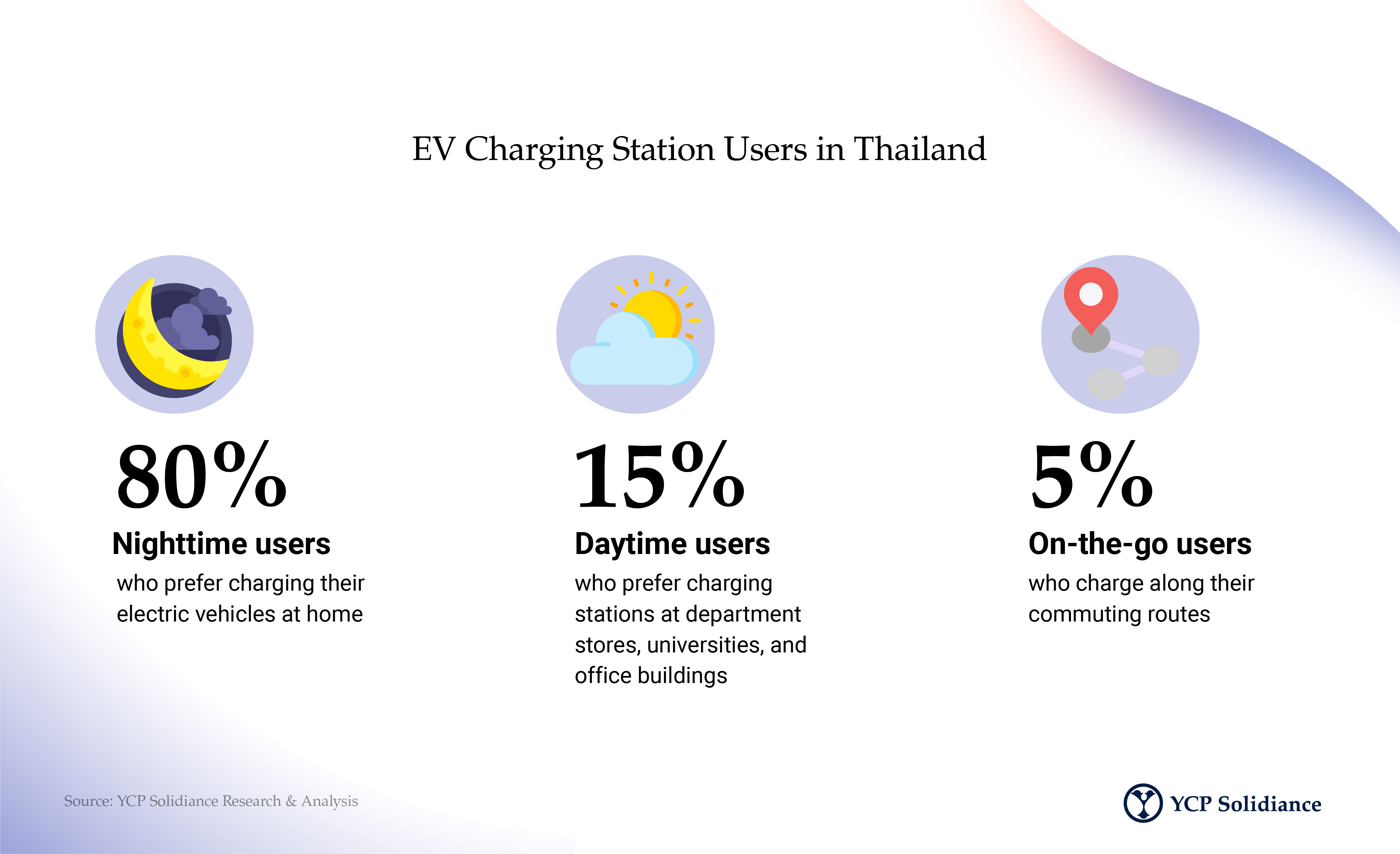

The National Energy Policy Commission has encouraged the Time of Use (TOU) charging scheme for EVs being charged at home or in charging stations to minimize electricity usage during the on-peak period of 9:00 a.m. to 10:00 p.m. During the on-peak period, the electricity price is 4.10 THB (0.12 USD) per unit, compared to the off-peak periods which are cheaper at 2.6 THB (0.08 USD) per unit. However, new charging rates were announced in June 2021 with a standardized rate of 2.6 THB per unit (0.08 USD), disregarding on-peak and off-peak periods.

In addition, the BOI is also promoting investments in the EV charging station business with a five-year corporate tax exemption for charging station investors.

Thailand’s Current EV Infrastructure

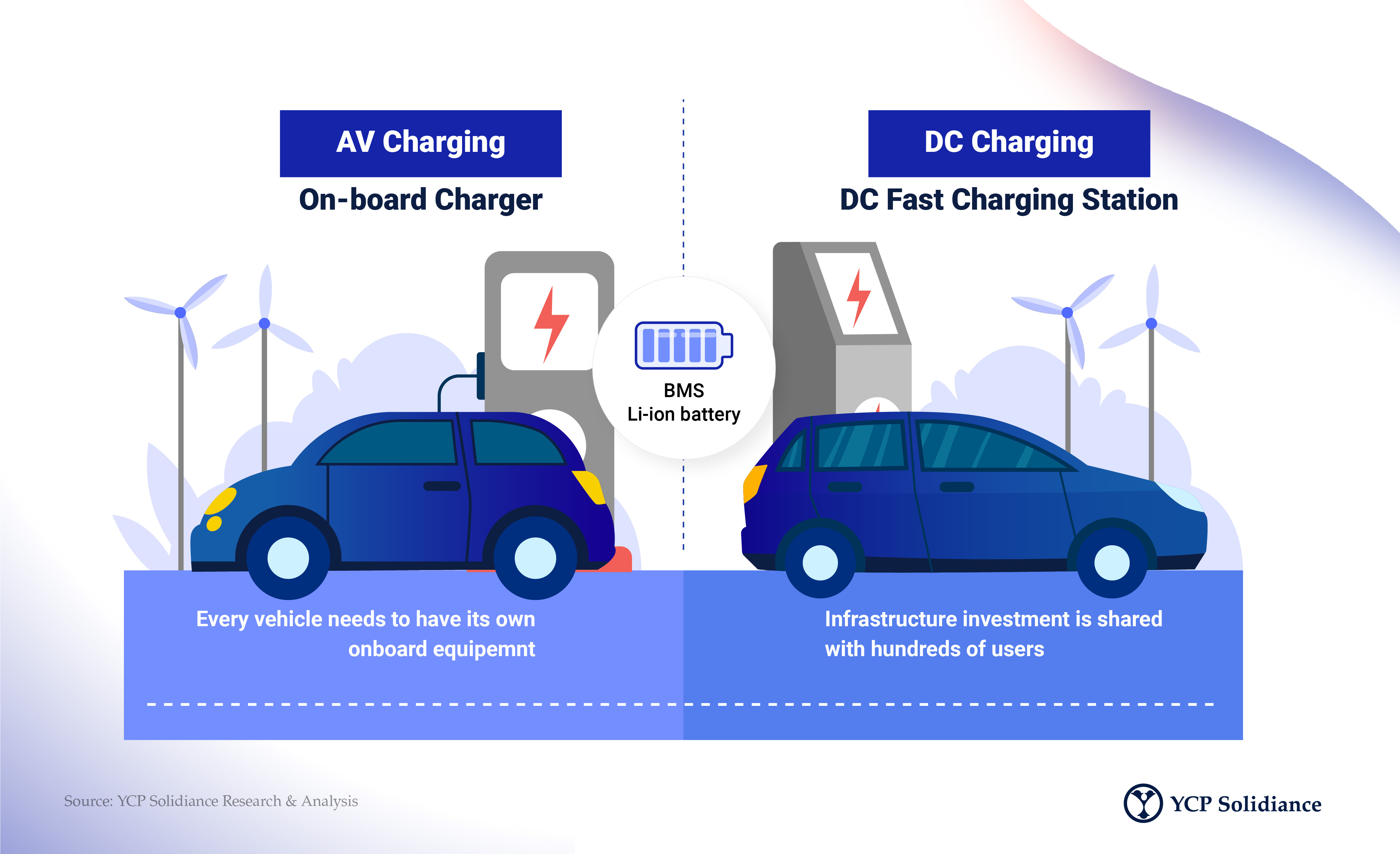

As of September 2021, there were 693 EV charging stations in Thailand, with normal chargers (AC outlets) dominating the market at 1,511 units (66%), compared to fast chargers (DC outlets) at 774 units (44%). The AC charging standard is adopted from IEC 62196-2, with AC Type 2 as the standardized AC charger, while DC chargers have complied with the CCS configuration (Combined Charging System).

The major EV charging operators are Oil & Gas companies, electricity state enterprises, and green energy companies. Energy Absolute (EA), a Thai-listed conglomerate, is one of the most active players in the market with over 417 charging locations across Thailand. Charging Station and Evolt are the second and third most active players in the market with 68 and 49 locations, respectively. PTT, the largest Oil & Gas company in the country, also operates its own PTT EV charging stations with 30 locations across Thailand as part of its non-oil business growth plans. PTT aims to construct 300 EV charging stations in the Greater Bangkok areas within 2023, in addition to their network of ~2,000 traditional gas stations across the country.

According to the EVAT, the distribution of EV charging stations is concentrated in central provinces such as Bangkok, Nonthaburi, and Samutprakarn, which make up around 70% of the total locations across Thailand. The number of charging stations in other regions, such as North, East, and South Thailand, remains low.

In addition, EV charger manufacturers can also take the chance to enter the Thai market and produce locally. Currently, the main pain point for stakeholders is that EVC equipment is mostly imported with high taxation, as the development of regulations and incentives for EVCs is still nascent compared to the EV market itself. Local products are also not at a comparable quality level with their imported counterparts, translating into a possible advantage for local players who could raise the quality level while offering more competitive prices leveraging on lower cost of local production.

To get further insight into business trends related to the automotive industry across economies in Asia, subscribe to our newsletter here and check out these reports: