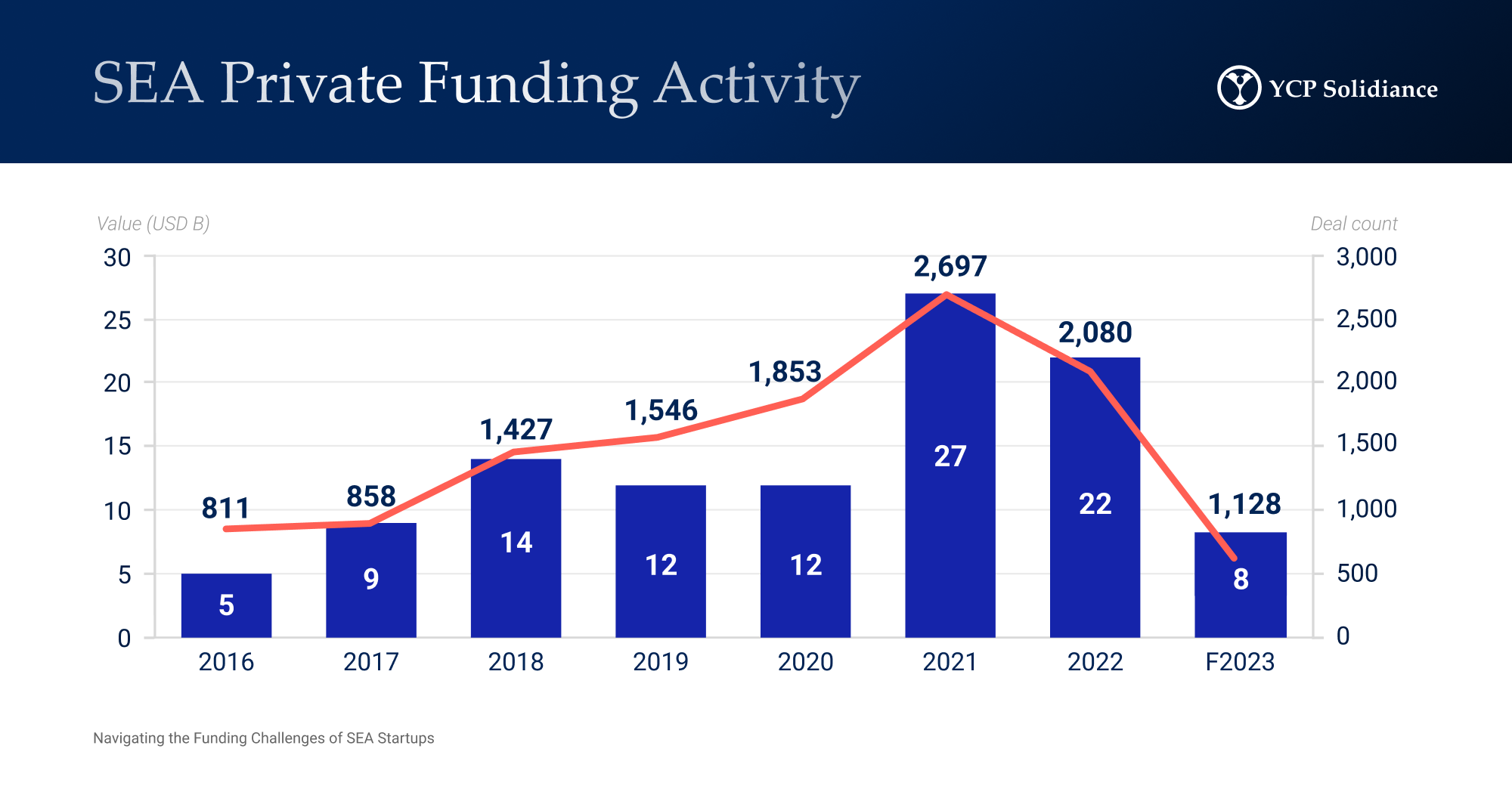

Southeast Asia's startup ecosystem is adapting to new realities. The COVID-19 pandemic and macroeconomic uncertainties have sparked a shift, with startups facing funding constraints and a renewed focus on profitability. From heightened competition for resources to VC struggles in divesting older investments, the landscape is evolving.

Startups must prioritize profitability, leading to increased competition and pressure for sustainable models. VCs struggle to exit older investments, while new investors see opportunities to acquire startups at discounted valuations with caution due to crowded cap tables.

Our latest white paper explores the current funding landscape in Southeast Asia, exploring the challenges and opportunities that startups are facing. The report examines how these factors have prompted a strategic pivot towards profitability in the startup landscape.

Learn more about the latest developments in Southeast Asia’s startup funding landscape and how startups can succeed in this new funding environment by downloading our latest white paper.

Author

Gary Murakami

Gary is YCP's Partner with a diverse portfolio of hands-on management services in M&A and post-merger integration advisory around Asia.

Recent White Paper

See All