As Thailand wrapped the first election since the 2014 military coup, there has been a lot of discussion on how the country will move forward with the new government, how the economy will progress and how the market's response will affect business in the country. YCP Solidiance deep dives to analyze the country's current situation and how the political landscape will impact Thailand's economy in new white paper "What You Need to Know Before Investing in Thailand."

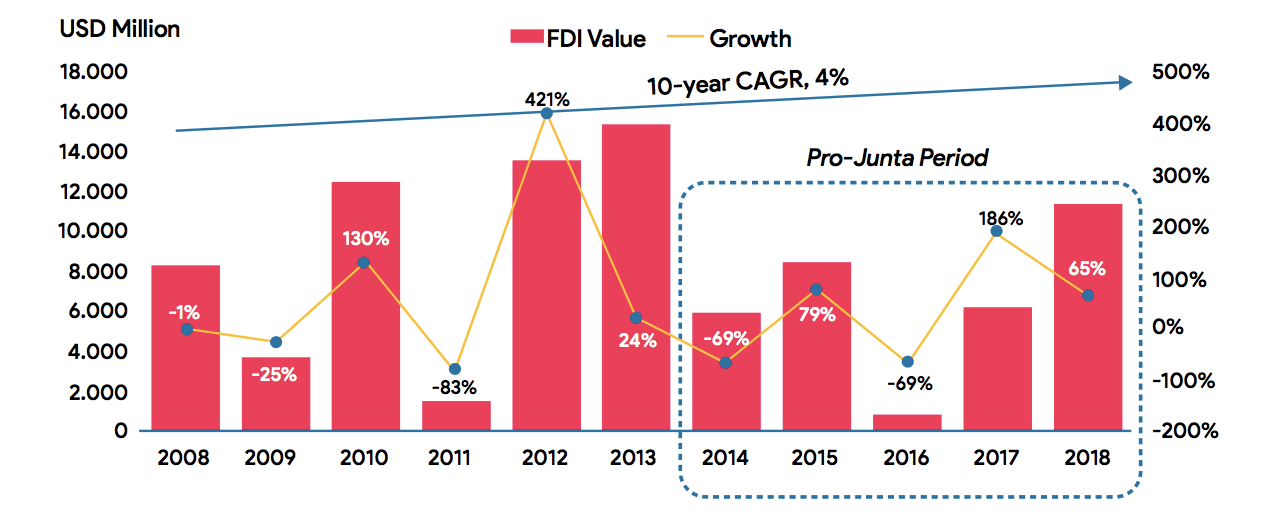

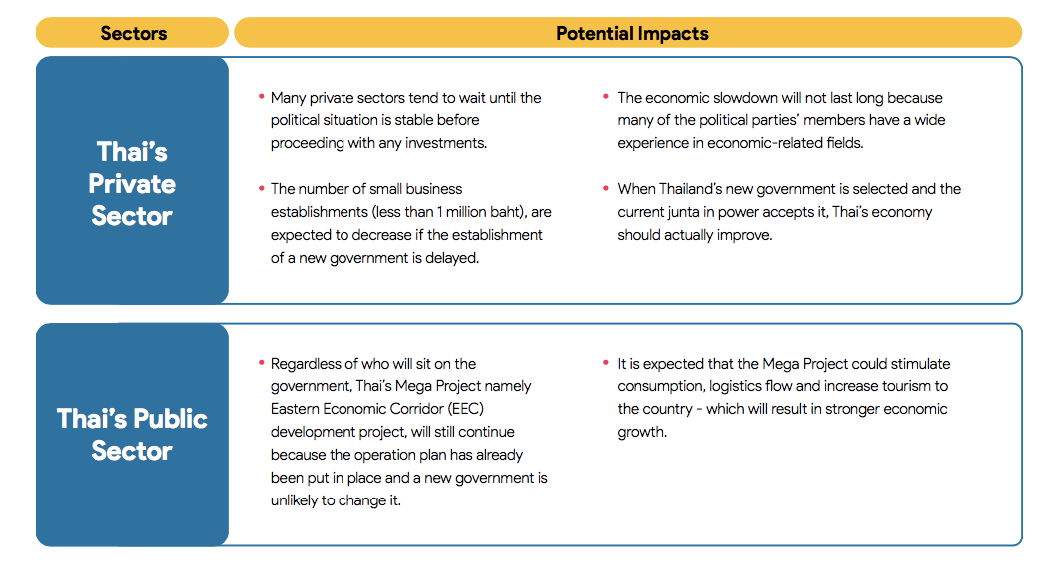

Although Thai's economy saw a slowdown after the election took place, Thai's businesses have yet to see major impacts on the overall economic growth. Over the past years, the country's GDP grew at an annual average of 3% during the Pro-Junta period, which is relatively lower than neighboring countries but still equivalent to GDP growth of all ASEAN countries.

However, Thai's GDP growth remained somewhat constant because of the country's wage policy. The rise in Thai's wages has resulted in some loss of competitiveness of Thailand against its neighbors, and foreign investments were shifted to other ASEAN markets like Vietnam.