In Singapore, small and medium-sized enterprise (SME) development is being bolstered by recent partnerships between the public and private sectors. Such partnerships can be seen across several major industries, most notably in automotive and mobility.

As per a report by the Straits Times, government-backed Enterprise Singapore has formed a partnership with Germany-based automobile company Continental, with the two entities set to launch Co-pace, an organization that will provide automotive SMEs with increased resources and access to improved market insights.

The value of public and private partnerships (PPPs) in the context of businesses cannot be understated as such collaboration not only accelerates growth, but also helps introduce an influx of both domestic and foreign investors. As Southeast Asia enters a post-pandemic era, such partnerships will be crucial for regional resilience and success.

Importance of Public-Private Partnerships

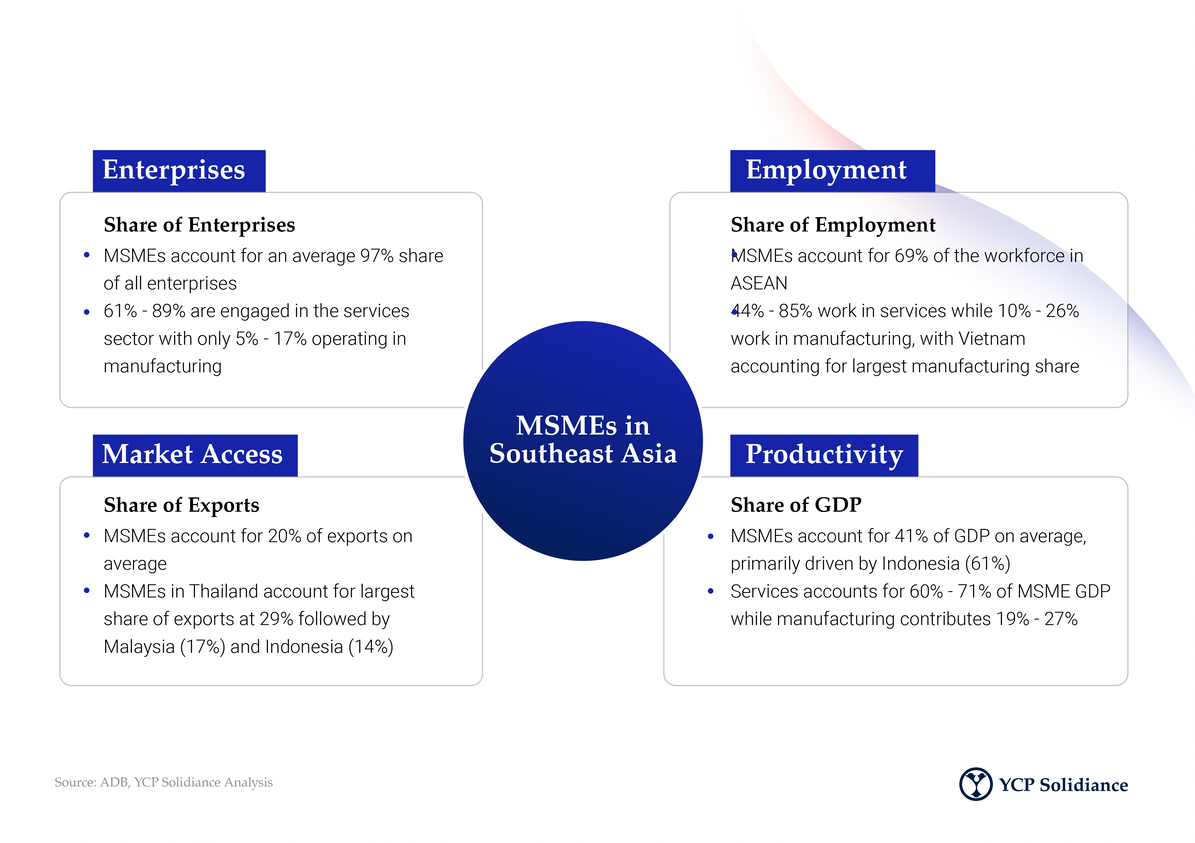

According to the YCP Solidiance white paper "Road to Recovery: Post Pandemic Business Outlook in Southeast Asia," 97% of all enterprises in the region can be classified as SMEs or even MSME (micro-enterprises), and account for around 41% of regional GDP. These enterprises were some of the hardest hit amidst the COVID-19 pandemic in 2020 and are only starting to recover with lockdown restrictions being lifted and the resurgence of international travel, making partnerships to build long-term growth and success a necessity.

In the YCP Solidiance white paper “Public and Private Sector Cooperation: Sustainable Urban Development in Vietnam,” the Vietnamese government sought out partnerships with the private sector to advance the development of transport infrastructure, specifically in know-how transfer, solutions development, and operation of smart systems. Thus, PPPs throughout Southeast Asia are being adjusted depending on a specific goal or industry in mind.

Public-Private Partnership in Southeast Asia

For the PPP dynamic in Southeast Asia, the duties of the public and private sectors are very distinct. Based on data from the aforementioned YCP Solidiance white paper from Vietnam, the public sector usually consists of public offices and government bodies that are responsible for goal setting, policy framing, and budgeting of national finances.

Meanwhile, the private sector is composed primarily of tech providers, manufacturers, start-ups, etc. The role of these parties can range anywhere from advisory and consultancy to product and solution providers, or even as investment and operation resources. Given that the public and private sectors in other Southeast Asian countries remain cooperative with one another, the PPP model observed in Vietnam could be replicated across the region.

Given that Southeast Asia is currently in the process of accelerating total digitalization, the public sector is particularly interested in forming partnerships with technology companies as they maximize reach and capability. Doing so not only helps parties like SMEs—who are directly engaged by PPPs—but perhaps more importantly, it will help position Southeast Asia to thrive as the world embraces the Fourth Industrial Revolution (4IR).

Considering the advantages that PPPs present, parties in both the public and private sectors in Southeast Asia will likely continue to seek each other out. At the end of the public sector, government bodies should entice potential investors by establishing favorable terms for businesses, such as tax breaks or exemptions. Then, for the private sector, tech companies should proactively explore PPP opportunities in nations that are interested in digitalization and exploring related areas, such as smart technology, smart cities, 4IR, etc.

To get insight into how other industries and important business trends in Singapore, subscribe to our newsletter here and check out these reports:

- Driving Trade in Singapore via Cross-Border Transactions

- Addressing Food Security in Singapore

- Implications of Sustainable Manufacturing in Singapore

- Scaling Up Singapore’s Community Eldercare Initiatives