Author

Shingo Kasumoto

Shingo is our Singapore Managing Partner and Southeast Asia Regional Manager with strength in business functions and strategy solutions competencies.

As we continue to recover from the COVID-19 pandemic, the lines between the physical and digital worlds are blurring like never before. This is because COVID-19 made it impossible to have physical contact with customers, and companies around the world have had to adapt to the new rules brought about by the pandemic. The result has been an acceleration of the race for digital survival.

It is said that the change in digital behavior on the customer side has also accelerated by several years—faster than originally anticipated—and expectations for customer experience (CX), including in the digital realm, continue to rise. Today, 77% of consumers are said to value the customer experience as much as the product or service itself. The key here is that the new digital CX is not evaluated against other brands in the same industry, but against the standards set by the world's leading digital service providers. Being better at digital CX than one's peers is no longer in itself a significant advantage from a consumer perspective.

In the context of digitization, efficiency improvements in the operational area are often discussed, but enhancing the digital customer experience is also an issue that cannot be overlooked.

Digital CX Global Market

The customer experience management market, which is estimated to be worth approximately 1.5 trillion yen in 2022, is expected to reach 4.2 trillion yen by 2029, growing at an annual rate of 16.2%. Although COVID-19 caused a drop in investment in the offline market, this was more than offset by online growth, which had no impact on the overall customer experience management market. In addition, consumer spending behavior is fundamentally changing, and it is a given that companies will continue to invest in seamless omnichannel experience enhancement both offline and online. The adoption of artificial intelligence (AI) and augmented reality (AR) by such companies will further accelerate market expansion.

Efforts by companies are not limited to investments in CX solutions, but are also accelerating the trend of setting CX as the new standard in internal processes and evaluation systems. In fact, 40% of companies use customer experience as part of their decision-making process, 75% use customer experience feedback as a criterion for rating and calculating incentives, and 85% of companies provide training to managers and general employees to improve customer experience.

It is said that 60% of consumers who switched from purchasing daily necessities through offline channels to online purchasing during the pandemic will continue to do so in the future, indicating that the change in consumer behavior is not temporary and will continue to evolve. In addition, there is a noticeable trend for consumers to choose online as their preferred channel, especially for household budget management and travel reservations, as well as utilities such as electricity, water, and gas. Furthermore, the digitization of the customer experience is not limited to B2C, but is also a prominent trend in the B2B domain, with the B2B EC market size expected to grow at an annual rate of 18.2% until 2028.

The ASEAN CX Market

The ASEAN market is said to be in a position to take global leadership in the expansion of digital customer experience due to the region’s increased connectivity and R&D investment, government-led stimulus packages, improved technology, and a growing segment of consumers who identify as digital natives.

The digital CX management market is also expected to grow at a rapid 17.1% CAGR from 2020 to 2027, growth expectations that are supported by the fact that 59% of managers in the region say they will accelerate their investments in customer experience management. In addition, Asia is at the forefront of digitization, accounting for 50% of global R&D spending and over 80% of patent applications in the areas of 5G connectivity, digital currency adoption, edge devices, IoT, AI, and smart cities.

On the other hand, the biggest challenge in ASEAN is the lack of human resources. Asia has become a global digital talent pool, producing 76% of graduates in the science, technology, engineering, and mathematics (STEM) fields globally from 2016 to 2018. However, most of its best digital talent has been lost to North America and Europe, and about 70% of Singaporean, Malaysian, Filipino, and Indian digital professionals are already working outside the region or have plans to do so in the future.

In this environment, the management of companies in the region cite the lack of skill levels within their organizations as their biggest concern, along with the slow pace of renewal of existing internal systems, as the main obstacles to success in the digital space for companies in the region. In addition to investing in technology solutions and systems, ASEAN needs to focus more on providing appropriate digital training to its internal personnel, and on acquiring the right people to drive digitalization.

Trends in Each Industry

E-Commerce

The e-commerce (EC) market is undoubtedly at the center of the digitalization of the customer experience, driven by the growth and maturation of Southeast Asian e-commerce platforms such as Lazada, Shopee, and Tokopedia, which have grown at an impressive 62% compound annual growth rate from 2015 to 2019. This growth was further accelerated by the pandemic, with the market reportedly growing from 63% to 97% between 2019 and 2020. This penetration is reflected in data showing that 56% of consumers in the region shop online at least once a week.

This rapid market growth has provided consumers with a myriad of options for online shopping. From the choice of device (PC or mobile), medium (website or app), and platform (official manufacturer, standalone platform, or retailer), the optimization of the customer experience across multiple channels has become a priority. Further complicating the situation is the transformation of social media, which has moved from being a promotional venue to an EC sales channel in what has been termed "social commerce.”

The EC market as a whole will undoubtedly continue to expand in the future due to the transformation of consumer spending behavior and the creation of an EC logistics ecosystem. On the other hand, companies should recognize that it is important to move away from the fragmented customer experience improvement measures of the past, to measures that make it easier for consumers to find the products they are looking for and make a purchase decision through the seamless integration of their shopping experience and the provision of personalized offers.

Another area that is often overlooked in the digitalization of the customer experience is customer service. Even with the most advanced system solutions in place, it is inevitable that customers will encounter problems during the product selection and purchase process, and the key is to provide prompt and flexible customer service. The question is how to supplement the functions expected of store clerks in the offline channel with those in the online channel, and this is one of the most promising areas for the use of AI.

Healthcare

The onset of the COVID-19 pandemic triggered the global spread of telehealth, which is expected to continue to grow in ASEAN, especially in Singapore and Thailand. Telehealth is not limited to online medical care as mobile health apps are also becoming increasingly popular, with 70% of patients in the region using mobile apps to manage their health at home.

In the telehealth space, personalized service provision is also important for further penetration, with emphasis on the evolution of customized communication and alerting functions that take into account each patient's specific circumstances. In the future, it is also expected to enable the expansion of access to healthcare in areas where there are no physical hospitals or physicians.

Financial Industry

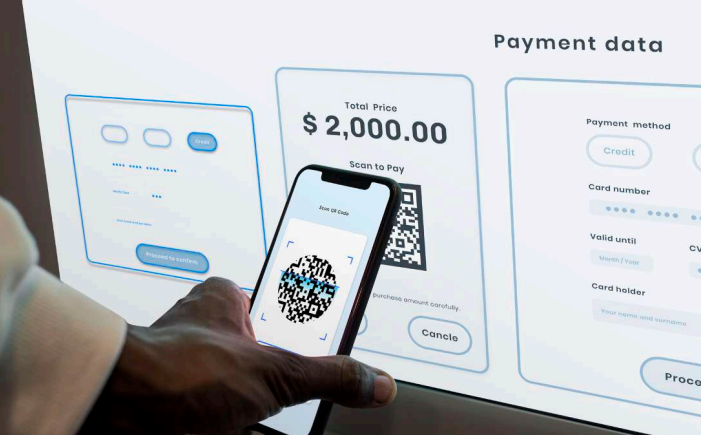

The digitalization of banking services at this stage is merely the use of digital channels to perform the simplest financial actions of remittance and payment management through online banking platforms. In the future, customer experience digitization in more complex services such as opening a bank account, consulting a financial advisor, processing a loan, or applying for a credit card is expected.

However, in complex transactions that require many steps to complete, there are many barriers that cannot be overcome by providing solutions limited to online channels, so customer experience design in conjunction with offline services will be crucial.

In addition, about one-fifth of the total population in ASEAN does not enjoy banking services other than a bank account, meaning that they do not handle any financial products and do not hold credit cards. Unlike other regions, where access to banks is universal, this lack of expected service provision from banks has led to the entry of many digital financial service providers into the market, who have taken on the role of complementing the services that are lacking.

Specifically, alternative third-party payment services for treasury management and settlement, such as Stripe, Venmo, and Revolut, are growing rapidly. In addition, QR code payments have become a standard in the cashless ecosystem in Thailand, as major banks early on introduced simple mutual payment services among users (C2C, B2C, and B2B) via QR code payments.

Digital CX Areas of Focus

Personalization

It is certain that more and more first contacts with companies and brands will be provided through digital channels, and it will be important to ensure personalization not only during the purchasing process, but also at the point of first contact with a potential customer.

On the other hand, as customers become more digitally savvy than ever before, their expectations for contact and interaction with companies and brands are also increasing. The amount and variety of customer data that must be analyzed to design tailored experiences has never been greater, but by leveraging AI technology, it is easier than ever before to extract useful insights from vast amounts of customer data and provide personalized proposals tailored to the customer.

It can be inferred that the source of competitive advantage among companies in the future will be the provision of "invisible benefits," such as how well a company understands its customers and how this leads to better CX by utilizing such data. There is no doubt that the importance of loyalty point programs, which have been at the center of customer loyalty improvement activities, will decline in relative importance.

Many companies pursuing new business models are focusing on building stronger relationships with their end consumers. While approaches vary (e.g. subscription services, both paid and free, and one-stop ecosystems), the objective remains consistent: to maintain and increase customer loyalty by collecting more detailed customer data on a more stable and larger scale.

Artificial Intelligence

The role of AI in customer experience solutions will be to enable the prediction of future consumer behavior through the organization and analysis of vast amounts of data, and to enable personalization proposals based on behavioral predictions.

As mentioned above, the definition of customer loyalty has changed since the pandemic. More emphasis is being placed on “invisible benefits,” i.e., how well a company understands its customers and how this deeper understanding is reflected in the customer experience. In fact, 40% of consumers in the digital channel cited “companies that help solve problems” and “companies that make the shopping experience easier” as the biggest factors in forming loyalty to a particular company or brand.

AI is essential to the development of such loyalty-building and strengthening measures, as it enables companies to analyze customer conversations, understand customer pain points, and create tailor-made solutions to solve each customer's unique problems.

AI also plays an important function in customer service. Given that 93% of customers expect companies and brands to reply within 24 hours and 89% of customers expect issues to be resolved within 24 hours, the use of AI will speed up and improve the efficiency of customer service responses. AI will also be particularly useful in the ASEAN region, where a variety of languages exist, and through AI, companies can interact with local customers in their preferred language, allowing them to communicate their issues more effectively, helping companies to better understand and propose appropriate solutions.

AI-related spending across Asia is expected to reach approximately 4.2 trillion yen by 2025, with a compound annual growth rate of 25.2% from 2020 to 2025. Driving this growth will be the B2B professional services domain, with customer service solutions that help solve customer problems.

Metaverse, AR, and VR

Virtual commerce technologies such as the metaverse, augmented reality (AR), and virtual reality (VR) are said to take online shopping to the next level. Until now, the digital channel has primarily played a specialized role in the buying process, as opposed to the comprehensive shopping experience that consumers get by visiting a store. As e-commerce expands, consumers increasingly expect shopping experiences in digital channels to replicate the interactions and emotions common in the physical world, rather than simply making a purchase.

Many brands have begun to build more virtual touchpoints for effective customer data collection, as well as the use of virtual commerce technology with the primary goal of enhancing brand equity—but most recently, they are moving to more sales-contributing activities. Examples include luxury fashion house Burberry and beverage brand Coca-Cola offering NFT collections.

In the virtual commerce technology space, beauty and fashion companies have been the most active. This is due to the personal nature of the products and services themselves, and the fact that the effects of introducing virtual technology can be more directly imagined.

Of course, in the future, the adoption of virtual commerce technologies, such as 3D visualization of the product itself and virtual reproduction of the store environment, is expected to advance without limiting the industry, and is expected to serve as a bridge between offline and online interactions. An example is furniture retailer IKEA, which has not only reduced the return rate of large furniture purchases by using AR to display actual-size furniture reproduced on a mobile camera (eliminating the need to take measurements), but has also increased customers' willingness to purchase by allowing them to create a “realistic” scene.

To date, 64% of major B2C brands have begun investing in such immersive experiences, and within five years (as was the case with the rise of social media 10 years ago), nearly all brands are projected to be using immersive experiences in their sales and promotional activities.

There is no doubt that the digitalization of the customer experience, which was half-accelerated by COVID-19, will continue irreversibly in the future. Its growth in ASEAN will be even more pronounced, given that it has a large number of consumers who identify as digital natives, and that it is one of the few growth markets attracting investments from global companies.

It is no exaggeration to say that they key to success in the ASEAN market will be determined by whether a company can strengthen its efforts to provide an appropriate digital customer experience. Companies must now have a platform that can collect large amounts of data, a system that can effectively analyze said data, the ability to quickly implement improvements based on analyses results, and the ability to recruit and train personnel who can effectively enhance digital CX.

Since its establishment in 2011, YCP Group has been providing management services in the areas of market research, strategy, operations, marketing, and M&A in various regions, with 17 offices and over 300 consultants across the world.

The main focus of business development in Southeast Asia is often how to replicate the successful Japanese model. Bringing business know-how established and developed in Japan’s mature business market into SEA is expected to increase the probability of success, and continues to be a straightforward strategy in most business areas.

On the other hand, in the digital domain—including the digital CX market—such an approach is no longer applicable. This is because the wave of digitalization sweeping Southeast Asia—regardless of the state of development per country—is not following Japan, but is progressing at the same axis as, and is even in some areas, ahead of Japan.

In the digital domain, flexible thinking that is not bound by conventional systems is required. In Southeast Asia, however, we believe it is essential to learn from the local market and create a precedent ahead of Japan by thinking from a zero-based approach.

Originally published in the Japan Chamber of Commerce, Singapore’s monthly magazine