Cambodia’s dynamic banking sector has experienced significant growth and transformation over the last three decades, thanks to technological advancements. The rise of digital payments and online banking have propelled the industry forward, attracting foreign investment.

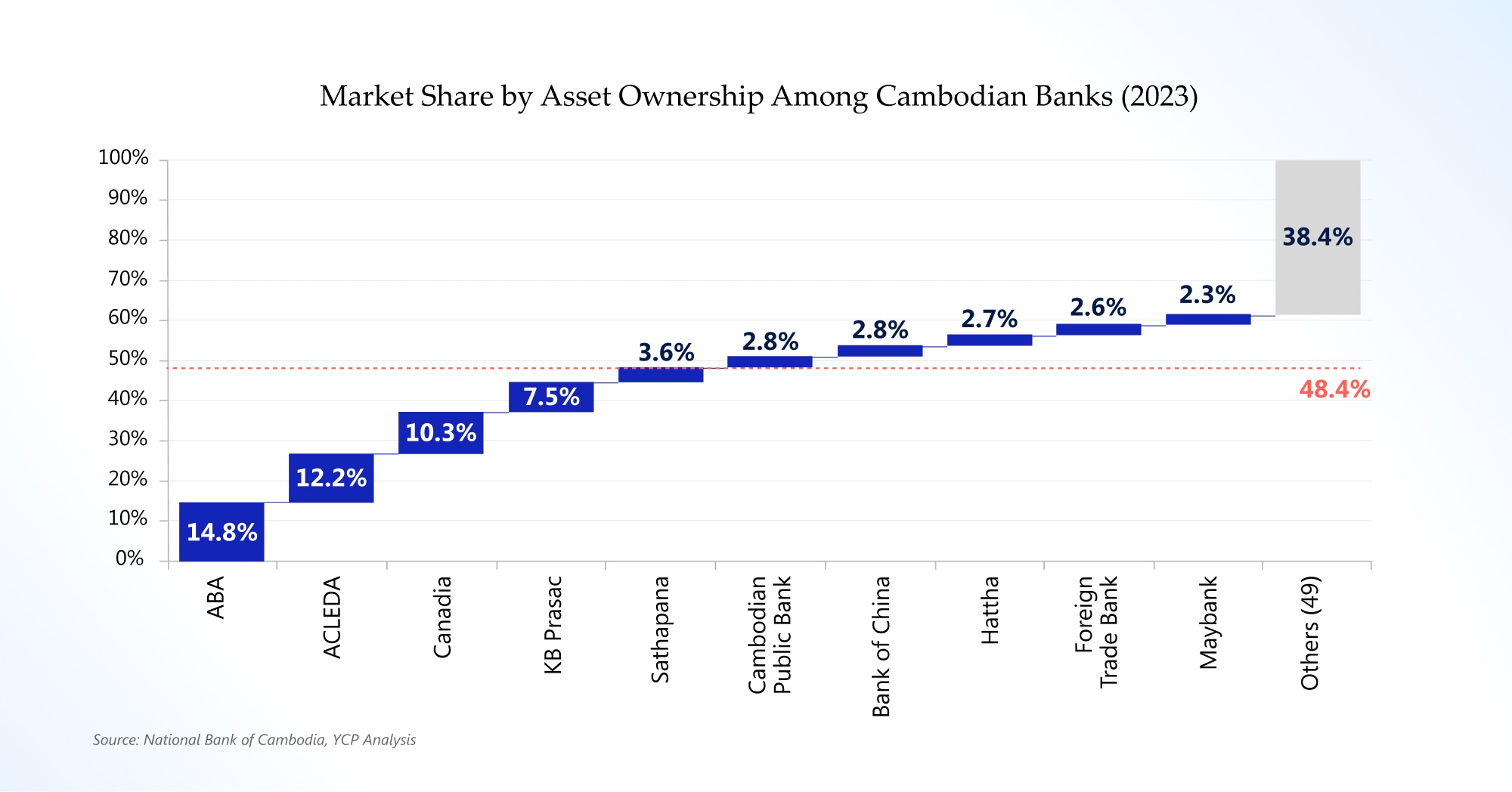

Currently, the financial services landscape in Cambodia is dominated by banks such as ABA, ACLEDA, and Canadia. Their presence and stronghold on Cambodia’s banking landscape signals the staunch interest from foreign firms.

However, these market leaders represent a small fraction of the total number of players within the industry. More recently, the market has become saturated with 59 key players competing for market share.

While rivals continue to push for market penetration, experts have also noticed a downturn in the sector’s profitability. Within the sector, the top five banks have seen a median decline in Return on Asset (ROA) from 2.3% to 1.2% and Net Profit Margin (NPM) from 26.6% to 16.5% between 2019 and 2023. Meanwhile, across 54 other banks, there was a median ROA decline from 1.5% to 0.3% and NPM from 27.2% to 6.2%. This significant downturn can be attributed to several factors, including escalating provisions, the growing proportion of personal loans, coupled with unfavorable post-pandemic conditions.

- Increasing personal loans: During the COVID-19 pandemic, Cambodia’s high dollarization allowed its banks to benefit from the US Federal Reserve interest rates. Combined with the National Bank of Cambodia’s (NBC) moratorium policies, this enabled banks to offer lower borrowing rates and ease debt payments within the personal loans market in Cambodia. Post-pandemic, consumers and businesses consumers who had taken on debt during the pandemic struggled due to a slower-than-expected recovery. This increased the risk of loan defaults, putting pressure on banks’ profitability as they had to increase loan provisions.

- Stagnating operating expenses: The top five banks have maintained their Overhead Ratios (computed by dividing operating expenses by operating income), with only a few improving efficiency. While this is not the primary cause for the declining profit, the stagnating nature of this metric exacerbates the pressure on the profit margins of banks. The challenge now is to reduce operating expenses to improve their financial performance.

Unlock a unique perspective on Cambodia’s banking sector by downloading YCP and Confluences’ free white paper. Gain deeper insights on the various factors affecting the downturn in profitability and learn how banks can regain momentum.

Authors

Gary Murakami

Gary is YCP's Partner with a diverse portfolio of hands-on management services in M&A and post-merger integration advisory around Asia.

Jason George

Jason is our Partner based in the United States, leading operations in the Americas for the Supply Chain Division. He has extensive professional services, information technology, and broadcast experience, and has held leadership roles in both the media and entertainment, and defense spaces

Recent White Paper

See All