India has taken a digital approach to the distribution of funds for its citizens. Earlier this August, the government announced the creation and launch of the e-RUPI digital payment system, which aims to efficiently deliver funds to Indian citizens and help prevent the misuse of allocated monies.

This system is a breakthrough towards helping serve the country’s underbanked, but what it also does is put India’s fintech landscape in the spotlight. As the necessity of cashless transactions spreads because of the COVID-19 pandemic, India’s fintech industry now has the unique chance to disrupt the norm in one of the world’s most populous markets.

Digital Payment Systems in India

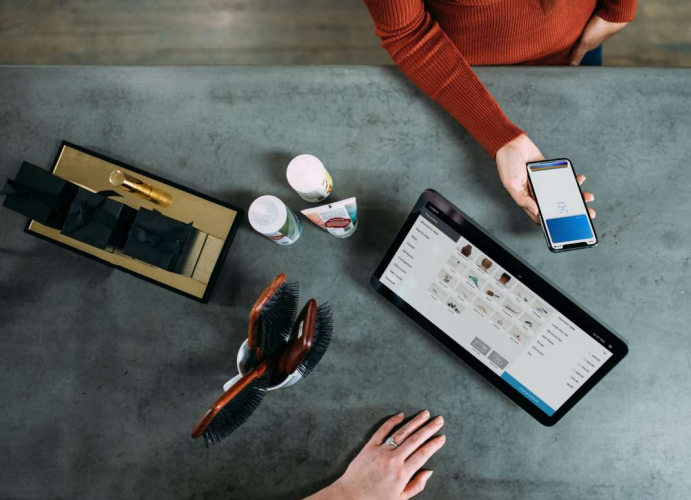

India’s recently launched digital payment system, e-RUPI, uses QR codes or text messages to send e-vouchers to Indians who need funds for food, healthcare, and other services. The system is accessible to anyone with a mobile phone and does not require a bank account, making it an ideal method for the country’s underbanked—190 million adults, according to a publication released by the University of Illinois in 2020.

Using prepaid e-vouchers that can only be redeemed for their intended purpose—such as vouchers that specifically can only be used for a certain type of medicine—make this system easily trackable and less liable to be misused. The system is part of the country-wide Unified Payments Interface (UPI) scheme launched in 2016 to facilitate inter-bank transactions.

Digitalization is shaping up to be an essential priority for the Indian government, and the rollout of this system only serves to accelerate digitalization and the integration of fintech into everyday Indian society. Already, digital payment options like Paytm, PhonePe, and RazorPay have grown popular as consumer behavior has shifted towards preferring e-commerce and touchless transactions; however the challenge for fintech providers remains in educating and converting the majority of the country’s underbanked who prefer to or can only pay in cash.

The Future of Fintech

India’s fintech industry has grown notably over recent years. In fact, Times of India reported earlier in 2021 that of the country’s 34 unicorn companies, nine are categorized as financial technology firms. While other industries in the country experienced a downturn, fintech has been focusing not on stability, but growth and integration into everyday use.

India Briefing estimates that helping solve issues with the underbanked will be the main trend in fintech for the foreseeable future. The rising cases of COVID-19 locally, made even worse with new variants like Delta that are far more infectious, have shifted consumer behavior towards preferring cashless transactions through e-wallets and other digital options; however financial literacy and the country’s level of digitalization make it challenging to address this issue. India’s large population, all speaking different dialects and with specific regional needs, also plays a part in the difficulty of a country-wide fintech breakthrough.

Potential fintech start-ups and existing businesses that want to find a niche within this space have to find hyperlocal solutions that solve specific problems within the diverse Indian cities and regions. The government’s e-RUPI system is a good start as it does not need a bank account, and further developments within this space can operate within similar parameters. With the threat of COVID-19 still a long way from being resolved, the urgency in which fintech must grow within the country is a challenge that must be undertaken by all fintech players.

For more insights on the growth of fintech across Asia, subscribe to our newsletter here.