As Vietnam and its domestic industries strengthen their position across Southeast Asia and the globe, an emphasis has been placed on the need for the energy systems needed to sustain such development. Thus, Vietnam is rapidly accelerating its clean energy transition, which concerns trends like reduced reliance on coal, increased natural gas and LNG capacity, and renewable energy adoption.

To better understand how Vietnam will navigate its clean energy journey, the barriers and drivers concerning the transition, and what potential business opportunities this presents, read this excerpt from our latest white paper, Policy Ambitions Versus Reality – The Current Energy Transition in Vietnam, which you can access and read in full here.

Ambition Meets Reality – The Need for Rapid Transition of Energy Systems in Vietnam

As Vietnam quickly transitions into an industrial and manufacturing hub in Southeast Asia, there has been a particular shift in focus to balancing rapid economic growth and reducing its environmental impact. Central government policy is the central focus of the energy industry as local demand grows, and the focus on climate change and sustainability plays an increasingly central role in the operations of major corporates in Vietnam.

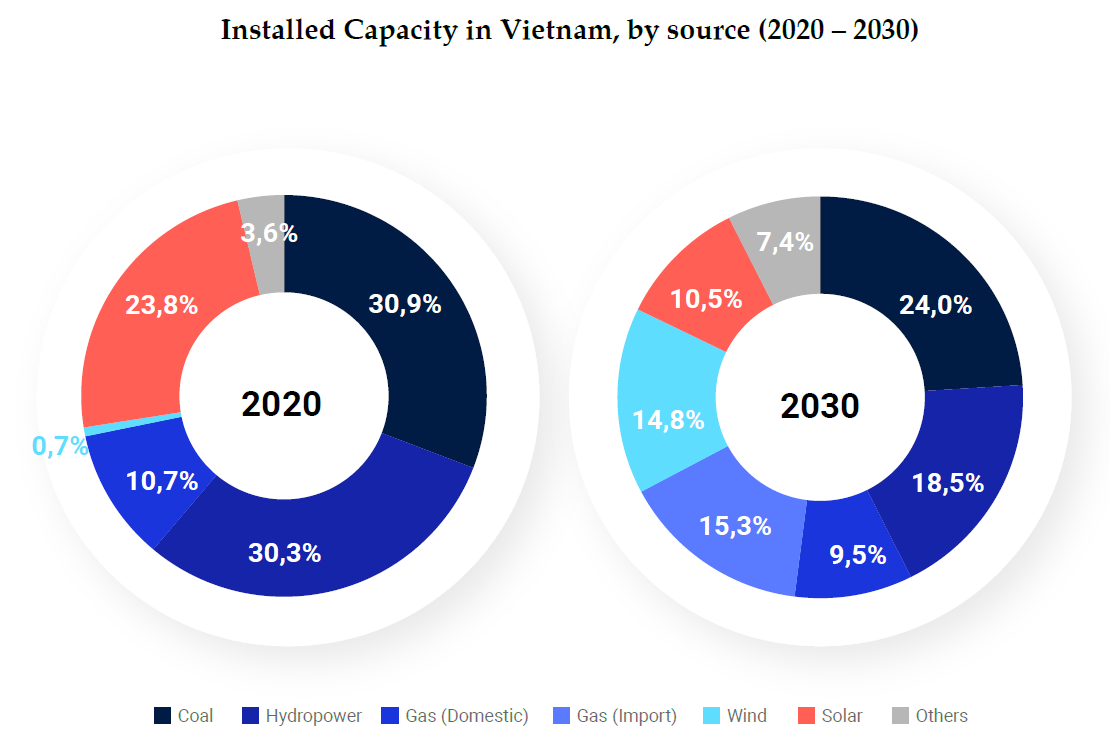

Over the last several years, Vietnam has achieved considerable progress in expanding its renewable energy generation capacity, adding around 10 GW of solar capacity in 2020 alone. Despite substantial growth in recent years—in order to meet pledges from the Prime Minister at the 2021 United Nations Climate Change Conference (COP26) to reach net-zero carbon emissions by 2050—more growth needs to occur at an even faster pace.

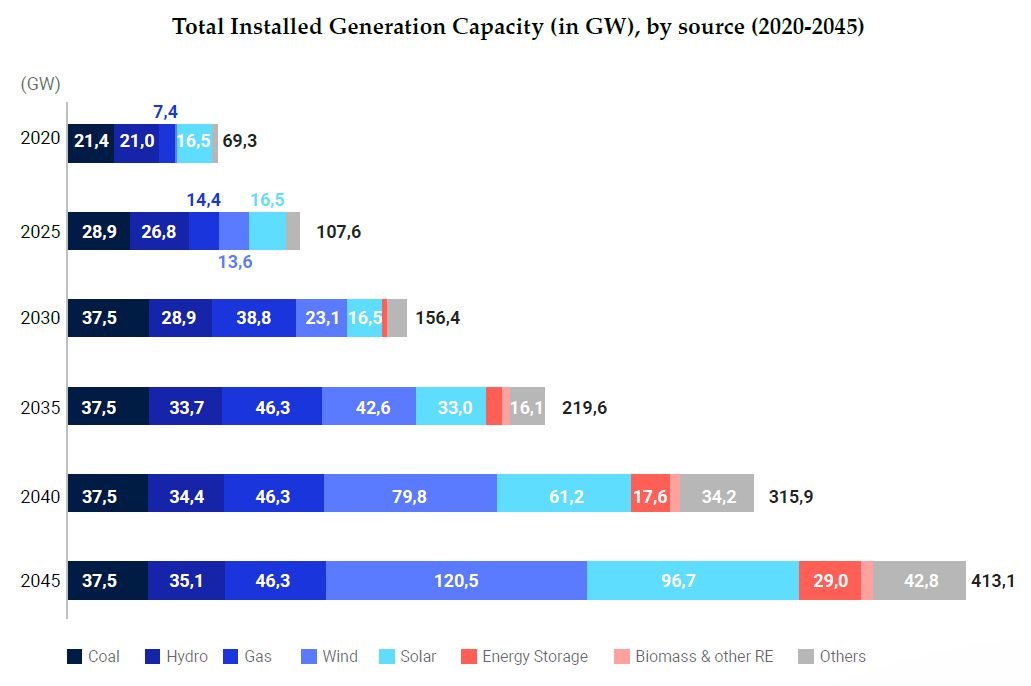

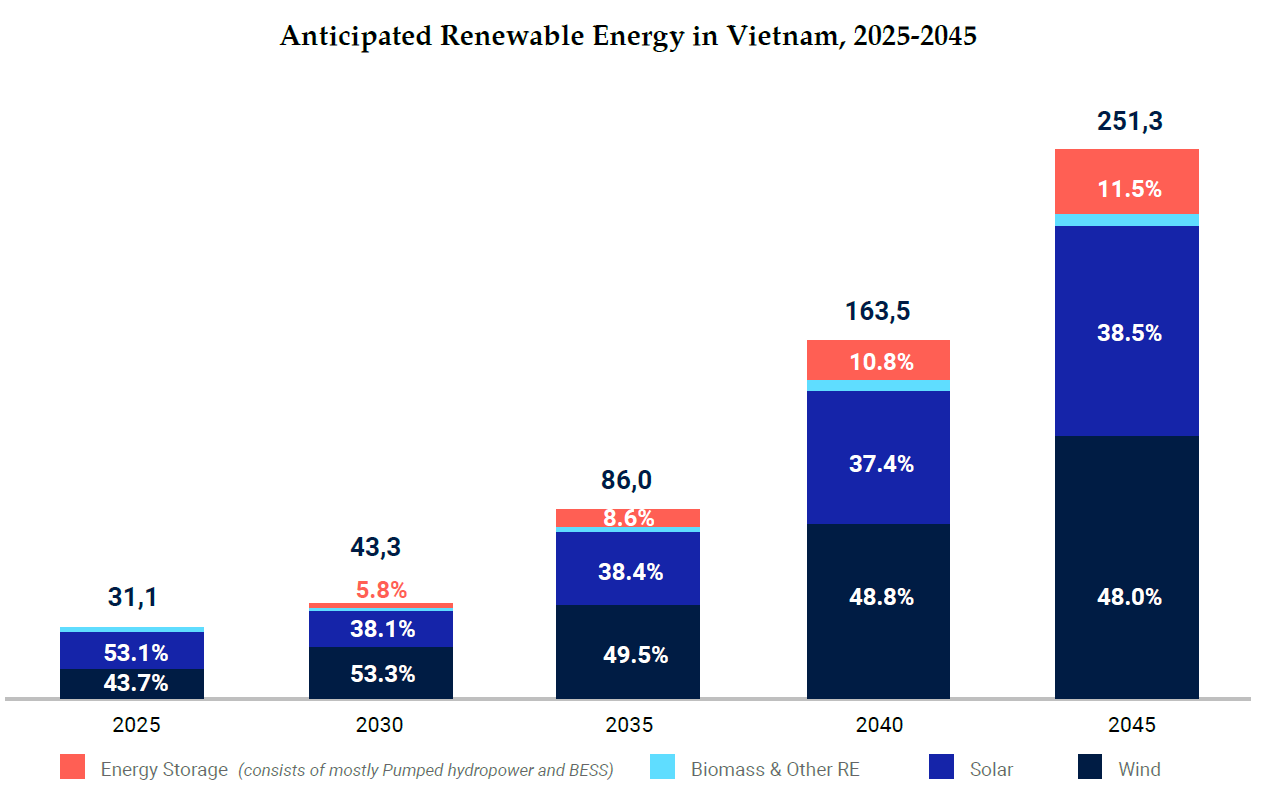

After numerous revisions and continued debate, coal will continue to grow in absolute amounts into the foreseeable future, but will reduce in its percentage share in the energy mix as detailed in essentially all recent drafts of the Power Development Plan 8 (PDP8). Though the share of renewable energy is expected to grow into 2030, much of the expected growth will be in Wind rather than Solar.

Long-Term Energy Transition Targets

In 2020, installed solar capacity in Vietnam surpassed Malaysia and Thailand to become the largest in Southeast Asia after attractive feed-in tariffs were introduced. However, electricity infrastructure was not ready to handle a sudden glut of generation resulting in curtailment and issues with connecting projects to the national grid. The Ministry of Industry and Trade forecasts modest growth in solar in the coming years as the industry consolidates and reorganizes.

According to the latest draft of PDP8 and related proposals in November 2022, renewable energy will be the ongoing focus for future energy transition, as coal represents approximately half of electricity generation currently, with renewable sources only at about 5%. However, the transition to net-zero emissions will likely be gradual and occur in phases.

Opportunities for Energy Investors in Vietnam

Renewable energy capacity has grown tremendously in recent years. With increasingly supportive and favorable policies, the Energy Transition in Vietnam will become more fast-paced, capital-intensive, and technically complex, especially in the LNG, Wind, and integrated Storage segments.

Although there are still many existing regulatory challenges that affect project feasibility, the potential advantages and profits from developing sustainable energy systems in Vietnam outweigh the barriers and challenges. There are still opportunities for new projects and disruptive technology to establish a place in the market.

Because of the lack of specific policies and regulations guiding certain energy developments and projects and their connection to the grid, investors and developers must closely collaborate with central and provincial agencies, such as the Ministry of Planning and Investment (MPI), Ministry of Industry and Trade (MoIT), and provincial investment promotion agencies.

Moreover, energy projects in Vietnam must comply with several laws and regulations—including, but not limited to—the national Power Development Plan, Law on Investment, Law on Enterprises, Law on Construction, Law on Land, Law on Environment Protection, and Law on Electricity. Because the master plan, law, policy, and regulation for renewable energy are continuously in development, investors and developers will likely encounter obstacles during project development which can be minimized with the close support of various governing agencies in order to resolve project-specific issues more effectively.

Foreign investors and developers without experience in Vietnam should establish partnerships with local organizations in order to get better visibility and expertise on the local market, project financing, and regulatory environment. By working with local partners, investors will reduce their risks and gain valuable local connections and insights.

To get further insight into other professional industries in Asia, subscribe to our newsletter here and check out these reports: