This article was developed and guided by expert insight from YCP Solidiance Manager Adeline Ooi, who is based in Malaysia and has years of relevant experience spanning across several industries.

According to a 2020 industry report conducted by Mastercard, Malaysia had the highest mobile wallet usage and up-take rate among Southeast Asian countries. Due to the COVID-19 pandemic, the report also found that Malaysia was heavily involved in related segments as compared to other countries in Southeast Asia, specifically in the categories of online shopping and digital payments.

This data reflects that the financial industry in Malaysia is characterized by a robust and dynamic nature that encourages rapid development. As such, the financial technology industry in Malaysia is quickly emerging as a powerhouse, both within Asia, and worldwide.

Understanding Fintech in Malaysia

While there are several fintech sub-sectors in Malaysia, majority of players are situated in the e-wallet and payment segments consisting of a mix of both local and international players. Generally, e-wallets in Malaysia may be categorized into three types:

- Brand-specific E-wallets – Created and operated by brands who wish to instill brand loyalty. The currency available may only be used to purchase goods and services directly related to the brand itself.

- Independent E-wallets – These are standalone e-wallets who operate independently and can be used to purchase a variety of products regardless of brand; usually operates through its own platform or application.

- Hybrid E-wallets – Characterized by currency that is related to a specific brand but can be used to purchase and procure goods and services from unrelated brands. An example is GrabPay, which functions as a payment option for the Grab application and its services, but can also be used for the products of other companies.

Initially, international independent wallets like Alipay were the first movers in Malaysia. However, there was no competitive advantage by early entry as hybrid e-wallets operated by local conglomerates quickly became the primary option for consumers. It is important to note that accelerated adoption can be attributed to the COVID-19 pandemic, wherein fintech acted as an effective solution for touchless transactions.

With the e-wallet segment becoming more saturated, traditional banks saw an opportunity to involve themselves via a collectively owned company. The payment infrastructure known as DuitNow was developed by Paynet, an entity composed of 12 major banks as shareholders wherein the central bank of Malaysia, Bank Negara Malaysia, is included. The introduction of DuitNow is significant as it affords merchants the freedom to choose a single solution to process e-wallet payments, thus streamlining the process altogether.

With the plethora of options available to the public, it is likely that Malaysian consumers will own multiple wallets of varying type, be it brand-specific, independent, or hybrid. Further, the trends observed in these segments provide potential business opportunities for those involved.

Future Direction of Fintech

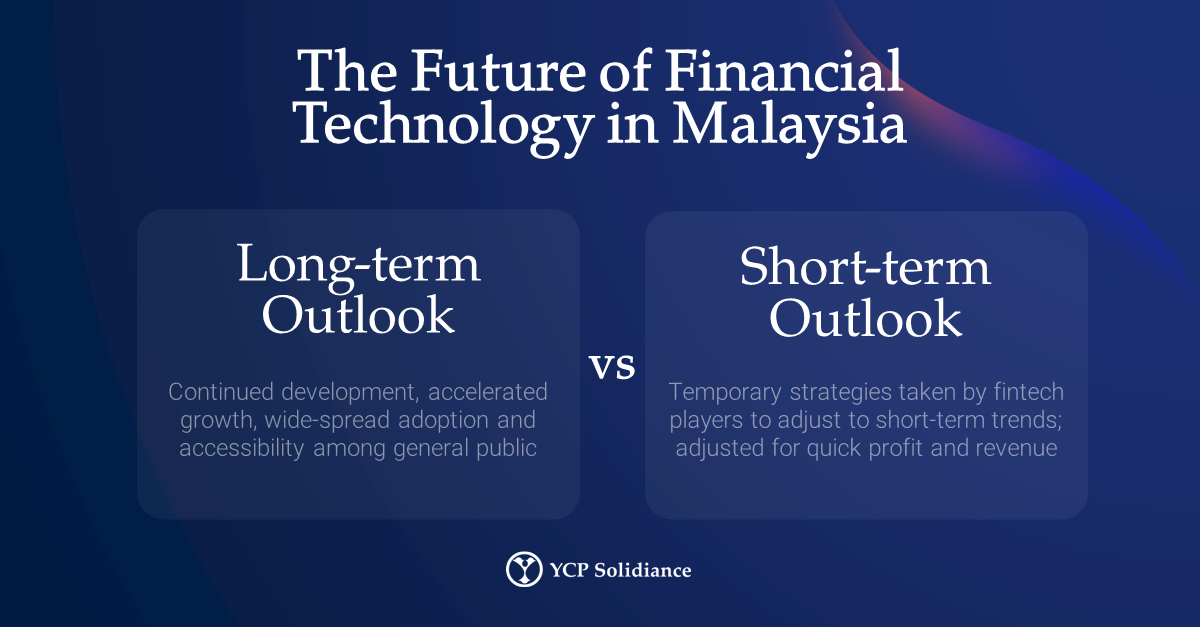

The future direction of fintech in Malaysia will likely be dictated by ongoing trends and developments, but will differ depending on short- and long-term needs. For example, while the creation of DuitNow is beneficial for merchants, e-wallets who earn revenue via merchant discount rates (MDRs) are likely to suffer in the short-term as traditional banks could offer lower fees and percentages. Such a development will motivate e-wallet operators to adjust to prevent a loss.

Strategies will inevitably vary, but some solutions that e-wallets can explore include: (1) offering services that act as a direct revenue source; (2) functioning as a promotional space for brands and facilitating purchase of vouchers through respective currencies; and (3) data collection and consumer analytics.

Moreover, as fintech in Malaysia matures, expect the government to continue its involvement as it aims to promote accelerated development. For instance, the central bank of Malaysia issued a regulatory sandbox framework that allows financial institutions and fintech players to safely explore new solutions in a production/live environment. Further, in anticipation of fintech’s increased popularity and usage, the Malaysian government is also proactively exploring the issue of digital banking licenses. If successful, Malaysia will only be the second country in ASEAN to do so.

Moving forward, expect a plethora of parties to drive the development of financial technology in Malaysia as many have expressed interest – be it fintech companies, the government, or traditional banks and other financial institutions. Interested parties and new entrants should explore options proactively now, even amid early-stage development.

To get further insight on the current state of financial technology in other countries and the closely related trends that are emerging, subscribe to our newsletter here and check out these reports: