What should businesses and professionals in Vietnam expect in 2022? As part of a new insight series, YCP Solidiance will be releasing several in-depth articles that feature emerging business trends in Vietnam, guided by research and analysis from YCP Solidiance Director, Dennis Lien.

Read the third installment below to learn about the Vietnam manufacturing industry’s growth amid the pandemic, and what steps will be taken to ensure development in a post-covid world. To read future installments of this series, subscribe to our newsletter here.

Throughout the duration of the global pandemic, Vietnam’s economy has remained resilient thanks in large part to the success and growth of its manufacturing sector. In fact, the domestic manufacturing industry contributed approximately 25% to Vietnam’s total GDP in 2021 as per data from Statista.

Despite experiencing supply chain issues that other countries have also encountered, like labor shortages and temporary closure of factories due to COVID-19, Vietnam’s manufacturing sector has managed to recover quickly. Thus, heading into 2022, expect such resiliency to translate into further development both domestically and internationally.

Labor Workforce as a Key Driver

While Vietnam is smaller in comparison to global manufacturing superpowers like China, the manufacturing industry has still managed to succeed due to several factors, such as low, competitive labor costs, and potential low-skilled and mid-skilled additions to the labor market.

Regarding low and competitive labor costs, Vietnam is an attractive location for manufacturers as labor compensation is almost half when compared to a manufacturer operating in China; 2.99 USD per hour in Vietnam, then 6.50 USD per hour in China. In addition to Vietnam being a relatively low and cost-effective alternative in comparison to other countries, the large workforce is also a significant factor for growth.

While the labor workforce did take a significant hit early into 2021 as workers opted to leave factories in major cities amidst the rise of the Delta variant, recent data reveals that business conditions have been gradually improving. According to data from a March 2022 industry report from information provider HIS Markit, the Vietnam Manufacturing Purchasing Managers’ Index (PMI) has been rising steadily for over 5 months with February recording a 54.3% high.

This data not only signifies recovery and progress amid a pandemic but more importantly, it is an indication that demand from customers—both domestic and international—is also increasing. Given this predicted rise in activity, expect involved stakeholders to urgently respond to accommodate, sustain, and fully capitalize on the influx of business.

Attracting Foreign Investment

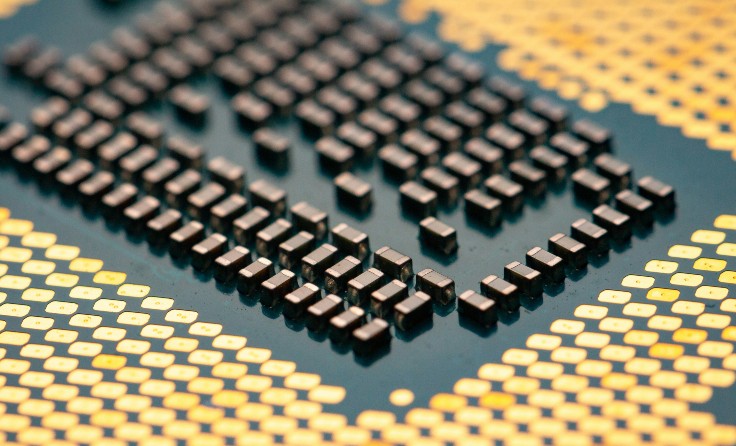

Considering the quality and potential of Vietnam’s manufacturing industry post-pandemic, investment from international sources is increasing. For instance, Samsung recently announced a 920 million USD investment to establish a new production facility, which boosts the tech giant’s overall investment to 2.27 billion USD within the country.

One of the main reasons why the manufacturing sector in Vietnam has witnessed an increase in foreign investment is the government’s proactivity to entice business, such as the use of free trade agreements (FTAs). These FTAs do not only provide better accessibility to foreign business and vice versa, but it also allows Vietnam to enjoy reduced tariffs with partner countries which ultimately strengthens the competitiveness of Vietnam’s manufacturing industry.

Overall, whether it be the potential of the labor force, the increase in foreign investment, or the proactive government initiatives, the manufacturing industry in Vietnam is developing healthily and quickly trending to be an appealing sector for potential investors. The increase in activity will not come from a single source, but rather, it will be a collaborative effort as involvement in manufacturing concerns several stakeholders stemming from varying backgrounds and demographics – big, small, international, domestic, etc.

To get further insight into other relevant industries and emerging business trends in Vietnam, subscribe to our newsletter and read these reports: