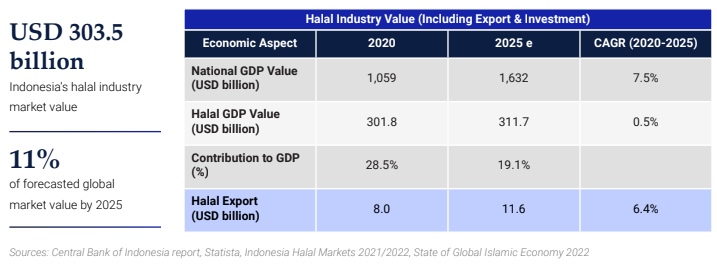

Indonesia, with the largest Muslim population in the world at 236 million, is a major player in the global halal industry. The country’s halal market value reaches USD 303.5 billion. As the nation takes center stage domestically and internationally, its halal sector's impact on the economy is nothing short of remarkable. Regarding exports, Indonesia's halal industry generated USD 8.0 billion in 2020, and projections indicate a substantial increase, reaching USD 11.6 billion by 2025. This robust performance positions Indonesia at the forefront of global halal trade, reflecting a growing demand for its halal products worldwide.

This substantial growth intricately shapes Indonesia's halal industry across diverse segments, with key players leading the charge. Meeting halal requirements is pivotal, given the predominantly Muslim population. As a result, businesses have ventured into the halal industry, establishing themselves as influential players.

Leading players in Indonesia's Halal Industry

- Halal food: Indofood and GarudaFood spearhead Indonesia's halal consumer goods industry. With an impressive revenue growth rate of 42% and 18% from 2017 to 2021, these companies exemplify a commitment to halal standards to strengthen their position in Indonesia’s halal food industry. Indofood, in particular, has established its halal certification body, tapping into fast-growing regions globally.

- Modest fashion: Dian Pelangi and Hijup, prominent fashion brands, dominate Indonesia's modest fashion scene. Focusing on contemporary designs adhering to Islamic dress codes, they leverage e-commerce platforms and collaborations with international brands to capture a broader market share.

- Pharmaceutical: Kalbe and Kimia Farma lead Indonesia's halal pharmaceutical industry. Boasting impressive growth rates of 110% and 30% from 2017 to 2021, these companies invest significantly in halal certification and production, catering to the growing demand for halal healthcare products.

- Cosmetics: Wardah Cosmetics has emerged as a leader in Indonesia's halal cosmetic industry. Certified by the Indonesian Ulema Council, Wardah's affordable and halal skincare, makeup, and personal care products resonate strongly with Muslim consumers, expanding its market share regionally.

- Islamic finance: Bank Syariah Indonesia (BSI), the largest Shariah-compliant lender, plays a pivotal role in Indonesia's finance halal product. Achieving a total assets value of USD 17 billion post-merger in 2021, BSI demonstrates substantial market presence, offering a range of Shariah-compliant financial products and services. Its role as a key player in Indonesia's financial landscape underscores the significance of Shariah-compliant banking in the country.

Indonesia's halal industry is a burgeoning economic force and a dynamic and evolving landscape where key players shape the industry's trajectory. With a commitment to halal standards, innovation, and global engagement, these leading players exemplify the resilience and potential of Indonesia's halal sector on the world stage.

To get insight into other business industries across Asia and emerging trends, subscribe to our newsletter hereand check out our latest reports below: