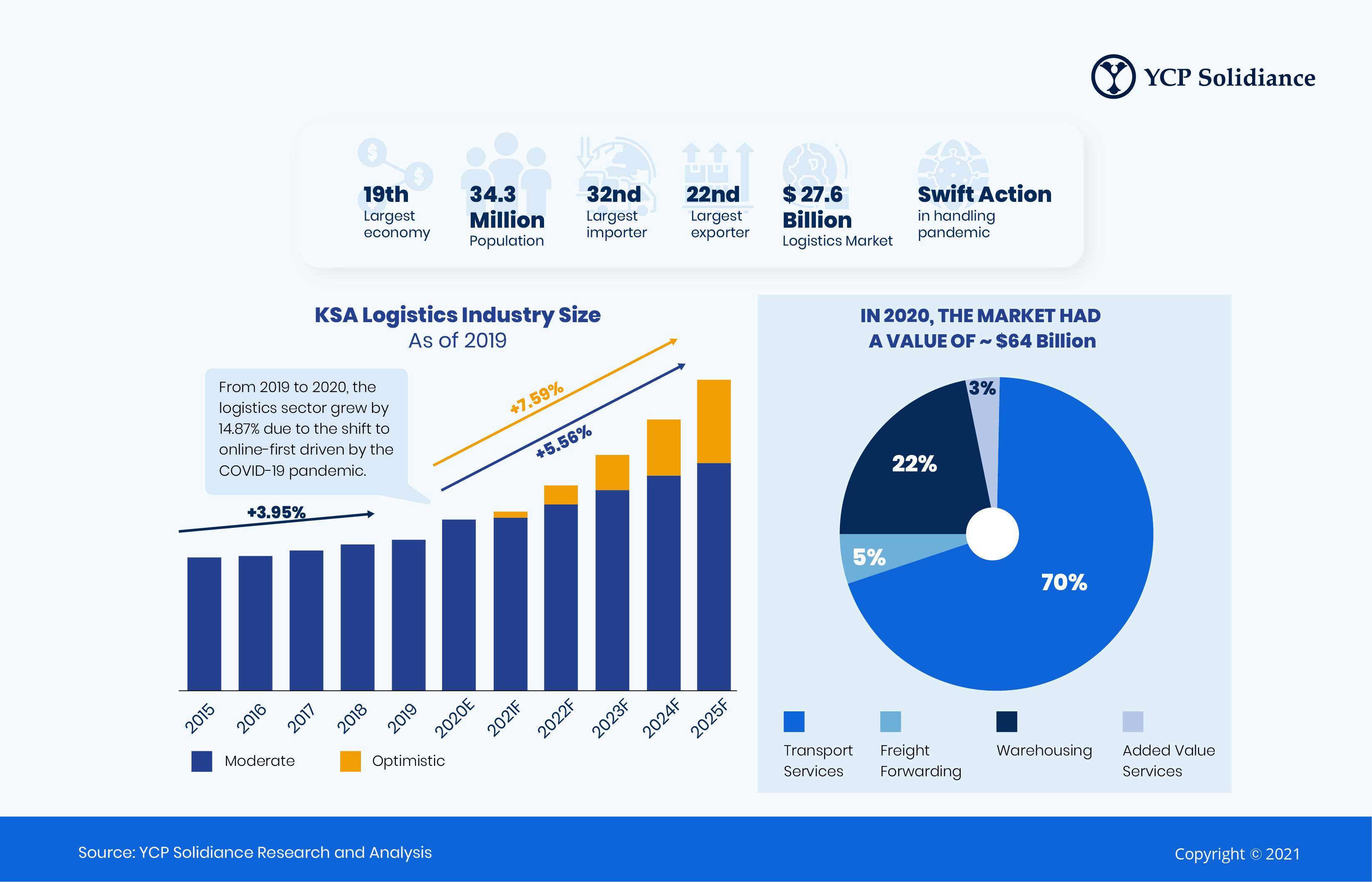

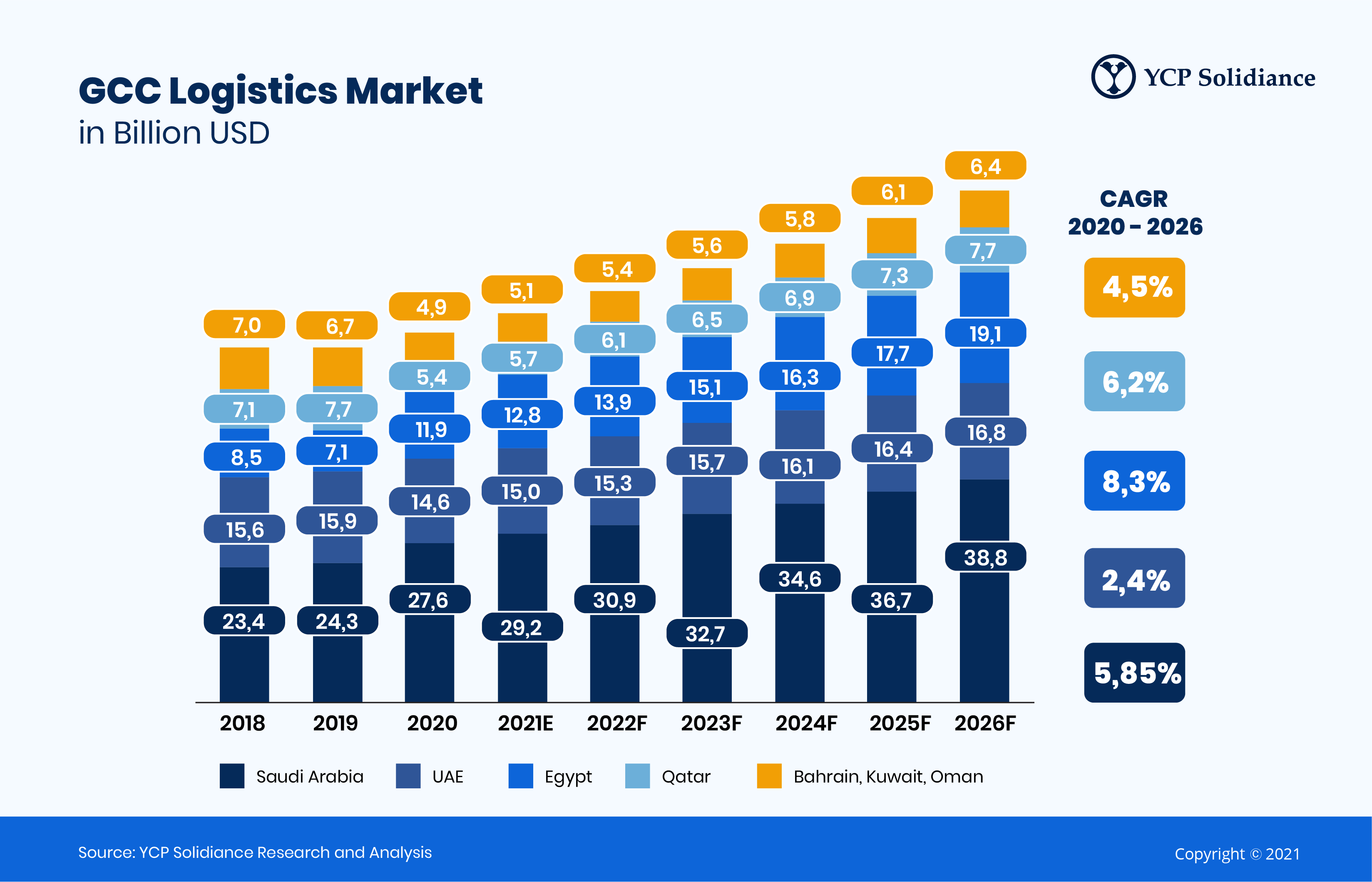

Over the years, Saudi Arabia has rapidly grown its logistics sector and is now working to position itself as a global logistics powerhouse. In 2020, the country’s logistics industry accounted for 43% of logistical activity in the Middle East and North Africa (MENA) region and the Gulf Cooperation Council (GCC) market, generating a total value of 27.6 billion USD. In light of this progress, the country is leveraging its position for further development through several initiatives that are centered on digitalization.

To understand how Saudi Arabia aims to fully realize its logistics industry’s digitalization potential, read this excerpt from our white paper, Transforming Saudi Arabia into the Middle East’s Logistics Powerhouse, which you can read in full here.

Despite the obstacles presented by the global pandemic, several sectors throughout Saudi Arabia experienced encouraging growth, namely: Food & Beverages (F&B), Pharmaceutics, and E-commerce. Due to various factors, such as decreased mobility and need for healthcare, the sectors mentioned were able to continue development as evidenced by their impressive compound annual growth rates, with F&B at 7% and Pharmaceutics at 10%.

Similarly, the success achieved by these sectors during the COVID-19 pandemic has also presented promising opportunities for Saudi Arabia’s logistics market. As a result of increased logistical demand from other sectors, Saudi Arabia’s logistics industry managed significant growth wherein the sector grew by 14.87% from 2019 to 2020.

While consumption and logistical demand are still expected to increase in the coming years, Saudi Arabia seeks to remain proactive by addressing issues through accelerated digitalization. Specifically, the KSA will seek to overcome these challenges through the promotion, application, and industry-wide adoption of digital solutions in logistical processes.

Continued Government Support

In 2016, the Saudi Arabian government launched Saudi Vision 2030, an initiative that aims to introduce a strategic framework that will transform the country via economic and social reform. As a major industry within the KSA, this initiative also heavily emphasizes the development of the logistics sector both in terms of the present and future. The initiative also hopes to attract investors (foreign and domestic) to the KSA logistics industry to further bolster growth.

Backed by support from the government, as well as the private and public sector, the digitalization of logistical operations in Saudi Arabia is becoming an increasingly relevant topic, made more evident by Saudi Vision 2030. To fully realize the goals set out by the government, the KSA’s logistics industry has already sought to implement measures geared toward digitalization. Currently, the implementation of digital solutions in logistical operations includes the following methods:

- Warehouse Management Systems: These days Saudi Arabia relies heavily on software applications for warehouse management wherein the handling of goods and products are optimized in key processes, such as planning, organization, and delivery.

- Robotics in Warehousing: In line with Saudi Arabia’s goal of improving warehouse infrastructure to maximize logistics capacity, logistics hubs have turned to the application of robotics to increase operational efficiency.

- Artificial Intelligence (AI): To lessen downtime, as well as improve data collection methods, the implementation of AI in logistics has gained popularity as it can be used to better facilitate the day-to-day operations of warehouses, transport hubs, and distribution centers.

The opportunity to integrate digital solutions in traditional logistics processes presents business owners with the chance to innovate and better serve involved stakeholders—but more importantly, digitalizing processes will help improve overall efficiency to help cope with increased logistical demand.

As logistics companies throughout Saudi Arabia become increasingly aware of the potential benefits that digitalizing operations have to offer, some companies have already embraced the shift to innovate and digitalize logistics operations.

For example, Tachyon, a cloud-based logistics firm operating in the KSA, has successfully developed an application that fully integrates users at several stages of the logistical process and has thus placed “coopetition” (cooperation & competition) at the heart of the logistical chain. By utilizing machine learning and blockchain technology, Tachyon has optimized several aspects of its operations, specifically: lowering costs, reducing downtime, and increasing user matching among carriers, shippers, and brokers.

Other companies are following suit, but instead, aim to cater to specific sectors that have increased logistical demand. One such case is DIGGIPACKS, a third-party logistics provider that exclusively serves e-commerce clients who have limited storage and delivery capacity. From shipping and dispatching reports to accurate geolocation, DIGGIPACKS offers its customers several enticing services that are only possible through their use of digital solutions, such as automated API (application programming interface) and real-time inventory tracking via the Warehouse Management System.

Saudi Arabia and Beyond

While consumers and businesses alike are sure to benefit from the increased efficiency owing to digitalizing processes, the decision to do so will also attract investors from around the globe. Naturally, maximizing operations in the logistics industry will also allow logistics companies to cater to more customers, which is significant given that the KSA’s number of potential global clients is approximately 3.5 billion.

Overall, due to the overwhelming support from the Saudi government and the initiative of companies to digitalize logistics operations, the KSA is on track to fully realize its logistical potential. In the coming years, expect Saudi Arabia’s logistics industry to establish itself as a powerhouse within the MENA region, the GCC market, and quite possibly the global stage.