What should businesses and professionals in Singapore expect in the second half of 2022? As part of a new series, YCP Solidiance will be releasing several in-depth articles that revisit previously analyzed emerging business trends in Singapore, guided by research and analysis from our team of professionals in the country. Read the first installment here.

To understand more about how the e-commerce landscape is growing in Singapore with Q3 and Q4 in 2022 and early 2023 in mind, read the final installment below and subscribe to our newsletter here.

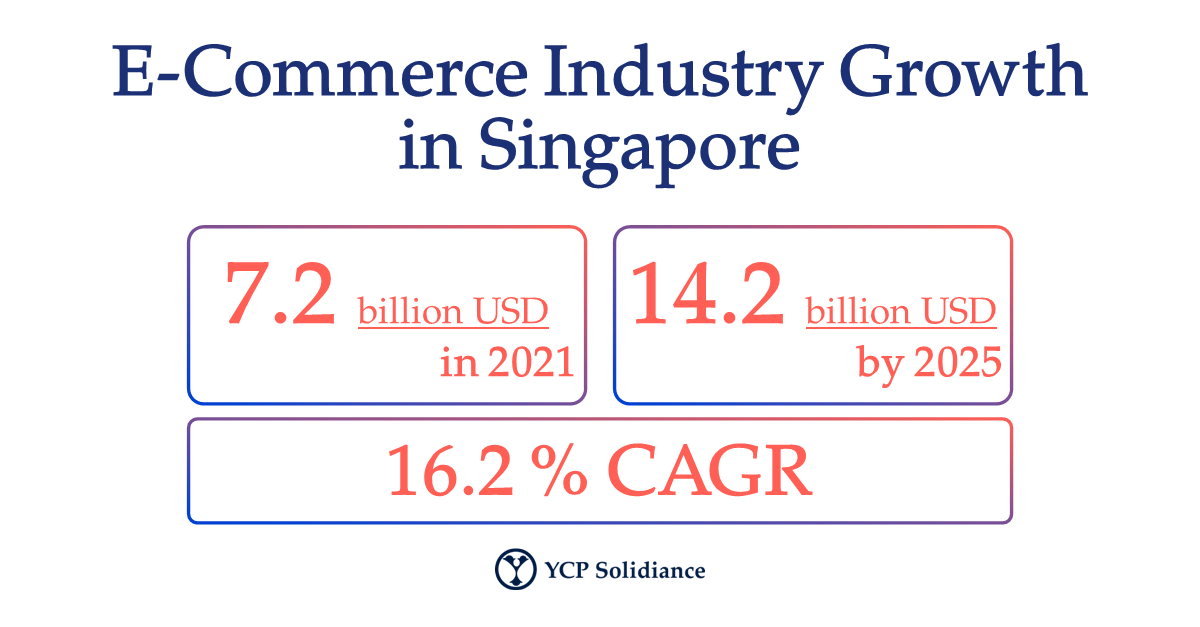

As per projections from a report by GlobalData, the e-commerce industry in Singapore is growing at an unprecedented pace, as evidenced by its 16.2% CAGR wherein the total value generated will jump from 7.2 billion SGD in 2021 to 14.2 billion SGD by 2025.

The accelerated development of e-commerce in Singapore is the result of several factors, such as a rise in spending amid post-pandemic recovery, government support via national initiatives, and a shift in consumer preference toward online shopping. With these considerations in mind, Singaporean e-commerce will likely continue its growth well into H2 of 2022 and beyond.

Sustaining Singapore’s E-commerce Growth

Given that the e-commerce market in Singapore has grown largely due to the COVID-19 pandemic, several trends have emerged. These trends have significantly contributed to e-commerce’s success in the short term, but perhaps more importantly, they will likely shape, influence, and help guide the evolution of the industry in the coming years. These are some of the e-commerce trends currently emerging in Singapore:

- E-commerce Booster Package 2022: Spearheaded by the government statutory board Enterprise Singapore (ESG) and major e-commerce platforms operating in the country, this initiative aims to help local offline SMEs digitally activate and transition toward online spaces. Through the package and its variety of solutions in several areas of e-commerce such as marketing and supply chain management, local SMEs as new market entrants will be able to diversify their revenue channels with relatively low transition costs that are shouldered by the government.

- Shopping in the Metaverse: Capitalizing on the advancement of the metaverse and its ability to have users digitally interact with content in a virtual world, e-commerce players are heavily interested in the growth potential of this segment. Specifically, brands are afforded the opportunity of having users extensively engage with their products via the decentralized space of the metaverse. Such a tool will not only provide immediate, actionable data but also nuanced insight into consumer habits, which serves to inform future strategies of e-commerce businesses.

- Secondary Effects: The finance industry has also experienced parallel growth because of digital payment activation on e-commerce platforms. Such a development has also helped the financial technology sector in Singapore accelerate rapidly with major digital payment providers like PayPal, Apple Pay, and Grab Pay having a 30.6% market share due to e-commerce growth.

Post-Pandemic Outlook of E-commerce in Singapore

While these e-commerce trends are expected to continue well into the future, some adjustments may have to be made especially as Singapore transitions toward a post-pandemic world. To guide this, e-commerce stakeholders should become familiar with how consumer behavior has changed and evolved over time.

Most notably, because of limited mobility and an increased emphasis on digitalization amidst the pandemic, consumers now consider online shopping as the primary option — a development that has greatly contributed to the success of the e-commerce industry. Despite this, analysts of the International Data Corporation (IDC) have projected that most leading retail brands will instead re-focus on physical in-store experiences by 2023.

To minimize the potential losses that the Singaporean e-commerce industry may incur, parties should explore how to leverage and better manage strategies that promote blended retail (a mixed balance of physical and online shopping). For example, e-commerce platforms can collaborate with retail brands to apply omni-channel retailing wherein specific strategies such as offering limited, online-exclusive items can be executed. Such collaboration between parties may allow e-commerce operators to retain their online audiences, while still ensuring that retail brands benefit.

Heading into Q3 and Q4 of 2022, the e-commerce industry in Singapore has maintained its relevancy while also managing to plan for an eventual post-pandemic shift. In early 2023, interested parties should expect the Singaporean e-commerce sector to continue to build on its growth by further developing its post-pandemic strategies.

To get insight into e-commerce-related business trends in other countries, subscribe to our newsletter here and check out these reports: