According to a January 2023 industry report developed by real estate player Colliers Philippines, the retail industry is set to experience an influx of revenue as shopping mall developers have reported increases in consumer traffic, reaching approximately 90% of pre-pandemic levels.

While several sub-sectors in the Philippine retail industry are expected to benefit, the food and beverage (F&B) segment finds itself in an especially suitable position as Colliers Philippines’ market report suggests the F&B sector will account for an estimated 50% of total retailers present across all shopping mall developments.

The Landscape of the Philippine F&B Industry

The domestic F&B industry comprises businesses of differing scales, from smaller, family-owned food stands and restaurants to large, multinational food and beverage companies. There are also several subsectors, including but not limited to the production of packaged and processed foods, the operation of fast-food chains and full-service restaurants, and the production and distribution of beverages of various types.

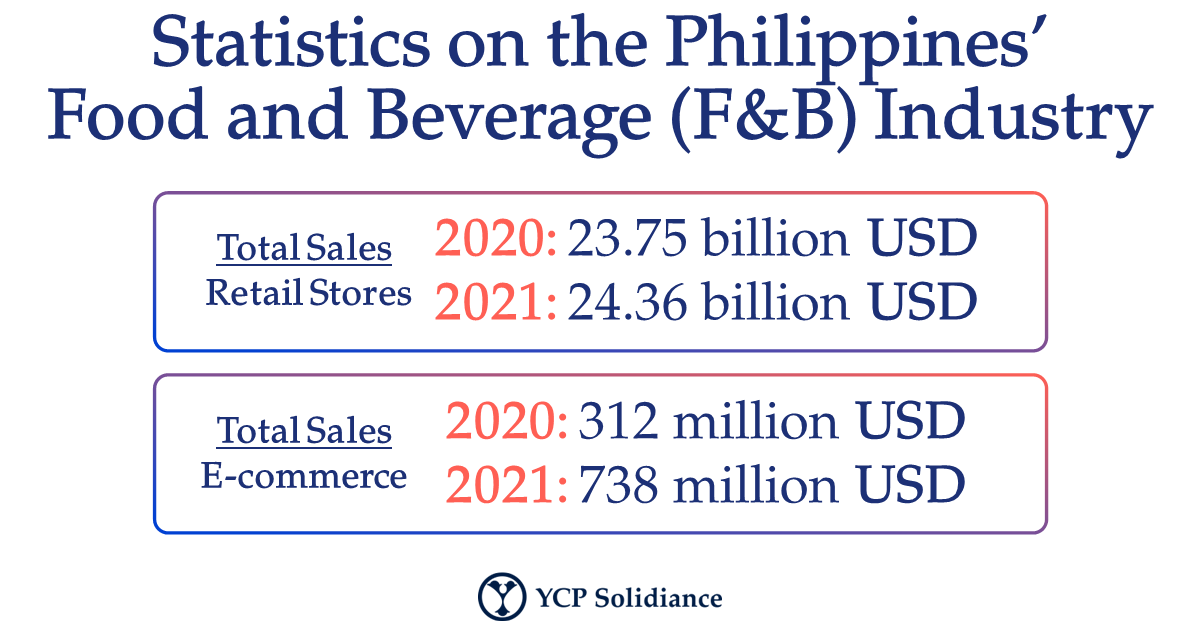

Despite setbacks brought about by the pandemic, the F&B industry has still managed year-on-year growth in recent years, as total sales of food and beverage retail stores reached 23.75 billion USD in 2020 and then 24.36 billion USD in 2021, as per data from Euromonitor International. The growth of the F&B market may be attributed to several factors, most notably the growing population, increasing disposable incomes across the middle and upper class, and the digitization of the industry at large. These factors will play significant roles as the public, and private sectors will look to sustain industry growth in the coming years.

Although the industry is slated for further development, involved stakeholders should still anticipate challenges: high competition due to the high volume of businesses, rising costs, difficulty in scaling up, and slow digitalization adoption among micro, small and medium enterprises (MSMEs). To address these issues, businesses will rely on investments from foreign and domestic parties that want to enter the F&B segment.

Considering Investment in F&B Businesses

Due to how diverse the Philippine F&B industry and its sub-sectors are, there exist several investment opportunities that interested parties can capitalize on.

One such opportunity is the scaling up and growth of MSMEs via investment. For instance, because it can sometimes be difficult to secure bank loans and government aid for F&B MSMEs, business owners will likely be receptive to investors who can provide financial backing. Pursuing investment in MSMEs will lead to immediate, short-term benefits such as improved operational efficiency and overall quality of products. In the long term, if applicable, MSMEs with investors can explore more lucrative and larger-scale opportunities like franchising or fast-moving consumer goods (FMCG).

Another sub-sector that will garner investor interest will be logistics directly concerning the F&B segment, such as processing, distribution, and related processes like cold chain solutions. Given the immense growth potential of the F&B sector, garnering investment in the logistical areas of the industry will be necessary to sustain the pace at which it is developing. In the context of F&B logistics, investors can leverage the following:

- Food Processing: The Philippines is a solid producer of tropical fruits, vegetables, seafood, and livestock, so F&B players are open to partnerships that will strengthen processing capabilities. This will likely involve expanding factories and processing plants, addressing workforce and labor shortages, introducing innovative technology to streamline processes, etc.

- Food Distribution: While the current supply chain has grown the F&B industry thus far, there is still a need to organize the fragmented portions of the market. Specifically, there is an opportunity to create a more comprehensive supply chain that connects producers with retailers and consumers. Investors could explore innovative solutions like farm-to-table and market digitalization to enable end-to-end services.

- Cold Chain Solutions: Generally, cold chain logistics leaves much to be desired because of inadequate conditions like frequent power outages and storage capacity. Thus, investors can capitalize on improving cold chain capabilities through solutions like refrigerated transportation, equipment sales, and leasing and renting for food preservation. Investors can also enter the market by offering specialized services such as workforce training focused on cold chain logistics.

Business owners and those considering investment should proceed cautiously by informing themselves of the potential challenges and growth opportunities. Considering that the F&B industry in the Philippines is a significant contributor to the country’s economy and that the market offers a wide range of business opportunities, stakeholders should expect the sector’s continued growth in years to come.

To get insight into business trends that interested parties should look out for in the retail industry across Asia, subscribe to our newsletter here and check out these reports: