Thailand’s automotive industry has long been a powerhouse, standing as the largest automobile producer in ASEAN at almost 43% of all motor production and 55% of total scooter and motorcycle production within the region. Given its robust automotive supply chain, Thailand’s role in regional EV growth is being established, further developing itself as a hub for ASEAN, with both the Thai government and major automotive players investing heavily in the sector's growth.

Both original equipment manufacturers (OEMs) and assemblers have expressed their electrification plans and the conversion of their existing Thailand facilities to produce EVs—Toyota has announced that it will invest 18 billion Thai baht into its local EV production operations, while Nissan will convert its existing Samut Prakan facility to produce EVs, signaling strong confidence and support in EV infrastructure development in Thailand.

As technology advances and infrastructure develops, Thailand stands poised to play a pivotal role in driving the evolution of electric mobility in Southeast Asia. This white paper provides a comprehensive overview of Thailand’s EV industry, along with opportunity areas to fully realize the industry's untapped potential.

EV Infrastructure Development in Thailand

Globally, the adoption of EVs has grown significantly, partly due to battery technology advancements and the easing of high prices. However, the pace of adoption per country and even per region depends greatly on multiple factors, such as charging infrastructure, market price, and local production, among other reasons.

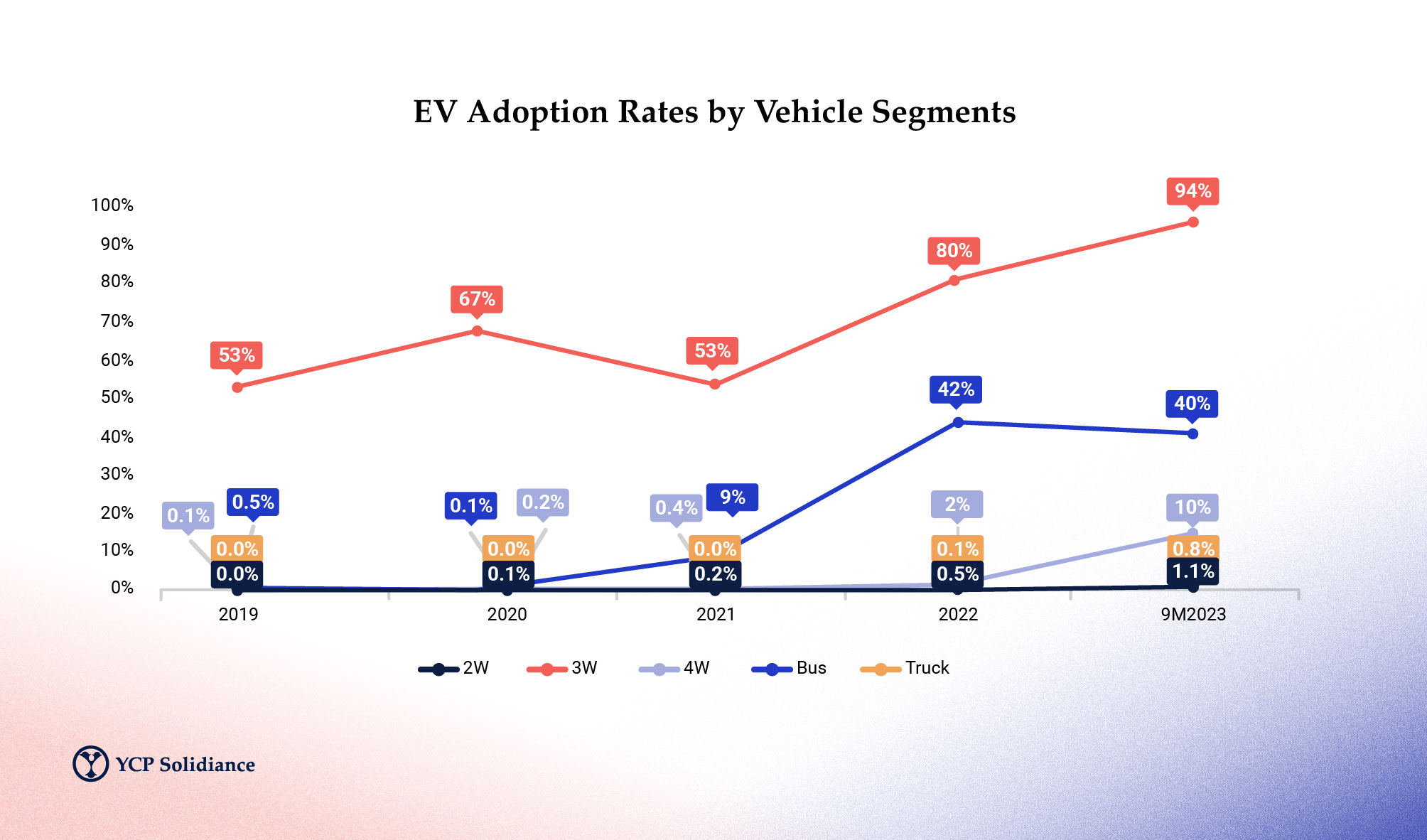

Electric vehicle adoption in Thailand has substantially increased across categories since 2020. Passenger EVs reached a 10% adoption rate in September 2023 compared to the two-wheeler (2W) segment. The growth of the three-wheeler (3W) segment has been fueled substantially by the emergence of electric 3W taxis, with local players such as MuvMi aiming to expand its fleet to 5,000 vehicles over the next five years.

Thailand's strides toward becoming a regional EV hub reflect a promising landscape, backed by significant investments in areas such as charging station network expansion and proactive government measures to evolve Thailand’s electric vehicle policy and regulation.

To learn more about this emerging industry, download our free report.

Author

Mehdi Jaouadi

Mehdi is a Partner based in Thailand, with over 14 years of experience in strategy formulation, business development, and large-scale expansion growth within Automotive, FMCG, Healthcare, and other sectors.

Recent White Paper

See All