Last June 2022, Vietnam’s Vingroup—the parent company of electric vehicle maker VinFast—announced its partnership with global tech giant Intel to provide 5G technology and other innovations for its suite of companies. Most notably, Intel is expected to develop Internet of Things (IoT) solutions to be incorporated into VinFast’s manufacturing of electric vehicles (EV) and batteries that will drastically improve efficiency and overall performance.

With the recent petrol surge and the global emphasis on sustainability, a larger spotlight has been put on Vietnam’s budding EV industry and the implications its success has for the long-term automotive landscape in Vietnam. The YCP Solidiance publication Public and Private Sector Cooperation: Sustainable Urban Development in Vietnam highlights this as part of a growing shift towards sustainable transportation in the country, and presents key opportunities for both private and public sector players.

An Overview of Sustainable Transportation in Vietnam

Electric vehicles are part of Vietnam’s plan to promote sustainable transportation, defined in the aforementioned YCP Solidiance report as “an integral part of a smart and sustainable city. It consists of developed infrastructure that meets the support of transportation systems of the future. Sustainably planned and smart transportation reduces pollution and traffic, thus promoting connectivity of the city and the overall well-being of its citizens.”

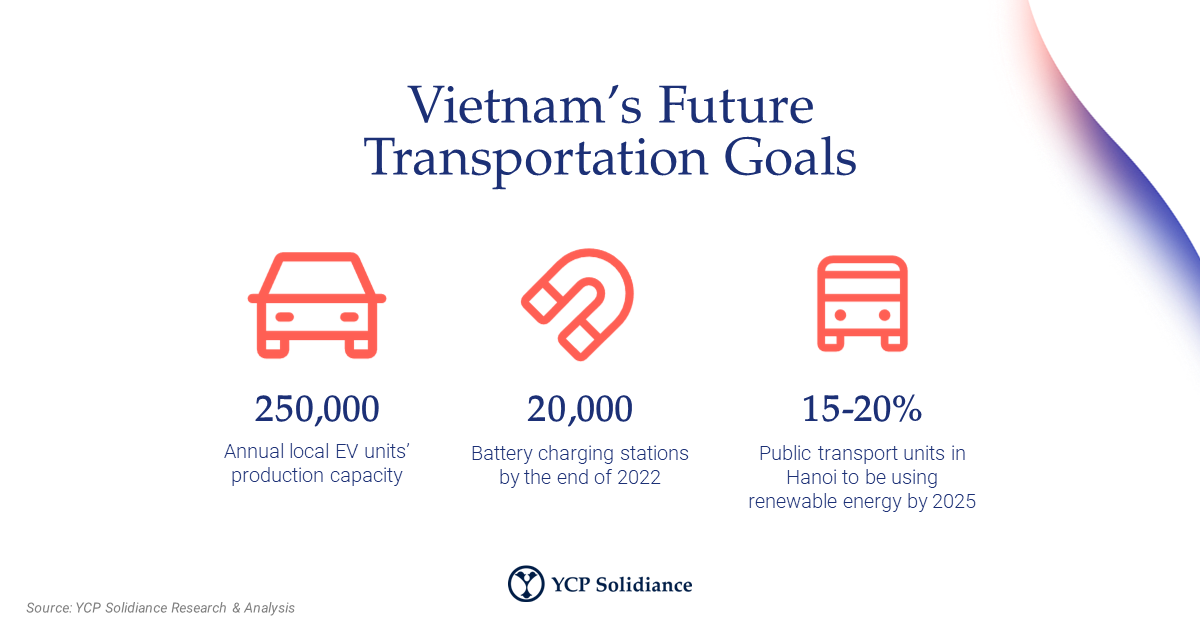

While motorbikes are still the most widespread form of transportation within Vietnam, electric automobile market size and penetration is also steadily growing, which has translated into accelerated sustainable transport goals and initiatives for the public sector:

Opportunities in Vietnam Automotive

Both the public and private sectors can stand to benefit from increased penetration and growth of electric vehicles in Vietnam—and as such, the government has started to implement policies and initiatives to encourage its widespread use:

- For Consumers: Law No. 70/2014/QH13, which gives special consumption tax rates for EVs from 5-15% (since 2018).

- For Manufacturers: Imported components for EV production are entitled to 0% tax in the first two tax periods without meeting minimum production requirements—but for the third year, at least 125 electric vehicles must be produced by the manufacturer.

Aside from these already enacted policies, several initiatives—such as a decree that proposes to reduce or fully eliminate registration fees for EVs, and another that aims to reduce the local assembly cost of hybrid and full EVs—are being discussed and expected to come into play in the near future.

These policies present several exciting opportunities for both automotive industry players and companies who can innovate tech-driven solutions for EV makers and consumers, most specifically in the area of EV manufacturing that incorporates elements of Industry 4.0.

For more insight into Vietnam’s emerging industries, subscribe to our newsletter here and read the following reports from our professionals: