Alternative Financing has gained significant popularity with consumers and SMEs due to its accessibility and repayment flexibility. Technological advancements have made the fintech lending market more accessible to a broader range of customers compared to traditional brick-and-mortar financial institutions.

This publication, which was written by YCP Solidiance’s M&A experts, explores how the next decade of Alternative Financing will be driven by Buy Now Pay Later (BNPL) and Peer-to-Peer (P2P) Lending—specifically analyzing the different success factors for each segment, the shifting dynamic of M&A within BNPL (where the type of acquirers are becoming increasingly diverse), and the particular valuation techniques used to value these companies, taking into account the challenges surrounding their growth stages and lack of profitability.

Exploring Fintech M&A Entry Strategies and Opportunities for BNPL and P2P

For BNPL, the key to success is achieved more organically than with P2P Lending, in which the establishment of a strong retail footprint and brand presence is critical. On the other hand, P2P lending has a stronger reliance on technological innovation for its competitive advantage, making it suitable for startups and attracting venture capital and private equity funding.

For strategic investors, though, particularly those with diverse retail networks, BNPL M&A opportunities will be more attractive as they can leverage their existing merchant relationships for swift adoption.

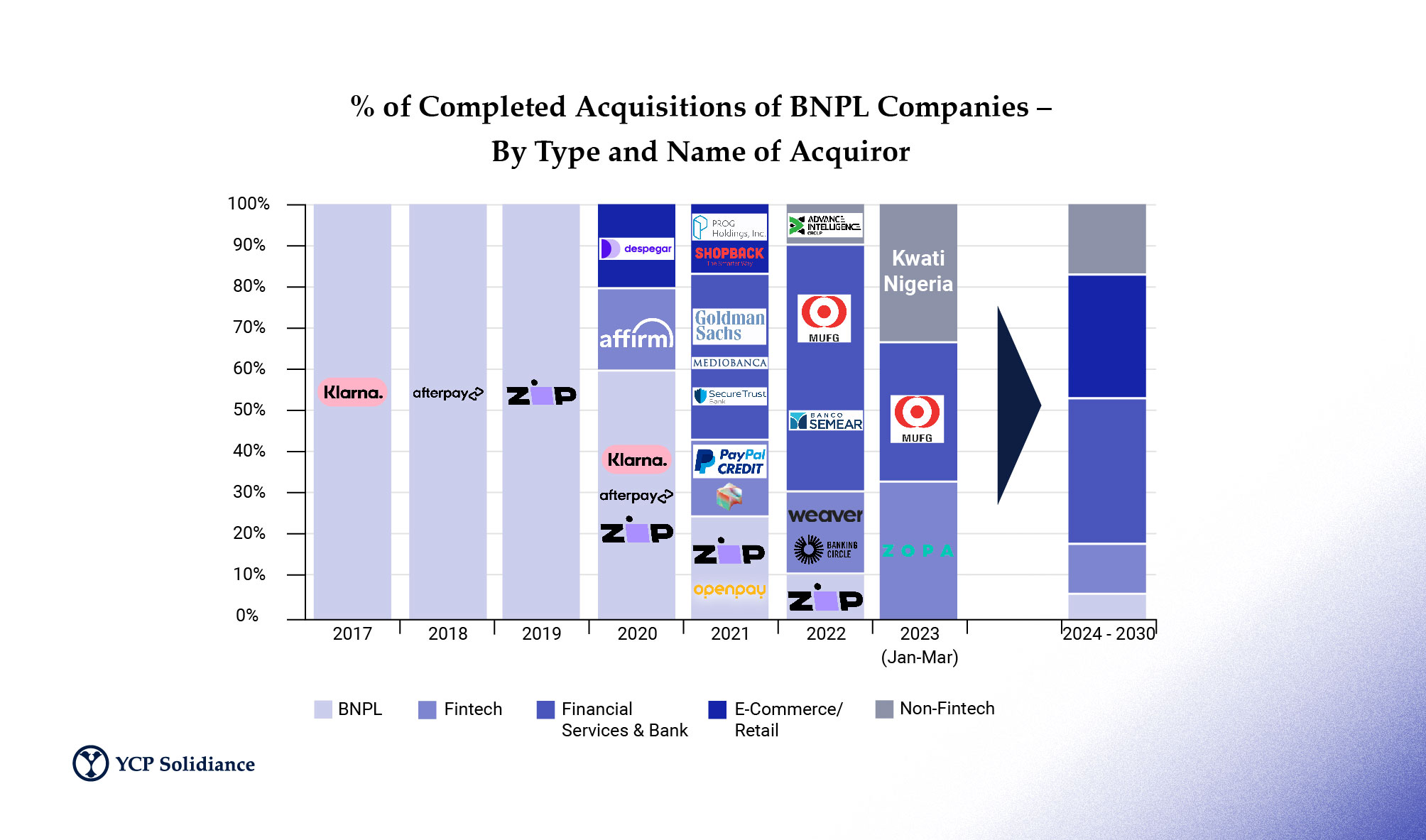

This is supported by the trend in M&A, with the BNPL industry witnessing a notable shift in the type of buyers involved. From 2017 to 2020, consolidation was primarily driven by existing BNPL players, but since 2021, financial services firms and traditional banks have become the dominant buyers, accounting for over 60% of global transactions. This shift can be attributed to the popularity of BNPL among consumers, the refinement of regulatory oversight, and the opportunity for banks to expand their range of financial services.

As the macroeconomic environment stabilizes, M&A activity is expected to increase. E-commerce and retail conglomerates could become the next prominent buyers of BNPL, particularly those with strong merchant networks and brand presence. These companies can benefit from the insights into customer spending behavior that BNPL services provide, enabling them to make informed business decisions.

Nonetheless, Price-to-Book-Value multiples of these sectors showcase stabilization at a similar level to other financing industries before COVID-19, suggesting the age of over-valued players is over. For instance, BNPL players converged to a median P/B of 1.35x, after exhibiting large volatility in the past five years between 12x and 1x, while P2P players also showed instability within a smaller range of 3x to 0.5x, now trading at a median of 0.75x. As a result, for investors specifically, it implies a decrease in price speculation and risk, resulting in better opportunities to identify and invest in companies at reasonable valuations.

To value those opportunities, the most suitable methods will be identifying comparable trading companies, as well as a modified Discounted Cash Flows analysis which can cater to the characteristics of the financial services industry, and specifically early-stage companies.

As businesses venture into new service verticals and target different customer segments, investors are advised to closely monitor these two segments, as they offer abundant growth opportunities. For a more comprehensive understanding of the general landscape, key success factors, M&A trends, and valuation techniques, we invite you to download our full report, which is available for free.

Author

Gary Murakami

Gary is YCP's Partner with a diverse portfolio of hands-on management services in M&A and post-merger integration advisory around Asia.

Recent White Paper

See All