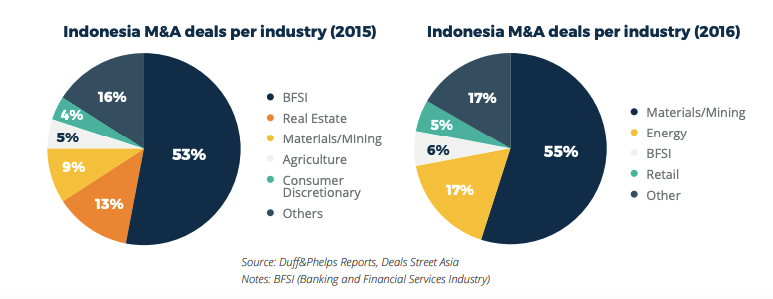

The rise in technology is expected to become one of the major drivers for M&A deals in the Indonesian market, as the country emerges as one of the growing economies in the region for technology startups.

Several factors attributing to this trend include the projection of internet and smartphone penetration rate which are expected to reach 68% and 39% respectively by 2020, the estimated 270 million population also in 2020 with around 50% categorized as a middle-affluent class, and government incentives through a supportive regulatory framework.

As of the first half of 2017, M&A deals in Indonesia was recorded at USD 4 billion, showing a remarkable 81% increment compared to the same period in 2016. The reason for this interesting shift was primarily due to the rapid growth of the technology sector in recent years, which overall contributed to 32% to deals value.

One of the most prominent M&A deals in the tech industry was between Tencent Holding investment and Go-Jek, an Indonesian based ride-hailing app, worth a whopping USD 1.2 billion. Other big deals were also made in the e-commerce sector, including China's e-commerce giant, Alibaba Group Holdings, which injected USD 1.1 billion into a local Indonesian e-commerce platform.

Acquisitions of Southeast Asian Startup Companies

With capital increasingly being allocated to up-and-coming players, the startup ecosystem in the Southeast Asia region is also rapidly thriving and maturing. This growth is supported by the rise in venture capitalists as well as a private equity investment in the region that helps to produce Southeast Asia’s first set of unicorns.

In 2019, the number of acquisitions of Southeast Asian technology startups has doubled in the first half of the year. Local companies in the region are strongly looking to expand their market share. According to Refinitic, takeovers of tech companies in the region reached USD 4.9 billion in the first half of 2019, compared to USD 2.2 billion over the same period in 2018 and USD 1.7 billion in 2017.

As more private equity players and non-tech companies invest in tech startups, the rise in interest in the Southeast Asia region has been forecasted to accelerate over the next five years. The trend is expected to increase exponentially with the estimation of at least 700 startups exits between 2023-2025, largely accounted by tech companies buying other companies.

Technology Drives M&A Activities Further

Technology plays a huge role in M&A and it keeps expanding with every deal. Companies are now required to make strategic investments in increasingly sophisticated digital innovations which also requires business-savvy IT executives to make efficient M&A transactions.

As digital transformation has become the key strategic goal for many businesses, the providers of new technology are turning to be the targets for acquisitions. Moreover, in order to gain access to new technologies as well as processes to complement their existing operations, businesses tend to pursue more M&A deals.

The year 2018 witnessed a continued diversification of the buyer class in the technology sector, both by type and geography. Corporations, private equity firms, and also financial institutions have set their sight on the technology sector, including a number of acquisitions made by joint venture acquirers that pool knowledge as well as capital. Adding to that, mobility services and cloud technology industries are also growing as investors in the M&A domain, seeking to bring a wide range of in-house technological solutions.