This article was developed and guided by expert insight from YCP Solidiance Manager Brett Zambarrano, who is based in our Manila office and has led several projects in construction, transport, and digital transformation, among other industries. He has also co-authored a white paper extensively covering the history and growth of digital wallets in the country.

Prior to the global pandemic, the fintech industry in the Philippines had already witnessed substantial movement as many had recognized its potential. Even now, current data reflects a similar consensus. As per data from Fintech News PH, fintech firms in the Philippines garnered 342 million USD in funding during the first half of 2021 alone; a record-high amount.

While this data reflects generally strong interest from investors and consumers alike, parties involved in fintech in the Philippines are still working diligently to foster further development. Here’s what businesses and professionals can expect from the Philippine fintech market this 2022.

Fintech Landscape in the Philippines

In the YCP Solidiance white paper “The Digitization of the Philippine Wallet: E-Money’s Emergence in the Philippines,” e-money transactions reflected significant growth in terms of inflow, outflow, and usage, with the latter demonstrating a 36% CAGR during the pre-pandemic period of 2014 – 2018. Looking to build on this progress, a plethora of initiatives and programs were introduced by several parties.

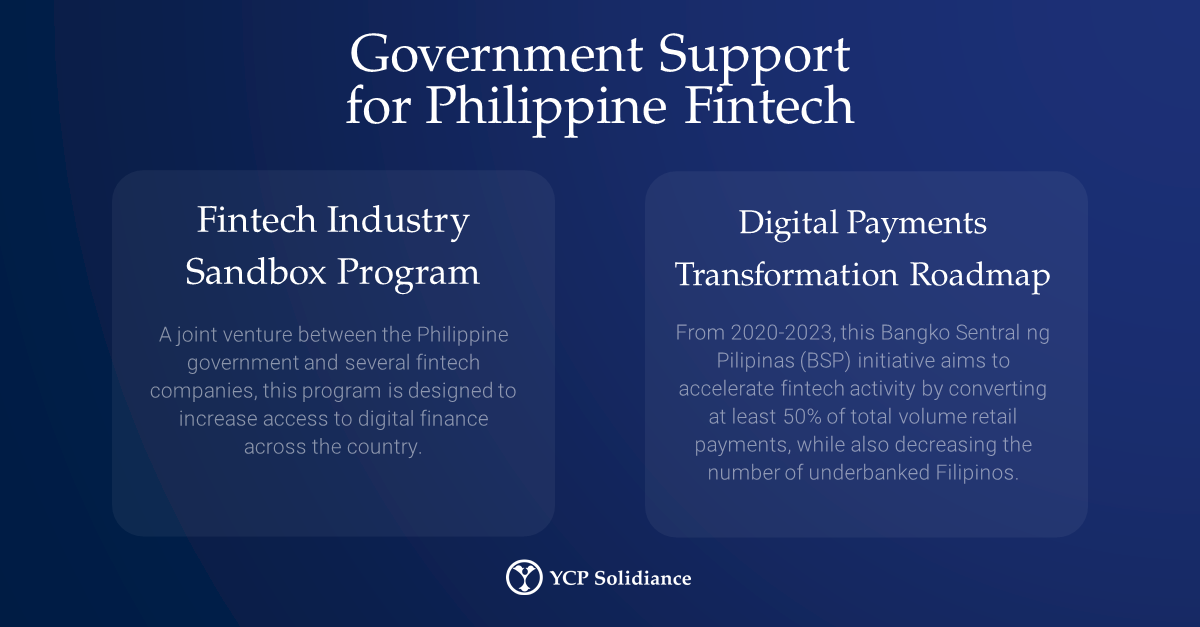

Recognizing that fintech is fast becoming an integral part of business operations, the Philippines’ central bank – Bangko Sentral ng Pilipinas (BSP) – expressed support by collaborating with various companies and organizations on fintech-centered programs. Such commitment has manifested through the Fintech Industry Sandbox Program, a collaborative initiative between major parties from the Philippines' digital finance sector, like Fintech Alliance.PH and Fintech Philippines Association (FPH) among others. This project aims to increase access to local financial institutions, while also promoting digital finance inclusivity within the Philippines.

As the fintech industry matures, garners more interest, and receives further support from involved parties, expect fintech solutions to become commonplace in the coming years. Beyond this, fintech’s engagement with other sectors like retail, e-commerce, and restaurants will also pave the way for other sectors to eventually utilize fintech, which in turn directly contributes to the growth of the fintech industry. As more and more businesses apply fintech solutions like mobile wallets and e-money, other previously underdeveloped channels will also steadily open themselves up to adopting fintech.

Securing Your Investment

Although there is significant activity currently taking place within the Philippine fintech landscape, it is important to remember that the industry has not yet fully matured. Therefore, when investing in fintech in the Philippines, concerned parties should keep in mind that adoption is a gradual process – one that must be carefully executed in consideration of consumers and respective business needs.

Given that there are still many untapped channels and markets wherein fintech has yet to be introduced, investors should remain proactive in recognizing these opportunities, especially when considering that trends suggest fintech adoption is inevitable.

To get insight into how financial technology will undoubtedly change the Philippine business landscape, and to better understand the potential benefits that this industry presents, subscribe to our newsletter here and check out these reports: